DRIVING PROFESSIONAL STANDARDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DRIVING</strong> <strong>PROFESSIONAL</strong> <strong>STANDARDS</strong><br />

2015 MII PROGRAMME DIRECTORY<br />

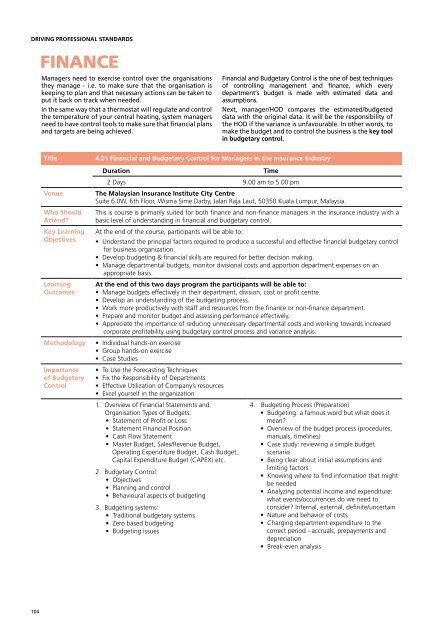

FINANCE<br />

Managers need to exercise control over the organisations<br />

they manage - i.e. to make sure that the organisation is<br />

keeping to plan and that necessary actions can be taken to<br />

put it back on track when needed.<br />

In the same way that a thermostat will regulate and control<br />

the temperature of your central heating, system managers<br />

need to have control tools to make sure that financial plans<br />

and targets are being achieved.<br />

Financial and Budgetary Control is the one of best techniques<br />

of controlling management and finance, which every<br />

department’s budget is made with estimated data and<br />

assumptions.<br />

Next, manager/HOD compares the estimated/budgeted<br />

data with the original data. It will be the responsibility of<br />

the HOD if the variance is unfavourable. In other words, to<br />

make the budget and to control the business is the key tool<br />

in budgetary control.<br />

Title<br />

4.01 Financial and Budgetary Control for Managers in the Insurance Industry<br />

Venue<br />

Who Should<br />

Attend<br />

Key Learning<br />

Objectives<br />

Learning<br />

Outcomes<br />

Methodology<br />

Importance<br />

of Budgetary<br />

Control<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

This is course is primarily suited for both finance and non-finance managers in the insurance industry with a<br />

basic level of understanding in financial and budgetary control.<br />

At the end of the course, participants will be able to:<br />

• Understand the principal factors required to produce a successful and effective financial budgetary control<br />

for business organization.<br />

• Develop budgeting & financial skills are required for better decision making.<br />

• Manage departmental budgets, monitor divisional costs and apportion department expenses on an<br />

appropriate basis.<br />

At the end of this two days program the participants will be able to:<br />

• Manage budgets effectively in their department, division, cost or profit centre.<br />

• Develop an understanding of the budgeting process.<br />

• Work more productively with staff and resources from the finance or non-finance department.<br />

• Prepare and monitor budget and assessing performance effectively.<br />

• Appreciate the importance of reducing unnecessary departmental costs and working towards increased<br />

corporate profitability using budgetary control process and variance analysis.<br />

• Individual hands-on exercise<br />

• Group hands-on exercise<br />

• Case Studies<br />

• To Use the Forecasting Techniques<br />

• Fix the Responsibility of Departments<br />

• Effective Utilization of Company’s resources<br />

• Excel yourself in the organization<br />

1. Overview of Financial Statements and<br />

Organisation Types of Budgets:<br />

• Statement of Profit or Loss<br />

• Statement Financial Position<br />

• Cash Flow Statement<br />

• Master Budget, Sales/Revenue Budget,<br />

Operating Expenditure Budget, Cash Budget,<br />

Capital Expenditure Budget (CAPEX) etc.<br />

2. Budgetary Control:<br />

• Objectives<br />

• Planning and control<br />

• Behavioural aspects of budgeting<br />

3. Budgeting systems:<br />

• Traditional budgetary systems<br />

• Zero based budgeting<br />

• Budgeting issues<br />

4. Budgeting Process (Preparation)<br />

• Budgeting: a famous word but what does it<br />

mean<br />

• Overview of the budget process (procedures,<br />

manuals, timelines)<br />

• Case study: reviewing a simple budget<br />

scenario<br />

• Being clear about initial assumptions and<br />

limiting factors<br />

• Knowing where to find information that might<br />

be needed<br />

• Analyzing potential income and expenditure:<br />

what events/occurrences do we need to<br />

consider Internal, external, definite/uncertain<br />

• Nature and behavior of costs<br />

• Charging department expenditure to the<br />

correct period - accruals, prepayments and<br />

depreciation<br />

• Break-even analysis<br />

5. Variance Analysis (Facing the Actual)<br />

• What are the variances and why are they<br />

important<br />

• The budget is the plan i.e. understanding the<br />

need to proactively work towards budget and<br />

adhere to budget.<br />

• Comparing actuals to budgeted monthly<br />

• Comparing actuals to budgeted year to date<br />

• Understanding the significance of changes in<br />

variances<br />

• Causes of Budget Variances<br />

• Calculating Variances<br />

• Proper Variance Analysis<br />

• Flexing the budget<br />

6. The Sales /Revenue (Premium) Budget, Operating<br />

Expenses Budget (eg Claims), Cash Budget &<br />

Capital Expenditure Budget (CAPEX)<br />

• Why they are needed Do high profits<br />

necessarily mean everything is going well<br />

• Hypothetical Insurance Company Case Study:<br />

Preparing a Sales/Revenue (Premium), Expenses<br />

(Claims), Cash and Capital Expenditure Budget<br />

FEES<br />

MEMBER<br />

RM 900<br />

GROUP MEMBER<br />

RM 850<br />

NON MEMBER<br />

RM 1,100<br />

GROUP NON MEMBER<br />

RM 1,050<br />

7. Presenting the Departmental Budget<br />

• Giving clear information<br />

• Presenting the main variables<br />

• Getting agreement<br />

• Putting it clearly onto paper<br />

8. Reporting, Monitoring and Analysing the<br />

Organisation’s Master Budget and Variance<br />

Analysis for Management Decision Making<br />

• Preparing, monitoring and analysing the<br />

Master Budget vs Actual Performance<br />

(Monthly, Quarterly, Half Yearly and Annually)<br />

• Providing significant information to make<br />

effective decisions e.g. Premium, Claims,<br />

Operating Expenses etc.<br />

• Importance of Budgetary Control.<br />

• Case Study based on an insurance company<br />

on the Budget<br />

INTERNATIONAL<br />

USD 300<br />

GROUP INTERNATIONAL<br />

USD 280<br />

104 105