2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>report</strong> <strong>2011</strong><br />

➜ note 30.2. Further details regarding<br />

the Trust TCLRT 98<br />

On December 16, 1998, the Group conducted a second asset<br />

backed securitization operation, this time for shipping containers,<br />

in the form of a trust registered in Delaware (USA), by the<br />

name of TOUAX Container Lease Receivables Trust TCLRT 98.<br />

This Trust was entirely financed by investors outside the<br />

Group (Indenture Agreement) through the issue of a senior<br />

debt (Senior Notes) and a subordinated debt (certificates)<br />

used to fund the purchase of shipping containers with a total<br />

value of $40.4 million, to be operated and managed by the<br />

Group under a management contract (Sales and Servicing<br />

Agreement) for a minimum of 10 years.<br />

In April 2009, Trust 1998's assets were sold; 85% (12,006.5 CEU)<br />

was purchased by investors and 15% (2,095.5 CEU) by Gold<br />

Container Investment Ltd.<br />

The leasing of the Trust’s containers by Gold Container<br />

had the following effects on the Group’s accounts in 2009<br />

and 2008; at December 31, <strong>2011</strong> there were no longer any<br />

containers belonging to Trust 98:<br />

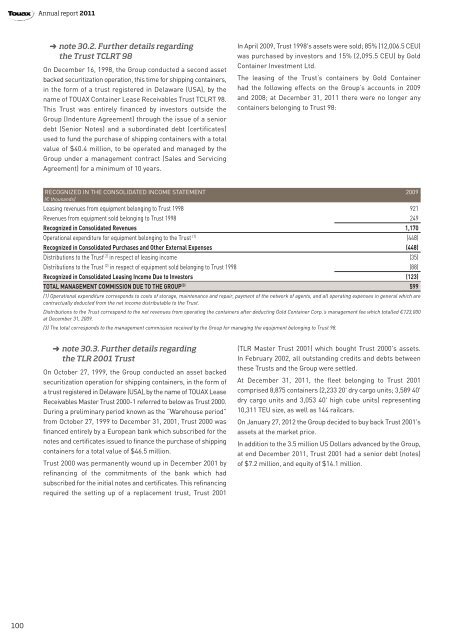

RECOGNIZED IN THE CONSOLIDATED INCOME STATEMENT 2009<br />

(€ thousands)<br />

Leasing revenues from equipment belonging to Trust 1998 921<br />

Revenues from equipment sold belonging to Trust 1998 249<br />

Recognized in Consolidated Revenues 1,170<br />

Operational expenditure for equipment belonging to the Trust (1) (448)<br />

Recognized in Consolidated Purchases and Other External Expenses (448)<br />

Distributions to the Trust ( 2) in respect of leasing income (35)<br />

Distributions to the Trust (2) in respect of equipment sold belonging to Trust 1998 (88)<br />

Recognized in Consolidated Leasing Income Due to Investors (123)<br />

TOTAL MANAGEMENT COMMISSION DUE TO THE GROUP (3) 599<br />

(1) Operational expenditure corresponds to costs of storage, maintenance and repair, payment of the network of agents, and all operating expenses in general which are<br />

contractually deducted from the net income distributable to the Trust.<br />

Distributions to the Trust correspond to the net revenues from operating the containers after deducting Gold Container Corp.’s management fee which totalled €123,000<br />

at December 31, 2009.<br />

(3) The total corresponds to the management commission received by the Group for managing the equipment belonging to Trust 98.<br />

➜ note 30.3. Further details regarding<br />

the TLR 2001 Trust<br />

On October 27, 1999, the Group conducted an asset backed<br />

securitization operation for shipping containers, in the form of<br />

a trust registered in Delaware (USA), by the name of TOUAX Lease<br />

Receivables Master Trust 2000-1 referred to below as Trust 2000.<br />

During a preliminary period known as the “Warehouse period”<br />

from October 27, 1999 to December 31, 2001, Trust 2000 was<br />

financed entirely by a European bank which subscribed for the<br />

notes and certificates issued to finance the purchase of shipping<br />

containers for a total value of $46.5 million.<br />

Trust 2000 was permanently wound up in December 2001 by<br />

refinancing of the commitments of the bank which had<br />

subscribed for the initial notes and certificates. This refinancing<br />

required the setting up of a replacement trust, Trust 2001<br />

(TLR Master Trust 2001) which bought Trust 2000's assets.<br />

In February 2002, all outstanding credits and debts between<br />

these Trusts and the Group were settled.<br />

At December 31, <strong>2011</strong>, the fleet belonging to Trust 2001<br />

comprised 8,875 containers (2,233 20' dry cargo units; 3,589 40'<br />

dry cargo units and 3,053 40' high cube units) representing<br />

10,311 TEU size, as well as 144 railcars.<br />

On January 27, 2012 the Group decided to buy back Trust 2001's<br />

assets at the market price.<br />

In addition to the 3.5 million US Dollars advanced by the Group,<br />

at end December <strong>2011</strong>, Trust 2001 had a senior debt (notes)<br />

of $7.2 million, and equity of $14.1 million.<br />

100