2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

18. Main shareholders<br />

18.1. Breakdown in capital and voting rights<br />

There are no categories of shares or securities which do not represent capital. There is no treasury stock (TOUAX SCA shares<br />

held by its subsidiaries). The number of own shares held (TOUAX SCA shares held by TOUAX SCA) is insignificant (see section 18.4<br />

on own shares held).<br />

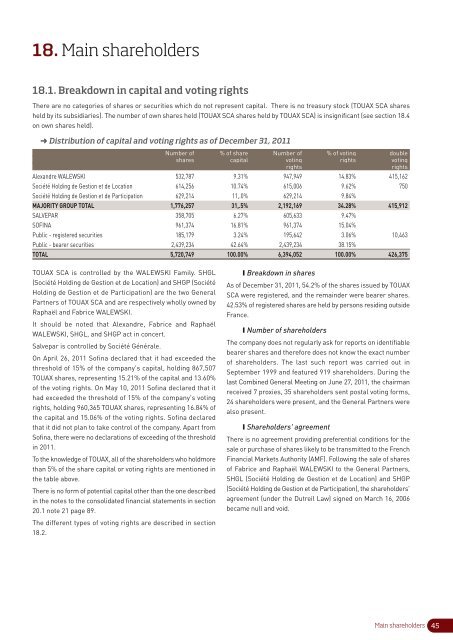

➜ Distribution of capital and voting rights as of December 31, <strong>2011</strong><br />

Number of % of share Number of % of voting double<br />

shares capital voting rights voting<br />

rights<br />

rights<br />

Alexandre WALEWSKI 532,787 9.31% 947,949 14.83% 415,162<br />

Société Holding de Gestion et de Location 614,256 10.74% 615,006 9.62% 750<br />

Société Holding de Gestion et de Participation 629,214 11,.0% 629,214 9.84%<br />

MAJORITY GROUP TOTAL 1,776,257 31,.5% 2,192,169 34.28% 415,912<br />

SALVEPAR 358,705 6.27% 605,633 9.47%<br />

SOFINA 961,374 16.81% 961,374 15.04%<br />

Public - registered securities 185,179 3.24% 195,642 3.06% 10,463<br />

Public - bearer securities 2,439,234 42.64% 2,439,234 38.15%<br />

TOTAL 5,720,749 100.00% 6,394,052 100.00% 426,375<br />

TOUAX SCA is controlled by the WALEWSKI Family. SHGL<br />

(Société Holding de Gestion et de Location) and SHGP (Société<br />

Holding de Gestion et de Participation) are the two General<br />

Partners of TOUAX SCA and are respectively wholly owned by<br />

Raphaël and Fabrice WALEWSKI.<br />

It should be noted that Alexandre, Fabrice and Raphaël<br />

WALEWSKI, SHGL, and SHGP act in concert.<br />

Salvepar is controlled by Société Générale.<br />

On April 26, <strong>2011</strong> Sofina declared that it had exceeded the<br />

threshold of 15% of the company's capital, holding 867,507<br />

TOUAX shares, representing 15.21% of the capital and 13.60%<br />

of the voting rights. On May 10, <strong>2011</strong> Sofina declared that it<br />

had exceeded the threshold of 15% of the company's voting<br />

rights, holding 960,365 TOUAX shares, representing 16.84% of<br />

the capital and 15.06% of the voting rights. Sofina declared<br />

that it did not plan to take control of the company. Apart from<br />

Sofina, there were no declarations of exceeding of the threshold<br />

in <strong>2011</strong>.<br />

To the knowledge of TOUAX, all of the shareholders who holdmore<br />

than 5% of the share capital or voting rights are mentioned in<br />

the table above.<br />

There is no form of potential capital other than the one described<br />

in the notes to the consolidated financial statements in section<br />

20.1 note 21 page 89.<br />

The different types of voting rights are described in section<br />

18.2.<br />

❙ Breakdown in shares<br />

As of December 31, <strong>2011</strong>, 54.2% of the shares issued by TOUAX<br />

SCA were registered, and the remainder were bearer shares.<br />

42.53% of registered shares are held by persons residing outside<br />

France.<br />

❙ Number of shareholders<br />

The company does not regularly ask for <strong>report</strong>s on identifiable<br />

bearer shares and therefore does not know the exact number<br />

of shareholders. The last such <strong>report</strong> was carried out in<br />

September 1999 and featured 919 shareholders. During the<br />

last Combined General Meeting on June 27, <strong>2011</strong>, the chairman<br />

received 7 proxies, 35 shareholders sent postal voting forms,<br />

24 shareholders were present, and the General Partners were<br />

also present.<br />

❙ Shareholders' agreement<br />

There is no agreement providing preferential conditions for the<br />

sale or purchase of shares likely to be transmitted to the French<br />

Financial Markets Authority (AMF). Following the sale of shares<br />

of Fabrice and Raphaël WALEWSKI to the General Partners,<br />

SHGL (Société Holding de Gestion et de Location) and SHGP<br />

(Société Holding de Gestion et de Participation), the shareholders'<br />

agreement (under the Dutreil Law) signed on March 16, 2006<br />

became null and void.<br />

Main shareholders 45