DRIVING PROFESSIONAL STANDARDS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DRIVING</strong> <strong>PROFESSIONAL</strong> <strong>STANDARDS</strong><br />

2015 MII PROGRAMME DIRECTORY<br />

Title<br />

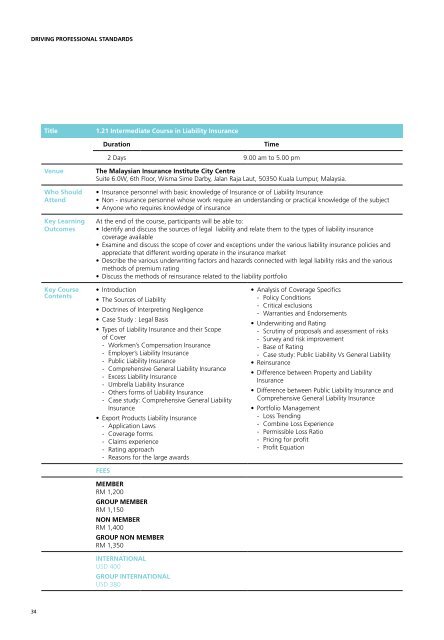

1.21 Intermediate Course in Liability Insurance<br />

Title<br />

1.22 Intermediate Course in Liability Insurance - Claims<br />

Duration<br />

Time<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

2 Days 9.00 am to 5.00 pm<br />

Venue<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Venue<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Who Should<br />

Attend<br />

• Insurance personnel with basic knowledge of Insurance or of Liability Insurance<br />

• Non - insurance personnel whose work require an understanding or practical knowledge of the subject<br />

• Anyone who requires knowledge of insurance<br />

Who Should<br />

Attend<br />

• Insurance personnel with basic knowledge of Insurance or Liability Insurance<br />

• Non - insurance personnel whose work require an understanding or practical knowledge of the subject<br />

• Anyone who requires knowledge of insurance<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

At the end of the course, participants will be able to:<br />

• Identify and discuss the sources of legal liability and relate them to the types of liability insurance<br />

coverage available<br />

• Examine and discuss the scope of cover and exceptions under the various liability insurance policies and<br />

appreciate that different wording operate in the insurance market<br />

• Describe the various underwriting factors and hazards connected with legal liability risks and the various<br />

methods of premium rating<br />

• Discuss the methods of reinsurance related to the liability portfolio<br />

• Introduction<br />

• The Sources of Liability<br />

• Doctrines of Interpreting Negligence<br />

• Case Study : Legal Basis<br />

• Types of Liability Insurance and their Scope<br />

of Cover<br />

- Workmen’s Compensation Insurance<br />

- Employer’s Liability Insurance<br />

- Public Liability Insurance<br />

- Comprehensive General Liability Insurance<br />

- Excess Liability Insurance<br />

- Umbrella Liability Insurance<br />

- Others forms of Liability Insurance<br />

- Case study: Comprehensive General Liability<br />

Insurance<br />

• Export Products Liability Insurance<br />

- Application Laws<br />

- Coverage forms<br />

- Claims experience<br />

- Rating approach<br />

- Reasons for the large awards<br />

• Analysis of Coverage Specifics<br />

- Policy Conditions<br />

- Critical exclusions<br />

- Warranties and Endorsements<br />

• Underwriting and Rating<br />

- Scrutiny of proposals and assessment of risks<br />

- Survey and risk improvement<br />

- Base of Rating<br />

- Case study: Public Liability Vs General Liability<br />

• Reinsurance<br />

• Difference between Property and Liability<br />

Insurance<br />

• Difference between Public Liability Insurance and<br />

Comprehensive General Liability Insurance<br />

• Portfolio Management<br />

- Loss Trending<br />

- Combine Loss Experience<br />

- Permissible Loss Ratio<br />

- Pricing for profit<br />

- Profit Equation<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

At the end of the course, participants will be able to:<br />

• Apply the fundamental insurance principles relate to liability polices<br />

• Explain the salient features and provisions afforded under the liability insurance policies<br />

• Discuss the process and practices of claims settlement and claims reserving<br />

• Acquire the skills as to how to negotiate with insured and third party claimants<br />

• Understand and appreciate court procedures<br />

Session 1<br />

• Application principles of insurance to Liability Claims<br />

Session 2<br />

• Circumstances which can give rise to claims under the following policy coverages;<br />

- Public Liability<br />

- Personal Liability<br />

- Products Liability<br />

- Professional Indemnity<br />

- Employer’s Liability<br />

- Workmen’s Compensation<br />

Session 3<br />

• Claims Procedure and Documentation<br />

• Claims Reserving<br />

- Third Party Property<br />

- Third Party injury and death<br />

Session 4<br />

• Negotiations with insured and third party<br />

Session 5<br />

• Court procedures<br />

• Case studies<br />

FEES<br />

FEES<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

34 35