2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>report</strong> <strong>2011</strong><br />

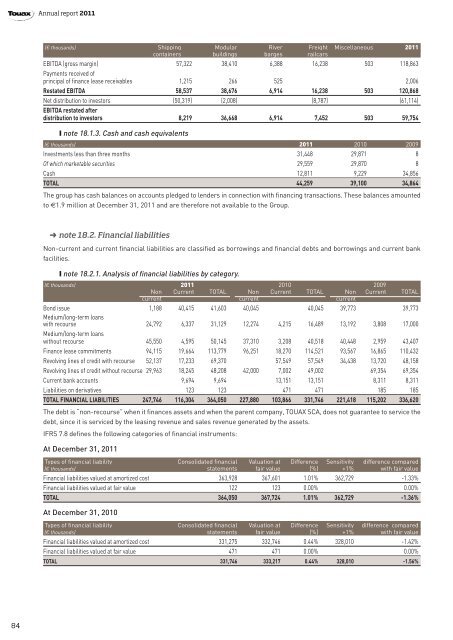

(€ thousands) Shipping Modular River Freight Miscellaneous <strong>2011</strong><br />

containers buildings barges railcars<br />

EBITDA (gross margin) 57,322 38,410 6,388 16,238 503 118,863<br />

Payments received of<br />

principal of finance lease receivables 1,215 266 525 2,006<br />

Restated EBITDA 58,537 38,676 6,914 16,238 503 120,868<br />

Net distribution to investors (50,319) (2,008) (8,787) (61,114)<br />

EBITDA restated after<br />

distribution to investors 8,219 36,668 6,914 7,452 503 59,754<br />

❙ note 18.1.3. Cash and cash equivalents<br />

(€ thousands) <strong>2011</strong> 2010 2009<br />

Investments less than three months 31,448 29,871 8<br />

Of which marketable securities 29,559 29,870 8<br />

Cash 12,811 9,229 34,856<br />

TOTAL 44,259 39,100 34,864<br />

The <strong>group</strong> has cash balances on accounts pledged to lenders in connection with financing transactions. These balances amounted<br />

to €1.9 million at December 31, <strong>2011</strong> and are therefore not available to the Group.<br />

➜ note 18.2. Financial liabilities<br />

Non-current and current financial liabilities are classified as borrowings and financial debts and borrowings and current bank<br />

facilities.<br />

❙ note 18.2.1. Analysis of financial liabilities by category.<br />

(€ thousands) <strong>2011</strong> 2010 2009<br />

Non Current TOTAL Non Current TOTAL Non Current TOTAL<br />

current current current<br />

Bond issue 1,188 40,415 41,603 40,045 40,045 39,773 39,773<br />

Medium/long-term loans<br />

with recourse 24,792 6,337 31,129 12,274 4,215 16,489 13,192 3,808 17,000<br />

Medium/long-term loans<br />

without recourse 45,550 4,595 50,145 37,310 3,208 40,518 40,448 2,959 43,407<br />

Finance lease commitments 94,115 19,664 113,779 96,251 18,270 114,521 93,567 16,865 110,432<br />

Revolving lines of credit with recourse 52,137 17,233 69,370 57,549 57,549 34,438 13,720 48,158<br />

Revolving lines of credit without recourse 29,963 18,245 48,208 42,000 7,002 49,002 69,354 69,354<br />

Current bank accounts 9,694 9,694 13,151 13,151 8,311 8,311<br />

Liabilities on derivatives 123 123 471 471 185 185<br />

TOTAL FINANCIAL LIABILITIES 247,746 116,304 364,050 227,880 103,866 331,746 221,418 115,202 336,620<br />

The debt is “non-recourse” when it finances assets and when the parent company, TOUAX SCA, does not guarantee to service the<br />

debt, since it is serviced by the leasing revenue and sales revenue generated by the assets.<br />

IFRS 7.8 defines the following categories of financial instruments:<br />

At December 31, <strong>2011</strong><br />

Types of financial liability Consolidated financial Valuation at Difference Sensitivity difference compared<br />

(€ thousands) statements fair value (%) +1% with fair value<br />

Financial liabilities valued at amortized cost 363,928 367,601 1.01% 362,729 -1.33%<br />

Financial liabilities valued at fair value 122 123 0.00% 0.00%<br />

TOTAL 364,050 367,724 1.01% 362,729 -1.36%<br />

At December 31, 2010<br />

Types of financial liability Consolidated financial Valuation at Difference Sensitivity difference compared<br />

(€ thousands) statements fair value (%) +1% with fair value<br />

Financial liabilities valued at amortized cost 331,275 332,746 0.44% 328,010 -1.42%<br />

Financial liabilities valued at fair value 471 471 0.00% 0.00%<br />

TOTAL 331,746 333,217 0.44% 328,010 -1.56%<br />

84