2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>report</strong> <strong>2011</strong><br />

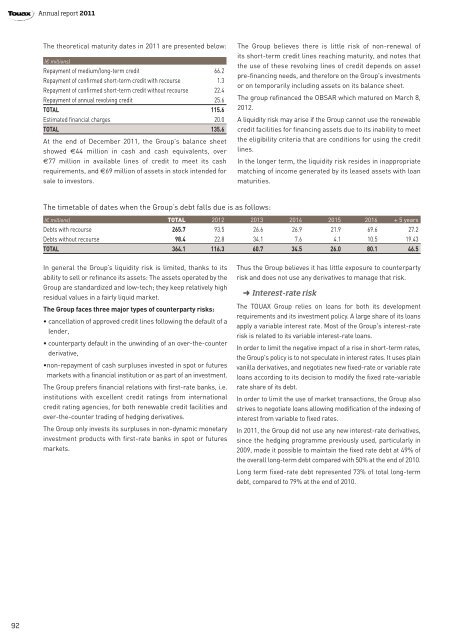

The theoretical maturity dates in <strong>2011</strong> are presented below:<br />

(€ millions)<br />

Repayment of medium/long-term credit 66.2<br />

Repayment of confirmed short-term credit with recourse 1.3<br />

Repayment of confirmed short-term credit without recourse 22.4<br />

Repayment of annual revolving credit 25.6<br />

TOTAL 115.6<br />

Estimated financial charges 20.0<br />

TOTAL 135.6<br />

At the end of December <strong>2011</strong>, the Group's balance sheet<br />

showed €44 million in cash and cash equivalents, over<br />

€77 million in available lines of credit to meet its cash<br />

requirements, and €69 million of assets in stock intended for<br />

sale to investors.<br />

The Group believes there is little risk of non-renewal of<br />

its short-term credit lines reaching maturity, and notes that<br />

the use of these revolving lines of credit depends on asset<br />

pre-financing needs, and therefore on the Group's investments<br />

or on temporarily including assets on its balance sheet.<br />

The <strong>group</strong> refinanced the OBSAR which matured on March 8,<br />

2012.<br />

A liquidity risk may arise if the Group cannot use the renewable<br />

credit facilities for financing assets due to its inability to meet<br />

the eligibility criteria that are conditions for using the credit<br />

lines.<br />

In the longer term, the liquidity risk resides in inappropriate<br />

matching of income generated by its leased assets with loan<br />

maturities.<br />

The timetable of dates when the Group’s debt falls due is as follows:<br />

(€ millions) TOTAL 2012 2013 2014 2015 2016 + 5 years<br />

Debts with recourse 265.7 93.5 26.6 26.9 21.9 69.6 27.2<br />

Debts without recourse 98.4 22.8 34.1 7.6 4.1 10.5 19.43<br />

TOTAL 364.1 116.3 60.7 34.5 26.0 80.1 46.5<br />

In general the Group’s liquidity risk is limited, thanks to its<br />

ability to sell or refinance its assets: The assets operated by the<br />

Group are standardized and low-tech; they keep relatively high<br />

residual values in a fairly liquid market.<br />

The Group faces three major types of counterparty risks:<br />

• cancellation of approved credit lines following the default of a<br />

lender,<br />

• counterparty default in the unwinding of an over-the-counter<br />

derivative,<br />

•non-repayment of cash surpluses invested in spot or futures<br />

markets with a financial institution or as part of an investment.<br />

The Group prefers financial relations with first-rate banks, i.e.<br />

institutions with excellent credit ratings from international<br />

credit rating agencies, for both renewable credit facilities and<br />

over-the-counter trading of hedging derivatives.<br />

The Group only invests its surpluses in non-dynamic monetary<br />

investment products with first-rate banks in spot or futures<br />

markets.<br />

Thus the Group believes it has little exposure to counterparty<br />

risk and does not use any derivatives to manage that risk.<br />

➜ Interest-rate risk<br />

The TOUAX Group relies on loans for both its development<br />

requirements and its investment policy. A large share of its loans<br />

apply a variable interest rate. Most of the Group's interest-rate<br />

risk is related to its variable interest-rate loans.<br />

In order to limit the negative impact of a rise in short-term rates,<br />

the Group's policy is to not speculate in interest rates. It uses plain<br />

vanilla derivatives, and negotiates new fixed-rate or variable rate<br />

loans according to its decision to modify the fixed rate-variable<br />

rate share of its debt.<br />

In order to limit the use of market transactions, the Group also<br />

strives to negotiate loans allowing modification of the indexing of<br />

interest from variable to fixed rates.<br />

In <strong>2011</strong>, the Group did not use any new interest-rate derivatives,<br />

since the hedging programme previously used, particularly in<br />

2009, made it possible to maintain the fixed rate debt at 49% of<br />

the overall long-term debt compared with 50% at the end of 2010.<br />

Long term fixed-rate debt represented 73% of total long-term<br />

debt, compared to 79% at the end of 2010.<br />

92