Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

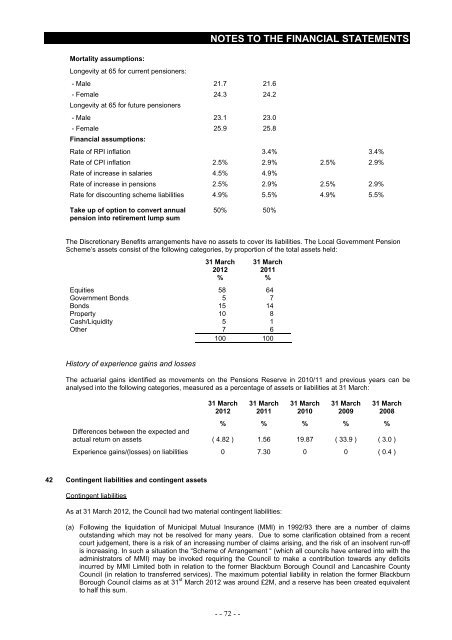

Mortality assumptions:<br />

Longevity at 65 for current pensioners:<br />

- Male 21.7 21.6<br />

- Female 24.3 24.2<br />

Longevity at 65 for future pensioners<br />

- Male 23.1 23.0<br />

- Female 25.9 25.8<br />

Financial assumptions:<br />

Rate <strong>of</strong> RPI inflation 3.4% 3.4%<br />

Rate <strong>of</strong> CPI inflation 2.5% 2.9% 2.5% 2.9%<br />

Rate <strong>of</strong> increase in salaries 4.5% 4.9%<br />

Rate <strong>of</strong> increase in pensions 2.5% 2.9% 2.5% 2.9%<br />

Rate for discounting scheme liabilities 4.9% 5.5% 4.9% 5.5%<br />

Take up <strong>of</strong> option to convert annual<br />

pension into retirement lump sum<br />

50% 50%<br />

The Discretionary Benefits arrangements have no assets to cover its liabilities. The Local Government Pension<br />

Scheme’s assets consist <strong>of</strong> the following categories, by proportion <strong>of</strong> the total assets held:<br />

31 March<br />

<strong>2012</strong><br />

31 March<br />

<strong>2011</strong><br />

% %<br />

Equities 58 64<br />

Government Bonds 5 7<br />

Bonds 15 14<br />

Property 10 8<br />

Cash/Liquidity 5 1<br />

Other 7 6<br />

100 100<br />

History <strong>of</strong> experience gains and losses<br />

The actuarial gains identified as movements on the Pensions Reserve in 2010/11 and previous years can be<br />

analysed into the following categories, measured as a percentage <strong>of</strong> assets or liabilities at 31 March:<br />

31 March<br />

<strong>2012</strong><br />

31 March<br />

<strong>2011</strong><br />

31 March<br />

2010<br />

31 March<br />

2009<br />

31 March<br />

2008<br />

% % % % %<br />

Differences between the expected and<br />

actual return on assets ( 4.82 ) 1.56 19.87 ( 33.9 ) ( 3.0 )<br />

Experience gains/(losses) on liabilities 0 7.30 0 0 ( 0.4 )<br />

42 Contingent liabilities and contingent assets<br />

Contingent liabilities<br />

As at 31 March <strong>2012</strong>, the Council had two material contingent liabilities:<br />

(a) Following the liquidation <strong>of</strong> Municipal Mutual Insurance (MMI) in 1992/93 there are a number <strong>of</strong> claims<br />

outstanding which may not be resolved for many years. Due to some clarification obtained from a recent<br />

court judgement, there is a risk <strong>of</strong> an increasing number <strong>of</strong> claims arising, and the risk <strong>of</strong> an insolvent run-<strong>of</strong>f<br />

is increasing. In such a situation the “Scheme <strong>of</strong> Arrangement “ (which all councils have entered into <strong>with</strong> the<br />

administrators <strong>of</strong> MMI) may be invoked requiring the Council to make a contribution towards any deficits<br />

incurred by MMI Limited both in relation to the former <strong>Blackburn</strong> <strong>Borough</strong> Council and Lancashire County<br />

Council (in relation to transferred services). The maximum potential liability in relation the former <strong>Blackburn</strong><br />

<strong>Borough</strong> Council claims as at 31 st March <strong>2012</strong> was around £2M, and a reserve has been created equivalent<br />

to half this sum.<br />

- - 72 - -