2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

➜ note 1.2. Estimates<br />

Drawing up financial statements in accordance with IFRS<br />

standards has led management to perform estimates and put<br />

forward assumptions affecting the book value of certain assets<br />

and liabilities, income and expenses, as well as the information<br />

given in certain notes to the statements.<br />

Since these assumptions are intrinsically uncertain, actual<br />

information may differ from the estimates. The Group regularly<br />

reviews its estimates and assessments in order to take past<br />

experience into account and factor in any elements considered<br />

relevant regarding economic conditions.<br />

The statements and information subject to significant estimates<br />

especially concern the appraisal of potential losses in value of the<br />

Group’s tangible assets, goodwill, financial assets, derivative<br />

financial instruments, inventories and work in progress, provisions<br />

for risks and charges, deferred taxes.<br />

➜ note 1.3. Consolidation methods<br />

The Group’s annual financial statements include the statements<br />

for TOUAX SCA and its subsidiaries covering the period from<br />

January 1 to December 31, <strong>2011</strong>.<br />

Companies in which TOUAX SCA has a controlling interest are<br />

fully consolidated and the rights of minority shareholders are<br />

recognized.<br />

Entities over which TOUAX SCA exerts a significant influence are<br />

consolidated by the equity method.<br />

Entities created for asset securitization are not included in the<br />

consolidation perimeter since they do not constitute controlled<br />

special purpose entities in the sense of SIC 12 “Consolidation –<br />

Special purpose entities” (see the notes to the consolidated<br />

financial statements, note 1.5 page 56).<br />

A list of companies included in the consolidation perimeter is<br />

provided below in the notes to the consolidated financial<br />

statements, note 2.2.<br />

Commercial and financial transactions between consolidated<br />

companies are eliminated, including internal profits.<br />

➜ note 1.4. Foreign currency conversion<br />

❙ note 1.4.1. Conversion of currency financial<br />

statements for foreign subsidiaries<br />

The functional and presentation currency of the Group is the euro.<br />

The functional currency for foreign subsidiaries is generally the<br />

local currency. When the majority of transactions is performed<br />

in a third currency, the operating currency is the third currency.<br />

Financial statements for the Group’s foreign companies are<br />

prepared in their functional currency. The accounts of foreign<br />

companies and are converted into the Group’s <strong>report</strong>ing<br />

currency (euro) as follows:<br />

• Assets and liabilities of foreign subsidiaries are converted into<br />

euros at the closing exchange rate;<br />

• Shareholders’ equity, maintained at the historical rate,<br />

is converted at the closing exchange rate;<br />

• The income and cash flow statements are converted at the<br />

average exchange rate for the period;<br />

• Profits or losses resulting from the conversion of the foreign<br />

companies’ financial statements are recognized in a conversion<br />

reserve included in the consolidated shareholders’ equity.<br />

Goodwill generated during the acquisition of foreign companies<br />

is recognized in the functional currency of the acquired company.<br />

The goodwill is then converted at the current exchange rate<br />

into the Group’s presentation currency. Any differences resulting<br />

from the conversion are recognized in the consolidated<br />

shareholders’ equity.<br />

In accordance with the option authorized by IFRS 1 “First-time<br />

Adoption of IFRS”, the Group has chosen to reclassify the<br />

aggregated “conversion reserves” as of January 1 2004, resulting<br />

from the conversion mechanism for foreign subsidiary financial<br />

statements, as “consolidated reserves”.<br />

Following the disposal of a foreign subsidiary, the aggregated<br />

exchange differences in the “conversion reserves” account<br />

since January 1, 2004 are recycled on the income statement as<br />

a component of the profit or loss from the disposal.<br />

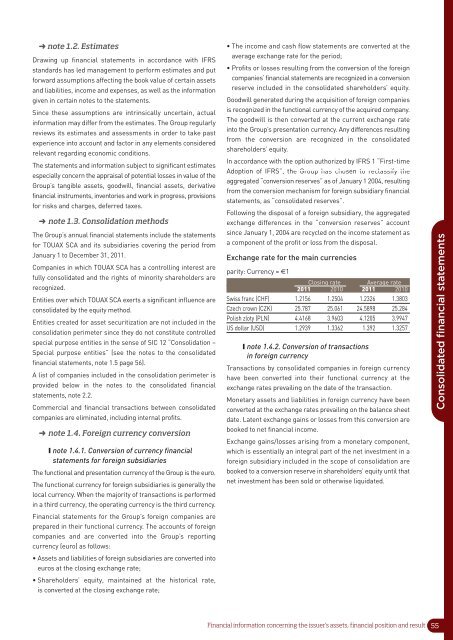

Exchange rate for the main currencies<br />

parity: Currency = €1<br />

Closing rate Average rate<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

Swiss franc (CHF) 1.2156 1.2504 1.2326 1.3803<br />

Czech crown (CZK) 25.787 25.061 24.5898 25.284<br />

Polish zloty (PLN) 4.4168 3.9603 4.1205 3.9947<br />

US dollar (USD) 1.2939 1.3362 1.392 1.3257<br />

❙ note 1.4.2. Conversion of transactions<br />

in foreign currency<br />

Transactions by consolidated companies in foreign currency<br />

have been converted into their functional currency at the<br />

exchange rates prevailing on the date of the transaction.<br />

Monetary assets and liabilities in foreign currency have been<br />

converted at the exchange rates prevailing on the balance sheet<br />

date. Latent exchange gains or losses from this conversion are<br />

booked to net financial income.<br />

Exchange gains/losses arising from a monetary component,<br />

which is essentially an integral part of the net investment in a<br />

foreign subsidiary included in the scope of consolidation are<br />

booked to a conversion reserve in shareholders’ equity until that<br />

net investment has been sold or otherwise liquidated.<br />

Consolidated financial statements<br />

Financial information concerning the issuer’s assets, financial position and result<br />

55