Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

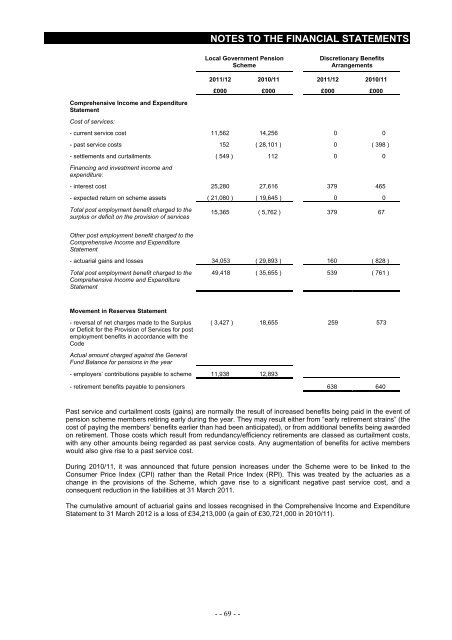

NOTES TO THE FINANCIAL STATEMENTS<br />

Local Government Pension<br />

Scheme<br />

Discretionary Benefits<br />

Arrangements<br />

<strong>2011</strong>/12 2010/11 <strong>2011</strong>/12 2010/11<br />

£000 £000 £000 £000<br />

Comprehensive Income and Expenditure<br />

<strong>Statement</strong><br />

Cost <strong>of</strong> services:<br />

- current service cost 11,562 14,256 0 0<br />

- past service costs 152 ( 28,101 ) 0 ( 398 )<br />

- settlements and curtailments ( 549 ) 112 0 0<br />

Financing and investment income and<br />

expenditure:<br />

- interest cost 25,280 27,616 379 465<br />

- expected return on scheme assets ( 21,080 ) ( 19,645 ) 0 0<br />

Total post employment benefit charged to the<br />

surplus or deficit on the provision <strong>of</strong> services<br />

15,365 ( 5,762 ) 379 67<br />

Other post employment benefit charged to the<br />

Comprehensive Income and Expenditure<br />

<strong>Statement</strong><br />

- actuarial gains and losses 34,053 ( 29,893 ) 160 ( 828 )<br />

Total post employment benefit charged to the<br />

Comprehensive Income and Expenditure<br />

<strong>Statement</strong><br />

49,418 ( 35,655 ) 539 ( 761 )<br />

Movement in Reserves <strong>Statement</strong><br />

- reversal <strong>of</strong> net charges made to the Surplus<br />

or Deficit for the Provision <strong>of</strong> Services for post<br />

employment benefits in accordance <strong>with</strong> the<br />

Code<br />

( 3,427 ) 18,655 259 573<br />

Actual amount charged against the General<br />

Fund Balance for pensions in the year<br />

- employers’ contributions payable to scheme 11,938 12,893<br />

- retirement benefits payable to pensioners 638 640<br />

Past service and curtailment costs (gains) are normally the result <strong>of</strong> increased benefits being paid in the event <strong>of</strong><br />

pension scheme members retiring early during the year. They may result either from “early retirement strains” (the<br />

cost <strong>of</strong> paying the members’ benefits earlier than had been anticipated), or from additional benefits being awarded<br />

on retirement. Those costs which result from redundancy/efficiency retirements are classed as curtailment costs,<br />

<strong>with</strong> any other amounts being regarded as past service costs. Any augmentation <strong>of</strong> benefits for active members<br />

would also give rise to a past service cost.<br />

During 2010/11, it was announced that future pension increases under the Scheme were to be linked to the<br />

Consumer Price Index (CPI) rather than the Retail Price Index (RPI). This was treated by the actuaries as a<br />

change in the provisions <strong>of</strong> the Scheme, which gave rise to a significant negative past service cost, and a<br />

consequent reduction in the liabilities at 31 March <strong>2011</strong>.<br />

The cumulative amount <strong>of</strong> actuarial gains and losses recognised in the Comprehensive Income and Expenditure<br />

<strong>Statement</strong> to 31 March <strong>2012</strong> is a loss <strong>of</strong> £34,213,000 (a gain <strong>of</strong> £30,721,000 in 2010/11).<br />

- - 69 - -