Marine Industries Global Market Analysis - Marine Institute

Marine Industries Global Market Analysis - Marine Institute

Marine Industries Global Market Analysis - Marine Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

46 MARINE INDUSTRIES GLOBAL MARKET ANALYSIS<br />

For the past 30 years oil prices have been subject to massive fluctuations as a result of<br />

political actions ranging from local civil disturbance to outright wars in the Middle<br />

East.The results were the tripling of oil prices in 1973 and again in 1979.The<br />

reaction of the oil consuming western economies has been to seek oil supplies from<br />

other less troubled areas, resulting in the development of whole new oil production<br />

provinces such as the North Sea. Although oil demand has continued to grow, from<br />

some 58 million barrels per day (bpd) in 1973 to some 80 million bpd in 2004, the<br />

proportion shipped from the Middle East has fallen as the OPEC countries lost<br />

market share to these new non-OPEC suppliers.<br />

Since 1973, European oil demand has grown by only 6%, the US by 16%, whilst in<br />

the developing economies growth has been 202%.<br />

But the picture is changing. In the North Sea and some other shallow-water offshore<br />

areas oil & gas production has passed its peak and will soon be entering a period of<br />

terminal decline. Coupled with other factors, the effects of supply restrictions are now<br />

evident in prices that exceeded $53 in late 2004.<br />

In theory, the reserves that are still available worldwide are considerable – 40 years at<br />

current demand is much quoted, but is this true Such figures do not take into<br />

account the problems (both technical and political) in accessing the reserves.There is<br />

no doubt that OPEC fully realises the economic problems that high oil prices cause<br />

its customer countries which, at their most serious, would again reduce demand.<br />

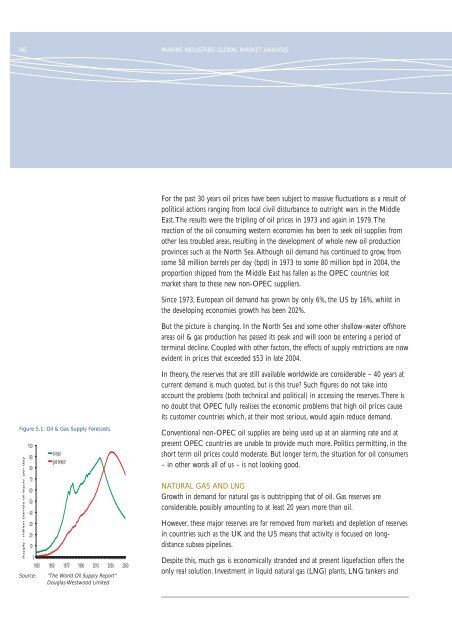

Figure 5.1: Oil & Gas Supply Forecasts<br />

Conventional non-OPEC oil supplies are being used up at an alarming rate and at<br />

present OPEC countries are unable to provide much more. Politics permitting, in the<br />

short term oil prices could moderate. But longer term, the situation for oil consumers<br />

– in other words all of us – is not looking good.<br />

Source:<br />

“The World Oil Supply Report”<br />

Douglas-Westwood Limited<br />

NATURAL GAS AND LNG<br />

Growth in demand for natural gas is outstripping that of oil. Gas reserves are<br />

considerable, possibly amounting to at least 20 years more than oil.<br />

However, these major reserves are far removed from markets and depletion of reserves<br />

in countries such as the UK and the US means that activity is focused on longdistance<br />

subsea pipelines.<br />

Despite this, much gas is economically stranded and at present liquefaction offers the<br />

only real solution. Investment in liquid natural gas (LNG) plants, LNG tankers and