Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

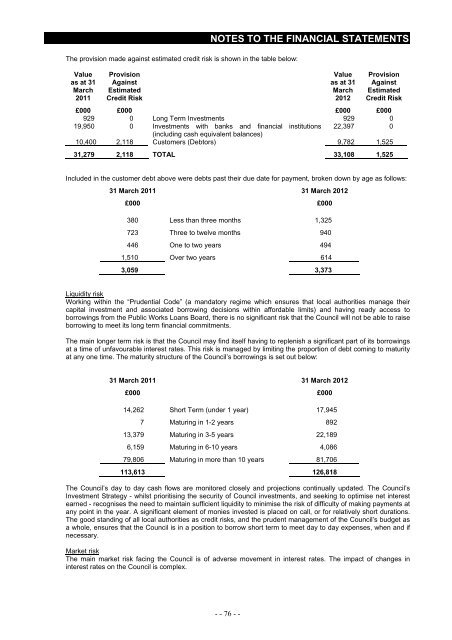

The provision made against estimated credit risk is shown in the table below:<br />

Value<br />

as at 31<br />

March<br />

<strong>2011</strong><br />

Provision<br />

Against<br />

Estimated<br />

Credit Risk<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Value<br />

as at 31<br />

March<br />

<strong>2012</strong><br />

Provision<br />

Against<br />

Estimated<br />

Credit Risk<br />

£000 £000 £000 £000<br />

929 0 Long Term Investments 929 0<br />

19,950 0 Investments <strong>with</strong> banks and financial institutions 22,397 0<br />

(including cash equivalent balances)<br />

10,400 2,118 Customers (Debtors) 9,782 1,525<br />

31,279 2,118 TOTAL 33,108 1,525<br />

Included in the customer debt above were debts past their due date for payment, broken down by age as follows:<br />

31 March <strong>2011</strong> 31 March <strong>2012</strong><br />

£000 £000<br />

380 Less than three months 1,325<br />

723 Three to twelve months 940<br />

446 One to two years 494<br />

1,510 Over two years 614<br />

3,059 3,373<br />

Liquidity risk<br />

Working <strong>with</strong>in the “Prudential Code” (a mandatory regime which ensures that local authorities manage their<br />

capital investment and associated borrowing decisions <strong>with</strong>in affordable limits) and having ready access to<br />

borrowings from the Public Works Loans Board, there is no significant risk that the Council will not be able to raise<br />

borrowing to meet its long term financial commitments.<br />

The main longer term risk is that the Council may find itself having to replenish a significant part <strong>of</strong> its borrowings<br />

at a time <strong>of</strong> unfavourable interest rates. This risk is managed by limiting the proportion <strong>of</strong> debt coming to maturity<br />

at any one time. The maturity structure <strong>of</strong> the Council’s borrowings is set out below:<br />

31 March <strong>2011</strong> 31 March <strong>2012</strong><br />

£000 £000<br />

14,262 Short Term (under 1 year) 17,945<br />

7 Maturing in 1-2 years 892<br />

13,379 Maturing in 3-5 years 22,189<br />

6,159 Maturing in 6-10 years 4,086<br />

79,806 Maturing in more than 10 years 81,706<br />

113,613 126,818<br />

The Council’s day to day cash flows are monitored closely and projections continually updated. The Council’s<br />

Investment Strategy - whilst prioritising the security <strong>of</strong> Council investments, and seeking to optimise net interest<br />

earned - recognises the need to maintain sufficient liquidity to minimise the risk <strong>of</strong> difficulty <strong>of</strong> making payments at<br />

any point in the year. A significant element <strong>of</strong> monies invested is placed on call, or for relatively short durations.<br />

The good standing <strong>of</strong> all local authorities as credit risks, and the prudent management <strong>of</strong> the Council’s budget as<br />

a whole, ensures that the Council is in a position to borrow short term to meet day to day expenses, when and if<br />

necessary.<br />

Market risk<br />

The main market risk facing the Council is <strong>of</strong> adverse movement in interest rates. The impact <strong>of</strong> changes in<br />

interest rates on the Council is complex.<br />

- - 76 - -