DRIVING PROFESSIONAL STANDARDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DRIVING</strong> <strong>PROFESSIONAL</strong> <strong>STANDARDS</strong><br />

2015 MII PROGRAMME DIRECTORY<br />

Title<br />

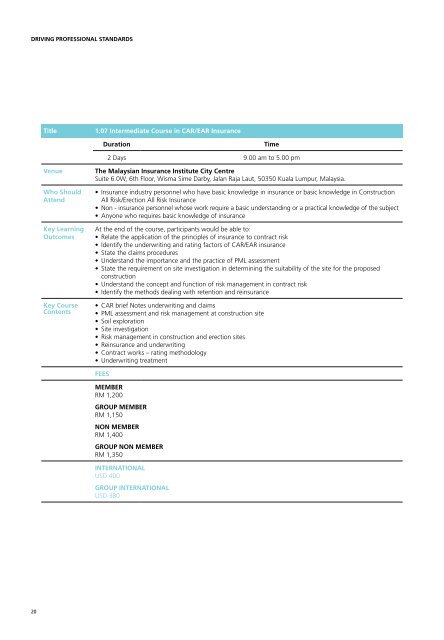

1.07 Intermediate Course in CAR/EAR Insurance<br />

Title<br />

1.08 Intermediate Course in CAR/EAR Insurance - Claims<br />

Duration<br />

Time<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

2 Days 9.00 am to 5.00 pm<br />

Venue<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Venue<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Who Should<br />

Attend<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

• Insurance industry personnel who have basic knowledge in insurance or basic knowledge in Construction<br />

All Risk/Erection All Risk Insurance<br />

• Non - insurance personnel whose work require a basic understanding or a practical knowledge of the subject<br />

• Anyone who requires basic knowledge of insurance<br />

At the end of the course, participants would be able to:<br />

• Relate the application of the principles of insurance to contract risk<br />

• Identify the underwriting and rating factors of CAR/EAR insurance<br />

• State the claims procedures<br />

• Understand the importance and the practice of PML assessment<br />

• State the requirement on site investigation in determining the suitability of the site for the proposed<br />

construction<br />

• Understand the concept and function of risk management in contract risk<br />

• Identify the methods dealing with retention and reinsurance<br />

• CAR brief Notes underwriting and claims<br />

• PML assessment and risk management at construction site<br />

• Soil exploration<br />

• Site investigation<br />

• Risk management in construction and erection sites<br />

• Reinsurance and underwriting<br />

• Contract works – rating methodology<br />

• Underwriting treatment<br />

FEES<br />

Who Should<br />

Attend<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

• Insurance staff with basic knowledge of Insurance or of Construction All Risk/Erection All Risk Insurance<br />

• Non - insurance personnel whose work require an understanding or practical knowledge of the subject<br />

• Anyone who requires knowledge of insurance<br />

At the end of the course, participants will be able to:<br />

• Describe the scope of cover afforded under CAR/EAR policies and the various types of bonds<br />

• Apply the general principles of claims handling, procedures, reserving and adjustment in relation to<br />

construction/erection works<br />

• Learn the various approaches and practical aspects of claims investigations, negotiations and settlement<br />

• Appreciate the significant support functions of loss adjusters and engineers<br />

Session 1<br />

• Policy cover under<br />

- Contractor’s All Risks<br />

- Erection All Risks<br />

• Types of Bonds<br />

Session 2<br />

• Claims procedures & Documentation<br />

Session 3<br />

• Role of Loss Adjusters/Engineers<br />

Session 4<br />

• Investigation & Adjustment of Claims<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

Session 5<br />

• Claims Reserving<br />

Session 6<br />

• Claims Disputes<br />

Session 7<br />

• Recoveries<br />

• Case studies<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

FEES<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

20 21