Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE FINANCIAL STATEMENTS<br />

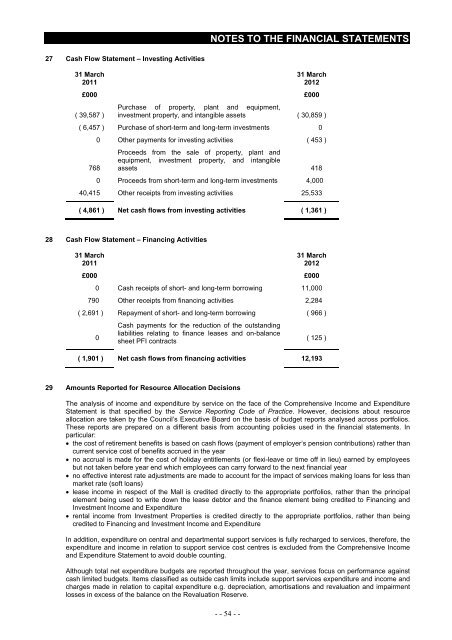

27 Cash Flow <strong>Statement</strong> – Investing Activities<br />

31 March<br />

<strong>2011</strong><br />

31 March<br />

<strong>2012</strong><br />

£000 £000<br />

Purchase <strong>of</strong> property, plant and equipment,<br />

( 39,587 ) investment property, and intangible assets ( 30,859 )<br />

( 6,457 ) Purchase <strong>of</strong> short-term and long-term investments 0<br />

0 Other payments for investing activities ( 453 )<br />

Proceeds from the sale <strong>of</strong> property, plant and<br />

equipment, investment property, and intangible<br />

768 assets 418<br />

0 Proceeds from short-term and long-term investments 4,000<br />

40,415 Other receipts from investing activities 25,533<br />

( 4,861 ) Net cash flows from investing activities ( 1,361 )<br />

28 Cash Flow <strong>Statement</strong> – Financing Activities<br />

31 March<br />

<strong>2011</strong><br />

31 March<br />

<strong>2012</strong><br />

£000 £000<br />

0 Cash receipts <strong>of</strong> short- and long-term borrowing 11,000<br />

790 Other receipts from financing activities 2,284<br />

( 2,691 ) Repayment <strong>of</strong> short- and long-term borrowing ( 966 )<br />

0<br />

Cash payments for the reduction <strong>of</strong> the outstanding<br />

liabilities relating to finance leases and on-balance<br />

sheet PFI contracts<br />

( 125 )<br />

( 1,901 ) Net cash flows from financing activities 12,193<br />

29 Amounts Reported for Resource Allocation Decisions<br />

The analysis <strong>of</strong> income and expenditure by service on the face <strong>of</strong> the Comprehensive Income and Expenditure<br />

<strong>Statement</strong> is that specified by the Service Reporting Code <strong>of</strong> Practice. However, decisions about resource<br />

allocation are taken by the Council’s Executive Board on the basis <strong>of</strong> budget reports analysed across portfolios.<br />

These reports are prepared on a different basis from accounting policies used in the financial statements. In<br />

particular:<br />

• the cost <strong>of</strong> retirement benefits is based on cash flows (payment <strong>of</strong> employer’s pension contributions) rather than<br />

current service cost <strong>of</strong> benefits accrued in the year<br />

• no accrual is made for the cost <strong>of</strong> holiday entitlements (or flexi-leave or time <strong>of</strong>f in lieu) earned by employees<br />

but not taken before year end which employees can carry forward to the next financial year<br />

• no effective interest rate adjustments are made to account for the impact <strong>of</strong> services making loans for less than<br />

market rate (s<strong>of</strong>t loans)<br />

• lease income in respect <strong>of</strong> the Mall is credited directly to the appropriate portfolios, rather than the principal<br />

element being used to write down the lease debtor and the finance element being credited to Financing and<br />

Investment Income and Expenditure<br />

• rental income from Investment Properties is credited directly to the appropriate portfolios, rather than being<br />

credited to Financing and Investment Income and Expenditure<br />

In addition, expenditure on central and departmental support services is fully recharged to services, therefore, the<br />

expenditure and income in relation to support service cost centres is excluded from the Comprehensive Income<br />

and Expenditure <strong>Statement</strong> to avoid double counting.<br />

Although total net expenditure budgets are reported throughout the year, services focus on performance against<br />

cash limited budgets. Items classified as outside cash limits include support services expenditure and income and<br />

charges made in relation to capital expenditure e.g. depreciation, amortisations and revaluation and impairment<br />

losses in excess <strong>of</strong> the balance on the Revaluation Reserve.<br />

- - 54 - -