Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

Statement of Accounts 2011/2012 - Blackburn with Darwen Borough ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

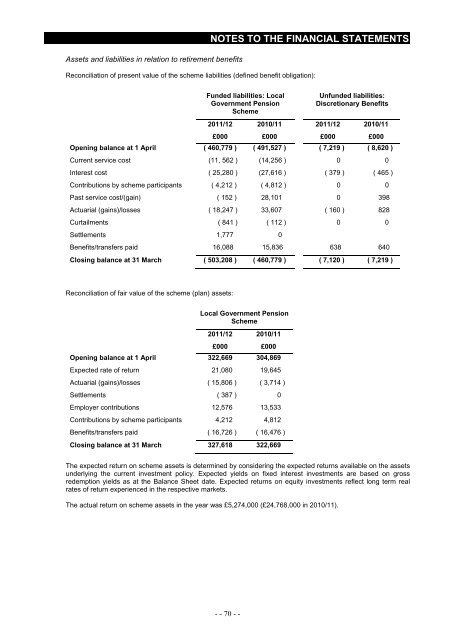

Assets and liabilities in relation to retirement benefits<br />

NOTES TO THE FINANCIAL STATEMENTS<br />

Reconciliation <strong>of</strong> present value <strong>of</strong> the scheme liabilities (defined benefit obligation):<br />

Funded liabilities: Local<br />

Government Pension<br />

Scheme<br />

Unfunded liabilities:<br />

Discretionary Benefits<br />

<strong>2011</strong>/12 2010/11 <strong>2011</strong>/12 2010/11<br />

£000 £000 £000 £000<br />

Opening balance at 1 April ( 460,779 ) ( 491,527 ) ( 7,219 ) ( 8,620 )<br />

Current service cost (11, 562 ) (14,256 ) 0 0<br />

Interest cost ( 25,280 ) (27,616 ) ( 379 ) ( 465 )<br />

Contributions by scheme participants ( 4,212 ) ( 4,812 ) 0 0<br />

Past service cost/(gain) ( 152 ) 28,101 0 398<br />

Actuarial (gains)/losses ( 18,247 ) 33,607 ( 160 ) 828<br />

Curtailments ( 841 ) ( 112 ) 0 0<br />

Settlements 1,777 0<br />

Benefits/transfers paid 16,088 15,836 638 640<br />

Closing balance at 31 March ( 503,208 ) ( 460,779 ) ( 7,120 ) ( 7,219 )<br />

Reconciliation <strong>of</strong> fair value <strong>of</strong> the scheme (plan) assets:<br />

Local Government Pension<br />

Scheme<br />

<strong>2011</strong>/12 2010/11<br />

£000 £000<br />

Opening balance at 1 April 322,669 304,869<br />

Expected rate <strong>of</strong> return 21,080 19,645<br />

Actuarial (gains)/losses ( 15,806 ) ( 3,714 )<br />

Settlements ( 387 ) 0<br />

Employer contributions 12,576 13,533<br />

Contributions by scheme participants 4,212 4,812<br />

Benefits/transfers paid ( 16,726 ) ( 16,476 )<br />

Closing balance at 31 March 327,618 322,669<br />

The expected return on scheme assets is determined by considering the expected returns available on the assets<br />

underlying the current investment policy. Expected yields on fixed interest investments are based on gross<br />

redemption yields as at the Balance Sheet date. Expected returns on equity investments reflect long term real<br />

rates <strong>of</strong> return experienced in the respective markets.<br />

The actual return on scheme assets in the year was £5,274,000 (£24,768,000 in 2010/11).<br />

- - 70 - -