2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

29. Draft of resolutions<br />

Ordinary and extraordinary<br />

shareholders’ meeting to be held<br />

on 15 june 2012<br />

On first notice of meeting, the Ordinary General Meeting can<br />

only validly proceed if the shareholders present in person or by<br />

proxy hold at least one fifth of the shares to which voting rights<br />

are attached. Motions pass by simple majority of votes cast.<br />

FIRST RESOLUTION (approval<br />

of the financial statements of<br />

the fiscal year <strong>2011</strong>)<br />

The General Meeting, after examining the <strong>report</strong>s of the<br />

Management Board, the Supervisory Board, the Chairman of<br />

the Supervisory Board, and the Statutory Auditors on the fiscal<br />

year ended December 31, <strong>2011</strong>, hereby approves the annual<br />

financial statements for the fiscal year ended December 31,<br />

<strong>2011</strong>, as presented to the Meeting, showing a net income of<br />

€4,589,884.06.<br />

The General Meeting approves the expenses and charges<br />

not deductible from profits as specified in Article 39-4 of the<br />

General Tax Code amounting to €195,361, as well as a tax<br />

saving of €235,596 resulting from the fiscal integration.<br />

SECOND RESOLUTION (approval of<br />

the consolidated statement of the<br />

fiscal year <strong>2011</strong>)<br />

The General Meeting, after examining the <strong>report</strong>s of the<br />

Management Board, the Supervisory Board, the Chairman of the<br />

Supervisory Board and the Statutory Auditors, approves the<br />

consolidated financial statements for the fiscal year ended<br />

December 31, <strong>2011</strong>, as presented to the Meeting, as well as the<br />

transactions reflected in these statements showing a profit<br />

of €13,434,318.<br />

THIRD RESOLUTION (discharge)<br />

The General Meeting grants discharge to the Management Board,<br />

the Supervisory Board and the Statutory Auditors for the<br />

performance of their mandates for the <strong>2011</strong> fiscal year.<br />

FOURTH RESOLUTION (allocation<br />

of net profit and distribution<br />

of dividend)<br />

The General Meeting, approving the recommendation of the<br />

Management Board, decides to allocate and appropriate the<br />

distributable profit as follows:<br />

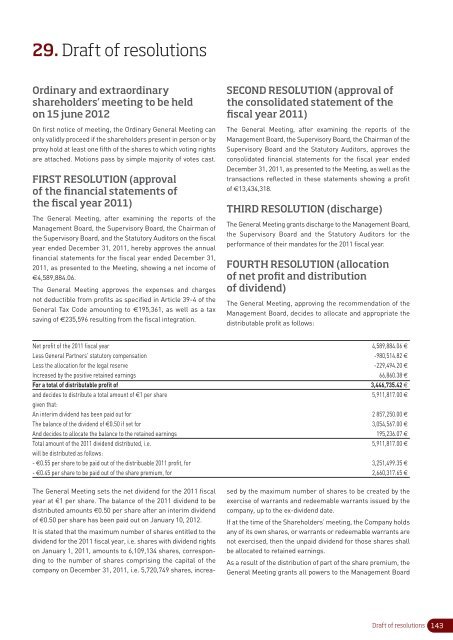

Net profit of the <strong>2011</strong> fiscal year 4,589,884.06 €<br />

Less General Partners' statutory compensation -980,514.82 €<br />

Less the allocation for the legal reserve -229,494.20 €<br />

Increased by the positive retained earnings 66,860.38 €<br />

For a total of distributable profit of 3,446,735.42 €<br />

and decides to distribute a total amount of €1 per share 5,911,817.00 €<br />

given that:<br />

An interim dividend has been paid out for 2 857,250.00 €<br />

The balance of the dividend of €0.50 if set for 3,054,567.00 €<br />

And decides to allocate the balance to the retained earnings 195,236.07 €<br />

Total amount of the <strong>2011</strong> dividend distributed, i.e. 5,911,817.00 €<br />

will be distributed as follows:<br />

- €0.55 per share to be paid out of the distribuable <strong>2011</strong> profit, for 3,251,499.35 €<br />

- €0.45 per share to be paid out of the share premium, for 2,660,317.65 €<br />

The General Meeting sets the net dividend for the <strong>2011</strong> fiscal<br />

year at €1 per share. The balance of the <strong>2011</strong> dividend to be<br />

distributed amounts €0.50 per share after an interim dividend<br />

of €0.50 per share has been paid out on January 10, 2012.<br />

It is stated that the maximum number of shares entitled to the<br />

dividend for the <strong>2011</strong> fiscal year, i.e. shares with dividend rights<br />

on January 1, <strong>2011</strong>, amounts to 6,109,134 shares, corresponding<br />

to the number of shares comprising the capital of the<br />

company on December 31, <strong>2011</strong>, i.e. 5,720,749 shares, increased<br />

by the maximum number of shares to be created by the<br />

exercise of warrants and redeemable warrants issued by the<br />

company, up to the ex-dividend date.<br />

If at the time of the Shareholders’ meeting, the Company holds<br />

any of its own shares, or warrants or redeemable warrants are<br />

not exercised, then the unpaid dividend for those shares shall<br />

be allocated to retained earnings.<br />

As a result of the distribution of part of the share premium, the<br />

General Meeting grants all powers to the Management Board<br />

Draft of resolutions 143