Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS<br />

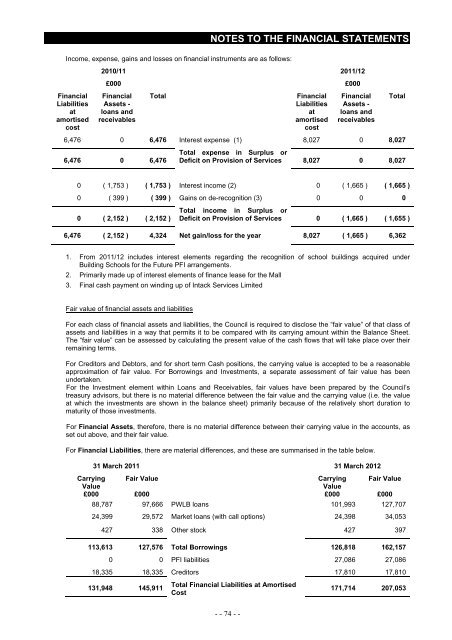

Income, expense, gains and losses on financial instruments are as follows:<br />

2010/11 <strong>2011</strong>/12<br />

£000 £000<br />

Financial<br />

Liabilities<br />

at<br />

amortised<br />

cost<br />

Financial<br />

Assets -<br />

loans and<br />

receivables<br />

Total<br />

Financial<br />

Liabilities<br />

at<br />

amortised<br />

cost<br />

Financial<br />

Assets -<br />

loans and<br />

receivables<br />

6,476 0 6,476 Interest expense (1) 8,027 0 8,027<br />

6,476 0 6,476<br />

Total<br />

Total expense in Surplus or<br />

Deficit on Provision <strong>of</strong> Services 8,027 0 8,027<br />

0 ( 1,753 ) ( 1,753 ) Interest income (2) 0 ( 1,665 ) ( 1,665 )<br />

0 ( 399 ) ( 399 ) Gains on de-recognition (3) 0 0 0<br />

0 ( 2,152 ) ( 2,152 )<br />

Total income in Surplus or<br />

Deficit on Provision <strong>of</strong> Services 0 ( 1,665 ) ( 1,655 )<br />

6,476 ( 2,152 ) 4,324 Net gain/loss for the year 8,027 ( 1,665 ) 6,362<br />

1. From <strong>2011</strong>/12 includes interest elements regarding the recognition <strong>of</strong> school buildings acquired under<br />

Building Schools for the Future PFI arrangements.<br />

2. Primarily made up <strong>of</strong> interest elements <strong>of</strong> finance lease for the Mall<br />

3. Final cash payment on winding up <strong>of</strong> Intack Services Limited<br />

Fair value <strong>of</strong> financial assets and liabilities<br />

For each class <strong>of</strong> financial assets and liabilities, the Council is required to disclose the “fair value” <strong>of</strong> that class <strong>of</strong><br />

assets and liabilities in a way that permits it to be compared <strong>with</strong> its carrying amount <strong>with</strong>in the Balance Sheet.<br />

The “fair value” can be assessed by calculating the present value <strong>of</strong> the cash flows that will take place over their<br />

remaining terms.<br />

For Creditors and Debtors, and for short term Cash positions, the carrying value is accepted to be a reasonable<br />

approximation <strong>of</strong> fair value. For Borrowings and Investments, a separate assessment <strong>of</strong> fair value has been<br />

undertaken.<br />

For the Investment element <strong>with</strong>in Loans and Receivables, fair values have been prepared by the Council’s<br />

treasury advisors, but there is no material difference between the fair value and the carrying value (i.e. the value<br />

at which the investments are shown in the balance sheet) primarily because <strong>of</strong> the relatively short duration to<br />

maturity <strong>of</strong> those investments.<br />

For Financial Assets, therefore, there is no material difference between their carrying value in the accounts, as<br />

set out above, and their fair value.<br />

For Financial Liabilities, there are material differences, and these are summarised in the table below.<br />

31 March <strong>2011</strong> 31 March <strong>2012</strong><br />

Carrying Fair Value<br />

Carrying Fair Value<br />

Value<br />

Value<br />

£000 £000 £000 £000<br />

88,787 97,666 PWLB loans 101,993 127,707<br />

24,399 29,572 Market loans (<strong>with</strong> call options) 24,398 34,053<br />

427 338 Other stock 427 397<br />

113,613 127,576 Total Borrowings 126,818 162,157<br />

0 0 PFI liabilities 27,086 27,086<br />

18,335 18,335 Creditors 17,810 17,810<br />

131,948 145,911<br />

Total Financial Liabilities at Amortised<br />

Cost<br />

171,714 207,053<br />

- - 74 - -