2011 Annual report - touax group

2011 Annual report - touax group

2011 Annual report - touax group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> <strong>report</strong> <strong>2011</strong><br />

• Belgian citizen,<br />

• Non-independent member, linked to the Sofina <strong>group</strong>,<br />

shareholder holding over 10% of the capital.<br />

Mrs Sophie SERVATY is an executive assistant at SOFINA.<br />

Other corporate offices held: director of Capital-E NV.<br />

Mrs Sophie SERVATY held 250 TOUAX SCA shares on December<br />

31, <strong>2011</strong>.<br />

It is stated that, in accordance with the law, the General Partners<br />

who are shareholders cannot take part in the vote to renew the<br />

terms of office of the members of the Supervisory Board.<br />

We propose that you allocate attendance fees to the members<br />

of the Supervisory Board for a total of €63,000.<br />

➜ Renewal of the authorization to carry out a<br />

stock redemption programme (13 th resolution)<br />

and authorization to cancel securities<br />

(15 th resolution)<br />

We propose that you renew the programme to authorize the<br />

buyback of shares in our company.<br />

It should be noted that this programme only concerns TOUAX<br />

shares listed for trading on Compartment C of the NYSE<br />

Euronext Paris regulated market, ISIN FR0000033003.<br />

The previous stock redemption programme was authorized by<br />

the Ordinary General Meeting of June 27, <strong>2011</strong> and has been<br />

<strong>report</strong>ed on half-yearly to the AMF. The purpose of the<br />

programme was to:<br />

• carrying out market making and ensuring the liquidity of the<br />

TOUAX SCA share through a liquidity agreement with an<br />

investment services provider, in accordance with the Code of<br />

Practice recognized by the French Financial Markets Authority<br />

(AMF);<br />

• granting stock options and/or allotting bonus shares to<br />

employees and managers of the company and/or of TOUAX<br />

Group companies;<br />

• granting coverage for securities that entitle the holder to<br />

receive shares in the partnership under the regulations<br />

currently in force;<br />

• keep the shares bought, and use them later for trading or as<br />

payment in possible corporate acquisitions, though the shares<br />

acquired for this purpose may not exceed 5% of the share<br />

capital;<br />

• cancel the shares.<br />

The scheme was set up for the sole purpose of conducting<br />

transactions so as to enhance activity and liquidity in the market<br />

for the shares. These purchase and sale transactions were<br />

carried out via a liquidity agreement concluded on October 17,<br />

2005 in accordance with the code of ethics approved by the<br />

AMF, with the investment services provider GILBERT DUPONT.<br />

At December 31, <strong>2011</strong> the company held 6,774 treasury shares,<br />

as shown in the following summary table:<br />

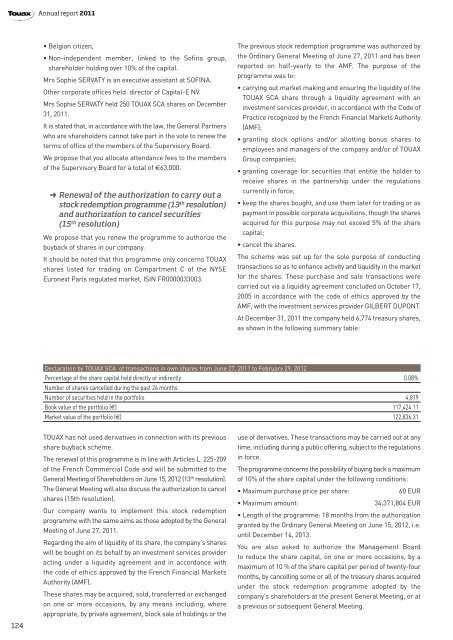

Declaration by TOUAX SCA of transactions in own shares from June 27, <strong>2011</strong> to February 29, 2012<br />

Percentage of the share capital held directly or indirectly 0.08%<br />

Number of shares cancelled during the past 24 months<br />

Number of securities held in the portfolio 4,819<br />

Book value of the portfolio (€) 117,424.11<br />

Market value of the portfolio (€) 122,836.31<br />

124<br />

TOUAX has not used derivatives in connection with its previous<br />

share buyback scheme.<br />

The renewal of this programme is in line with Articles L. 225-209<br />

of the French Commercial Code and will be submitted to the<br />

General Meeting of Shareholders on June 15, 2012 (13 th resolution).<br />

The General Meeting will also discuss the authorization to cancel<br />

shares (15th resolution).<br />

Our company wants to implement this stock redemption<br />

programme with the same aims as those adopted by the General<br />

Meeting of June 27, <strong>2011</strong>.<br />

Regarding the aim of liquidity of its share, the company's shares<br />

will be bought on its behalf by an investment services provider<br />

acting under a liquidity agreement and in accordance with<br />

the code of ethics approved by the French Financial Markets<br />

Authority (AMF).<br />

These shares may be acquired, sold, transferred or exchanged<br />

on one or more occasions, by any means including, where<br />

appropriate, by private agreement, block sale of holdings or the<br />

use of derivatives. These transactions may be carried out at any<br />

time, including during a public offering, subject to the regulations<br />

in force.<br />

The programme concerns the possibility of buying back a maximum<br />

of 10% of the share capital under the following conditions:<br />

• Maximum purchase price per share:<br />

60 EUR<br />

• Maximum amount:<br />

34,371,804 EUR<br />

• Length of the programme: 18 months from the authorization<br />

granted by the Ordinary General Meeting on June 15, 2012, i.e.<br />

until December 14, 2013.<br />

You are also asked to authorize the Management Board<br />

to reduce the share capital, on one or more occasions, by a<br />

maximum of 10 % of the share capital per period of twenty-four<br />

months, by cancelling some or all of the treasury shares acquired<br />

under the stock redemption programme adopted by the<br />

company's shareholders at the present General Meeting, or at<br />

a previous or subsequent General Meeting.