Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

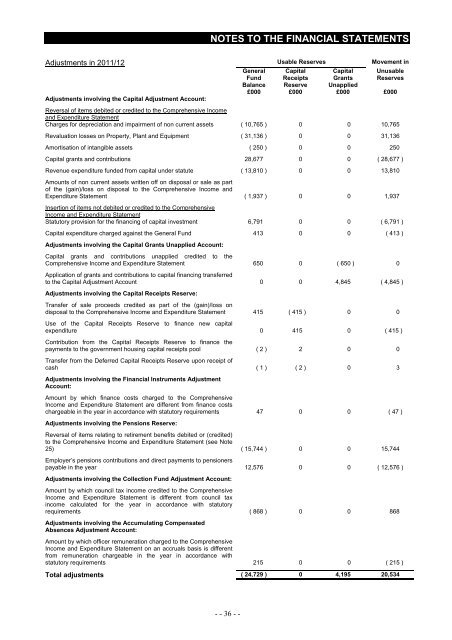

NOTES TO THE FINANCIAL STATEMENTS<br />

Adjustments in <strong>2011</strong>/12 Usable Reserves Movement in<br />

General<br />

Fund<br />

Balance<br />

Capital<br />

Receipts<br />

Reserve<br />

Capital<br />

Grants<br />

Unapplied<br />

Unusable<br />

Reserves<br />

£000 £000 £000 £000<br />

Adjustments involving the Capital Adjustment Account:<br />

Reversal <strong>of</strong> items debited or credited to the Comprehensive Income<br />

and Expenditure <strong>Statement</strong><br />

Charges for depreciation and impairment <strong>of</strong> non current assets ( 10,765 ) 0 0 10,765<br />

Revaluation losses on Property, Plant and Equipment ( 31,136 ) 0 0 31,136<br />

Amortisation <strong>of</strong> intangible assets ( 250 ) 0 0 250<br />

Capital grants and contributions 28,677 0 0 ( 28,677 )<br />

Revenue expenditure funded from capital under statute ( 13,810 ) 0 0 13,810<br />

Amounts <strong>of</strong> non current assets written <strong>of</strong>f on disposal or sale as part<br />

<strong>of</strong> the (gain)/loss on disposal to the Comprehensive Income and<br />

Expenditure <strong>Statement</strong> ( 1,937 ) 0 0 1,937<br />

Insertion <strong>of</strong> items not debited or credited to the Comprehensive<br />

Income and Expenditure <strong>Statement</strong><br />

Statutory provision for the financing <strong>of</strong> capital investment 6,791 0 0 ( 6,791 )<br />

Capital expenditure charged against the General Fund 413 0 0 ( 413 )<br />

Adjustments involving the Capital Grants Unapplied Account:<br />

Capital grants and contributions unapplied credited to the<br />

Comprehensive Income and Expenditure <strong>Statement</strong> 650 0 ( 650 ) 0<br />

Application <strong>of</strong> grants and contributions to capital financing transferred<br />

to the Capital Adjustment Account 0 0 4,845 ( 4,845 )<br />

Adjustments involving the Capital Receipts Reserve:<br />

Transfer <strong>of</strong> sale proceeds credited as part <strong>of</strong> the (gain)/loss on<br />

disposal to the Comprehensive Income and Expenditure <strong>Statement</strong> 415 ( 415 ) 0 0<br />

Use <strong>of</strong> the Capital Receipts Reserve to finance new capital<br />

expenditure 0 415 0 ( 415 )<br />

Contribution from the Capital Receipts Reserve to finance the<br />

payments to the government housing capital receipts pool ( 2 ) 2 0 0<br />

Transfer from the Deferred Capital Receipts Reserve upon receipt <strong>of</strong><br />

cash ( 1 ) ( 2 ) 0 3<br />

Adjustments involving the Financial Instruments Adjustment<br />

Account:<br />

Amount by which finance costs charged to the Comprehensive<br />

Income and Expenditure <strong>Statement</strong> are different from finance costs<br />

chargeable in the year in accordance <strong>with</strong> statutory requirements 47 0 0 ( 47 )<br />

Adjustments involving the Pensions Reserve:<br />

Reversal <strong>of</strong> items relating to retirement benefits debited or (credited)<br />

to the Comprehensive Income and Expenditure <strong>Statement</strong> (see Note<br />

25) ( 15,744 ) 0 0 15,744<br />

Employer’s pensions contributions and direct payments to pensioners<br />

payable in the year 12,576 0 0 ( 12,576 )<br />

Adjustments involving the Collection Fund Adjustment Account:<br />

Amount by which council tax income credited to the Comprehensive<br />

Income and Expenditure <strong>Statement</strong> is different from council tax<br />

income calculated for the year in accordance <strong>with</strong> statutory<br />

requirements ( 868 ) 0 0 868<br />

Adjustments involving the Accumulating Compensated<br />

Absences Adjustment Account:<br />

Amount by which <strong>of</strong>ficer remuneration charged to the Comprehensive<br />

Income and Expenditure <strong>Statement</strong> on an accruals basis is different<br />

from remuneration chargeable in the year in accordance <strong>with</strong><br />

statutory requirements 215 0 0 ( 215 )<br />

Total adjustments ( 24,729 ) 0 4,195 20,534<br />

- - 36 - -