DRIVING PROFESSIONAL STANDARDS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>DRIVING</strong> <strong>PROFESSIONAL</strong> <strong>STANDARDS</strong><br />

2015 MII PROGRAMME DIRECTORY<br />

LIABILITY<br />

COURSES<br />

These courses are created to enable participants<br />

to develop a comprehensive understanding on<br />

important areas of Liability Insurance in a reasonably<br />

short time frame.<br />

Title<br />

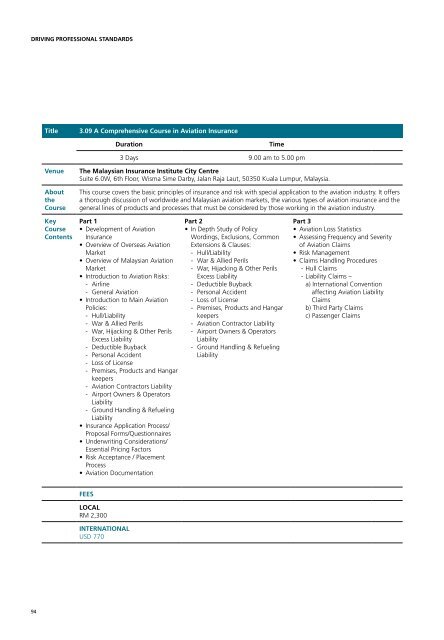

3.09 A Comprehensive Course in Aviation Insurance<br />

Title<br />

3.10 A Comprehensive Course in Professional Indemnity & Director’s Liability Insurance<br />

Duration<br />

Time<br />

Duration<br />

Time<br />

3 Days 9.00 am to 5.00 pm<br />

3 Days 9.00 am to 5.00 pm<br />

Venue<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Venue<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

About<br />

the<br />

Course<br />

This course covers the basic principles of insurance and risk with special application to the aviation industry. It offers<br />

a thorough discussion of worldwide and Malaysian aviation markets, the various types of aviation insurance and the<br />

general lines of products and processes that must be considered by those working in the aviation industry.<br />

About the<br />

Course<br />

This course has been designed to provide a broad knowledge and insight of professional indemnity and directors<br />

liability insurances. Participants will look at key features and processes, major underwriting considerations as<br />

well as issues and development facing the business.<br />

Key<br />

Course<br />

Contents<br />

Part 1<br />

• Development of Aviation<br />

Insurance<br />

• Overview of Overseas Aviation<br />

Market<br />

• Overview of Malaysian Aviation<br />

Market<br />

• Introduction to Aviation Risks:<br />

- Airline<br />

- General Aviation<br />

• Introduction to Main Aviation<br />

Policies:<br />

- Hull/Liability<br />

- War & Allied Perils<br />

- War, Hijacking & Other Perils<br />

Excess Liability<br />

- Deductible Buyback<br />

- Personal Accident<br />

- Loss of License<br />

- Premises, Products and Hangar<br />

keepers<br />

- Aviation Contractors Liability<br />

- Airport Owners & Operators<br />

Liability<br />

- Ground Handling & Refueling<br />

Liability<br />

• Insurance Application Process/<br />

Proposal Forms/Questionnaires<br />

• Underwriting Considerations/<br />

Essential Pricing Factors<br />

• Risk Acceptance / Placement<br />

Process<br />

• Aviation Documentation<br />

FEES<br />

Part 2<br />

• In Depth Study of Policy<br />

Wordings, Exclusions, Common<br />

Extensions & Clauses:<br />

- Hull/Liability<br />

- War & Allied Perils<br />

- War, Hijacking & Other Perils<br />

Excess Liability<br />

- Deductible Buyback<br />

- Personal Accident<br />

- Loss of License<br />

- Premises, Products and Hangar<br />

keepers<br />

- Aviation Contractor Liability<br />

- Airport Owners & Operators<br />

Liability<br />

- Ground Handling & Refueling<br />

Liability<br />

Part 3<br />

• Aviation Loss Statistics<br />

• Assessing Frequency and Severity<br />

of Aviation Claims<br />

• Risk Management<br />

• Claims Handling Procedures<br />

- Hull Claims<br />

- Liability Claims –<br />

a) International Convention<br />

affecting Aviation Liability<br />

Claims<br />

b) Third Party Claims<br />

c) Passenger Claims<br />

Key Course<br />

Contents<br />

Upon completion of the course, participants should be able to:<br />

• Apply the principles of insurance on practical terms<br />

• Identify the global trends that have given rise to demand for Specialist Liability Insurance Classes such as<br />

Professional Indemnity and Directors’ & Offers’ (D&O) Liability<br />

• Understand the legal exposure by Directors and Officers in today’s environment<br />

• Highlight the various factors and issues that influence the underwriting of D&O Insurance<br />

• Analyse different industries and exposures<br />

• Understand the policy terms and conditions<br />

• Understand the D&O claims process<br />

Professional Indemnity:<br />

• Definition of Professional Eligibility<br />

• Demand for PI Cover - Effects to Global Trends<br />

• Understanding the Proposal Form<br />

• Underwriting Considerations<br />

• Types of PI Policies<br />

• Main Features of PI Policy<br />

• Policy Coverage<br />

Directors’ and Offices’ (D & O) Liability:<br />

• D & O Market Today and the Changes<br />

• Directors’ & Officers’ Terminology (D & O)<br />

• Understanding the Proposal Form<br />

• Policy Coverage<br />

• Underwriting Considerations<br />

• Issues and Development in D & O Coverage and Exclusion Technical<br />

• Rating Issues<br />

FEES<br />

LOCAL<br />

RM 2,300<br />

INTERNATIONAL<br />

USD 770<br />

LOCAL<br />

RM 2,300<br />

INTERNATIONAL<br />

USD 770<br />

94 95