2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

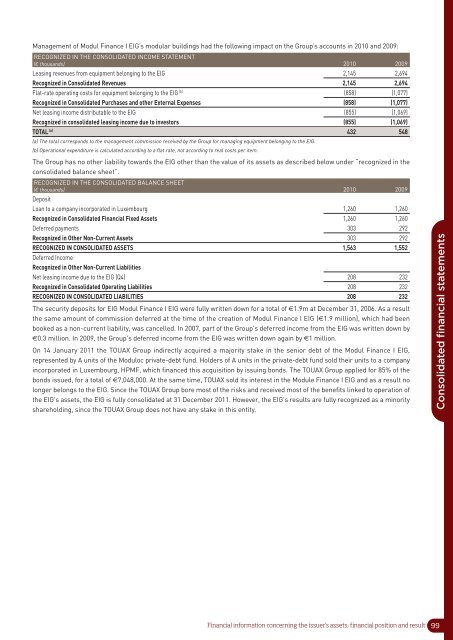

Management of Modul Finance I EIG’s modular buildings had the following impact on the Group’s accounts in 2010 and 2009:<br />

RECOGNIZED IN THE CONSOLIDATED INCOME STATEMENT<br />

(€ thousands) 2010 2009<br />

Leasing revenues from equipment belonging to the EIG 2,145 2,694<br />

Recognized in Consolidated Revenues 2,145 2,694<br />

Flat-rate operating costs for equipment belonging to the EIG (b) (858) (1,077)<br />

Recognized in Consolidated Purchases and other External Expenses (858) (1,077)<br />

Net leasing income distributable to the EIG (855) (1,069)<br />

Recognized in consolidated leasing income due to investors (855) (1,069)<br />

TOTAL (a) 432 548<br />

(a) The total corresponds to the management commission received by the Group for managing equipment belonging to the EIG.<br />

(b) Operational expenditure is calculated according to a flat rate, not according to real costs per item.<br />

The Group has no other liability towards the EIG other than the value of its assets as described below under “recognized in the<br />

consolidated balance sheet”.<br />

RECOGNIZED IN THE CONSOLIDATED BALANCE SHEET<br />

(€ thousands) 2010 2009<br />

Deposit<br />

Loan to a company incorporated in Luxembourg 1,260 1,260<br />

Recognized in Consolidated Financial Fixed Assets 1,260 1,260<br />

Deferred payments 303 292<br />

Recognized in Other Non-Current Assets 303 292<br />

RECOGNIZED IN CONSOLIDATED ASSETS 1,563 1,552<br />

Deferred Income<br />

Recognized in Other Non-Current Liabilities<br />

Net leasing income due to the EIG (Q4) 208 232<br />

Recognized in Consolidated Operating Liabilities 208 232<br />

RECOGNIZED IN CONSOLIDATED LIABILITIES 208 232<br />

The security deposits for EIG Modul Finance I EIG were fully written down for a total of €1.9m at December 31, 2006. As a result<br />

the same amount of commission deferred at the time of the creation of Modul Finance I EIG (€1.9 million), which had been<br />

booked as a non-current liability, was cancelled. In 2007, part of the Group's deferred income from the EIG was written down by<br />

€0.3 million. In 2009, the Group's deferred income from the EIG was written down again by €1 million.<br />

On 14 January <strong>2011</strong> the TOUAX Group indirectly acquired a majority stake in the senior debt of the Modul Finance I EIG,<br />

represented by A units of the Moduloc private-debt fund. Holders of A units in the private-debt fund sold their units to a company<br />

incorporated in Luxembourg, HPMF, which financed this acquisition by issuing bonds. The TOUAX Group applied for 85% of the<br />

bonds issued, for a total of €7,048,000. At the same time, TOUAX sold its interest in the Module Finance I EIG and as a result no<br />

longer belongs to the EIG. Since the TOUAX Group bore most of the risks and received most of the benefits linked to operation of<br />

the EIG's assets, the EIG is fully consolidated at 31 December <strong>2011</strong>. However, the EIG's results are fully recognized as a minority<br />

shareholding, since the TOUAX Group does not have any stake in this entity.<br />

Consolidated financial statements<br />

Financial information concerning the issuer’s assets, financial position and result 99