2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

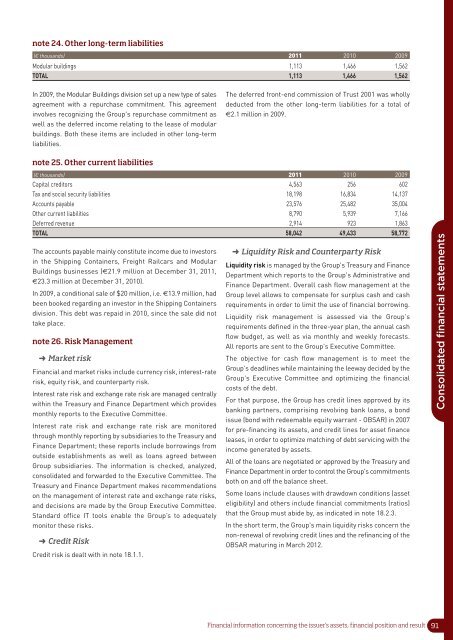

note 24. Other long-term liabilities<br />

(€ thousands) <strong>2011</strong> 2010 2009<br />

Modular buildings 1,113 1,466 1,562<br />

TOTAL 1,113 1,466 1,562<br />

In 2009, the Modular Buildings division set up a new type of sales<br />

agreement with a repurchase commitment. This agreement<br />

involves recognizing the Group's repurchase commitment as<br />

well as the deferred income relating to the lease of modular<br />

buildings. Both these items are included in other long-term<br />

liabilities.<br />

The deferred front-end commission of Trust 2001 was wholly<br />

deducted from the other long-term liabilities for a total of<br />

€2.1 million in 2009.<br />

note 25. Other current liabilities<br />

(€ thousands) <strong>2011</strong> 2010 2009<br />

Capital creditors 4,563 256 602<br />

Tax and social security liabilities 18,198 16,834 14,137<br />

Accounts payable 23,576 25,482 35,004<br />

Other current liabilities 8,790 5,939 7,166<br />

Deferred revenue 2,914 923 1,863<br />

TOTAL 58,042 49,433 58,772<br />

The accounts payable mainly constitute income due to investors<br />

in the Shipping Containers, Freight Railcars and Modular<br />

Buildings businesses (€21.9 million at December 31, <strong>2011</strong>,<br />

€23.3 million at December 31, 2010).<br />

In 2009, a conditional sale of $20 million, i.e. €13.9 million, had<br />

been booked regarding an investor in the Shipping Containers<br />

division. This debt was repaid in 2010, since the sale did not<br />

take place.<br />

note 26. Risk Management<br />

➜ Market risk<br />

Financial and market risks include currency risk, interest-rate<br />

risk, equity risk, and counterparty risk.<br />

Interest rate risk and exchange rate risk are managed centrally<br />

within the Treasury and Finance Department which provides<br />

monthly <strong>report</strong>s to the Executive Committee.<br />

Interest rate risk and exchange rate risk are monitored<br />

through monthly <strong>report</strong>ing by subsidiaries to the Treasury and<br />

Finance Department; these <strong>report</strong>s include borrowings from<br />

outside establishments as well as loans agreed between<br />

Group subsidiaries. The information is checked, analyzed,<br />

consolidated and forwarded to the Executive Committee. The<br />

Treasury and Finance Department makes recommendations<br />

on the management of interest rate and exchange rate risks,<br />

and decisions are made by the Group Executive Committee.<br />

Standard office IT tools enable the Group’s to adequately<br />

monitor these risks.<br />

➜ Credit Risk<br />

Credit risk is dealt with in note 18.1.1.<br />

➜ Liquidity Risk and Counterparty Risk<br />

Liquidity risk is managed by the Group's Treasury and Finance<br />

Department which <strong>report</strong>s to the Group's Administrative and<br />

Finance Department. Overall cash flow management at the<br />

Group level allows to compensate for surplus cash and cash<br />

requirements in order to limit the use of financial borrowing.<br />

Liquidity risk management is assessed via the Group's<br />

requirements defined in the three-year plan, the annual cash<br />

flow budget, as well as via monthly and weekly forecasts.<br />

All <strong>report</strong>s are sent to the Group's Executive Committee.<br />

The objective for cash flow management is to meet the<br />

Group's deadlines while maintaining the leeway decided by the<br />

Group's Executive Committee and optimizing the financial<br />

costs of the debt.<br />

For that purpose, the Group has credit lines approved by its<br />

banking partners, comprising revolving bank loans, a bond<br />

issue (bond with redeemable equity warrant - OBSAR) in 2007<br />

for pre-financing its assets, and credit lines for asset finance<br />

leases, in order to optimize matching of debt servicing with the<br />

income generated by assets.<br />

All of the loans are negotiated or approved by the Treasury and<br />

Finance Department in order to control the Group's commitments<br />

both on and off the balance sheet.<br />

Some loans include clauses with drawdown conditions (asset<br />

eligibility) and others include financial commitments (ratios)<br />

that the Group must abide by, as indicated in note 18.2.3.<br />

In the short term, the Group's main liquidity risks concern the<br />

non-renewal of revolving credit lines and the refinancing of the<br />

OBSAR maturing in March 2012.<br />

Consolidated financial statements<br />

Financial information concerning the issuer’s assets, financial position and result 91