DRIVING PROFESSIONAL STANDARDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DRIVING</strong> <strong>PROFESSIONAL</strong> <strong>STANDARDS</strong><br />

2015 MII PROGRAMME DIRECTORY<br />

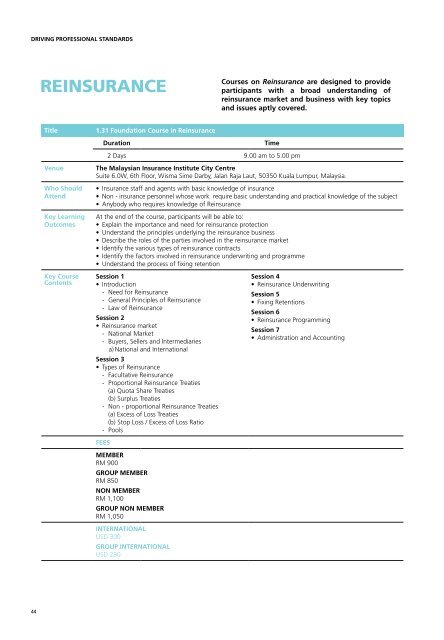

REINSURANCE<br />

Courses on Reinsurance are designed to provide<br />

participants with a broad understanding of<br />

reinsurance market and business with key topics<br />

and issues aptly covered.<br />

Title<br />

Venue<br />

Who Should<br />

Attend<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

1.31 Foundation Course in Reinsurance<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

• Insurance staff and agents with basic knowledge of insurance<br />

• Non - insurance personnel whose work require basic understanding and practical knowledge of the subject<br />

• Anybody who requires knowledge of Reinsurance<br />

At the end of the course, participants will be able to:<br />

• Explain the importance and need for reinsurance protection<br />

• Understand the principles underlying the reinsurance business<br />

• Describe the roles of the parties involved in the reinsurance market<br />

• Identify the various types of reinsurance contracts<br />

• Identify the factors involved in reinsurance underwriting and programme<br />

• Understand the process of fixing retention<br />

Session 1<br />

• Introduction<br />

- Need for Reinsurance<br />

- General Principles of Reinsurance<br />

- Law of Reinsurance<br />

Session 2<br />

• Reinsurance market<br />

- National Market<br />

- Buyers, Sellers and Intermediaries<br />

a) National and International<br />

Session 3<br />

• Types of Reinsurance<br />

- Facultative Reinsurance<br />

- Proportional Reinsurance Treaties<br />

(a) Quota Share Treaties<br />

(b) Surplus Treaties<br />

- Non - proportional Reinsurance Treaties<br />

(a) Excess of Loss Treaties<br />

(b) Stop Loss / Excess of Loss Ratio<br />

- Pools<br />

FEES<br />

MEMBER<br />

RM 900<br />

GROUP MEMBER<br />

RM 850<br />

NON MEMBER<br />

RM 1,100<br />

GROUP NON MEMBER<br />

RM 1,050<br />

INTERNATIONAL<br />

USD 300<br />

GROUP INTERNATIONAL<br />

USD 280<br />

Session 4<br />

• Reinsurance Underwriting<br />

Session 5<br />

• Fixing Retentions<br />

Session 6<br />

• Reinsurance Programming<br />

Session 7<br />

• Administration and Accounting<br />

Title<br />

Venue<br />

Who Should Attend<br />

Key Learning<br />

Outcomes<br />

1.32 Intermediate Course in Reinsurance - Accounting<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

• Insurance personnel with basic knowledge of Insurance or of Reinsurance<br />

• Non - insurance personnel whose work require understanding and practical knowledge of the subject<br />

• Anyone who requires knowledge of Reinsurance<br />

At the end of the course, participants will be able to:<br />

• Appreciate and apply the principles and techniques involved in reinsurance accounting<br />

• Present and handle the appropriate reinsurance statistics<br />

Key Course Contents Session 1<br />

• Introduction<br />

- Types of Reinsurance<br />

- Facultative<br />

- Treaties: (a) Proportional (b) Non-proportional<br />

- Underwriting Process<br />

- Records, procedures, controls<br />

Session 2<br />

• Financial provisions of Proportional Reinsurance<br />

& Accounting<br />

- Reinsurance commission<br />

- Reimbursement of taxes and levy<br />

- Profit commission<br />

- Portfolio Transfer Provisions<br />

- Premium Reserve and Interest on Reserve<br />

- Cash loss recoveries<br />

- Compilation of Accounts<br />

- Control on settlements<br />

Session 3<br />

• Financial Provisions of Excess of Loss Cover<br />

- Deposit Premium<br />

- Minimum Premium<br />

- Adjustment Premium<br />

- Burning cost loaded rate<br />

- Specified rate percent<br />

- Cost of Living Index Clause<br />

- Claims recovery<br />

• Credit for salvage and recoveries<br />

- Reinstatement provisions<br />

FEES<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

Session 4<br />

• Internal controls<br />

- In relation to administration of reinsurance<br />

cessions<br />

- In relations to administration of inward<br />

reinsurance<br />

Session 5<br />

• Accounting Treatment for foreign Exchange<br />

- Reinsurance Cessions<br />

- Reinsurance Acceptance<br />

Session 6<br />

• Provision for outstanding claims-Inward<br />

Reinsurance<br />

- Inward Facultative Business<br />

- Inward Excess of Loss Covers<br />

- Inward Treaties<br />

- Provision for IBNR claims<br />

Session 7<br />

• Statutory provisions in relation to reinsurance<br />

- Insurance Act/FSA<br />

- Income Tax Act<br />

Session 8<br />

• Statistics and Management Report<br />

Session 9<br />

• Compliance<br />

- Malaysian Accounting Standard<br />

- Bank Negara guidelines and circulars<br />

Session 10<br />

• Case Studies<br />

44 45