2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

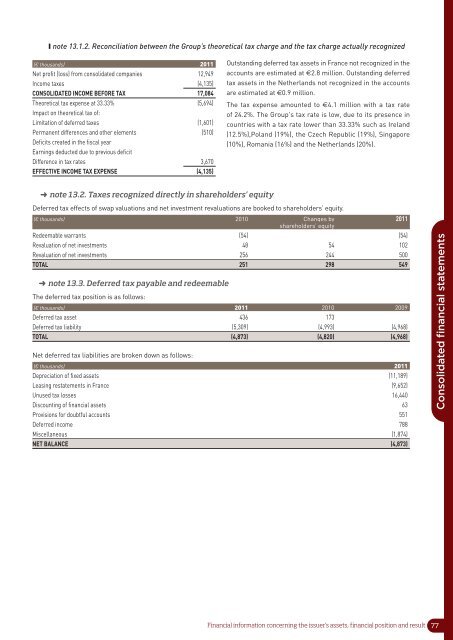

❙ note 13.1.2. Reconciliation between the Group’s theoretical tax charge and the tax charge actually recognized<br />

(€ thousands) <strong>2011</strong><br />

Net profit (loss) from consolidated companies 12,949<br />

Income taxes (4,135)<br />

CONSOLIDATED INCOME BEFORE TAX 17,084<br />

Theoretical tax expense at 33.33% (5,694)<br />

Impact on theoretical tax of:<br />

Limitation of deferred taxes (1,601)<br />

Permanent differences and other elements (510)<br />

Deficits created in the fiscal year<br />

Earnings deducted due to previous deficit<br />

Difference in tax rates 3,670<br />

EFFECTIVE INCOME TAX EXPENSE (4,135)<br />

Outstanding deferred tax assets in France not recognized in the<br />

accounts are estimated at €2.8 million. Outstanding deferred<br />

tax assets in the Netherlands not recognized in the accounts<br />

are estimated at €0.9 million.<br />

The tax expense amounted to €4.1 million with a tax rate<br />

of 24.2%. The Group's tax rate is low, due to its presence in<br />

countries with a tax rate lower than 33.33% such as Ireland<br />

(12.5%),Poland (19%), the Czech Republic (19%), Singapore<br />

(10%), Romania (16%) and the Netherlands (20%).<br />

➜ note 13.2. Taxes recognized directly in shareholders’ equity<br />

Deferred tax effects of swap valuations and net investment revaluations are booked to shareholders’ equity.<br />

(€ thousands) 2010 Changes by <strong>2011</strong><br />

shareholders’ equity<br />

Redeemable warrants (54) (54)<br />

Revaluation of net investments 48 54 102<br />

Revaluation of net investments 256 244 500<br />

TOTAL 251 298 549<br />

➜ note 13.3. Deferred tax payable and redeemable<br />

The deferred tax position is as follows:<br />

(€ thousands) <strong>2011</strong> 2010 2009<br />

Deferred tax asset 436 173<br />

Deferred tax liability (5,309) (4,993) (4,968)<br />

TOTAL (4,873) (4,820) (4,968)<br />

Net deferred tax liabilities are broken down as follows:<br />

(€ thousands) <strong>2011</strong><br />

Depreciation of fixed assets (11,189)<br />

Leasing restatements in France (9,652)<br />

Unused tax losses 16,440<br />

Discounting of financial assets 63<br />

Provisions for doubtful accounts 551<br />

Deferred income 788<br />

Miscellaneous (1,874)<br />

NET BALANCE (4,873)<br />

Consolidated financial statements<br />

Financial information concerning the issuer’s assets, financial position and result<br />

77