DRIVING PROFESSIONAL STANDARDS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>DRIVING</strong> <strong>PROFESSIONAL</strong> <strong>STANDARDS</strong><br />

2015 MII PROGRAMME DIRECTORY<br />

Title<br />

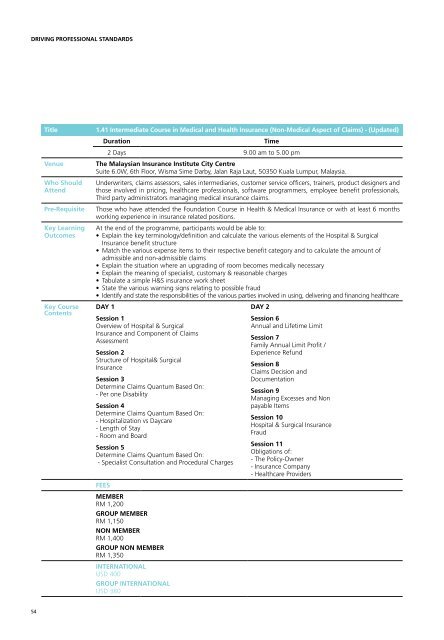

1.41 Intermediate Course in Medical and Health Insurance (Non-Medical Aspect of Claims) - (Updated)<br />

Title<br />

1.42 Intermediate Course In Medical & Health Insurance – (Claims) - (Updated)<br />

Venue<br />

Who Should<br />

Attend<br />

Pre-Requisite<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Underwriters, claims assessors, sales intermediaries, customer service officers, trainers, product designers and<br />

those involved in pricing, healthcare professionals, software programmers, employee benefit professionals,<br />

Third party administrators managing medical insurance claims.<br />

Those who have attended the Foundation Course in Health & Medical Insurance or with at least 6 months<br />

working experience in insurance related positions.<br />

At the end of the programme, participants would be able to:<br />

• Explain the key terminology/definition and calculate the various elements of the Hospital & Surgical<br />

Insurance benefit structure<br />

• Match the various expense items to their respective benefit category and to calculate the amount of<br />

admissible and non-admissible claims<br />

• Explain the situation where an upgrading of room becomes medically necessary<br />

• Explain the meaning of specialist, customary & reasonable charges<br />

• Tabulate a simple H&S insurance work sheet<br />

• State the various warning signs relating to possible fraud<br />

• Identify and state the responsibilities of the various parties involved in using, delivering and financing healthcare<br />

DAY 1<br />

Session 1<br />

Overview of Hospital & Surgical<br />

Insurance and Component of Claims<br />

Assessment<br />

Session 2<br />

Structure of Hospital& Surgical<br />

Insurance<br />

Session 3<br />

Determine Claims Quantum Based On:<br />

- Per one Disability<br />

Session 4<br />

Determine Claims Quantum Based On:<br />

- Hospitalization vs Daycare<br />

- Length of Stay<br />

- Room and Board<br />

Session 5<br />

Determine Claims Quantum Based On:<br />

- Specialist Consultation and Procedural Charges<br />

DAY 2<br />

Session 6<br />

Annual and Lifetime Limit<br />

Session 7<br />

Family Annual Limit Profit /<br />

Experience Refund<br />

Session 8<br />

Claims Decision and<br />

Documentation<br />

Session 9<br />

Managing Excesses and Non<br />

payable Items<br />

Session 10<br />

Hospital & Surgical Insurance<br />

Fraud<br />

Session 11<br />

Obligations of:<br />

- The Policy-Owner<br />

- Insurance Company<br />

- Healthcare Providers<br />

Venue<br />

Who Should<br />

Attend<br />

Pre-Requisite<br />

Key Learning<br />

Outcomes<br />

Key Course<br />

Contents<br />

Duration<br />

Time<br />

2 Days 9.00 am to 5.00 pm<br />

The Malaysian Insurance Institute City Centre<br />

Suite 6.0W, 6th Floor, Wisma Sime Darby, Jalan Raja Laut, 50350 Kuala Lumpur, Malaysia.<br />

Underwriters, claims assessors, sales intermediaries, customer service officers, trainers, product designers and<br />

those involved in pricing, healthcare professionals, software programmers, employee benefit professionals,<br />

Third party administrators managing medical insurance claims.<br />

Those who have attended the Foundation Course in Health & Medical Insurance or with at least 9 months<br />

working experience in insurance related positions.<br />

At the end of the programme, participant would be able to:<br />

• Interpret and explain commonly used medical terminologies and abbreviations<br />

• Explain key medical terminologies, medical conditions, medical related clauses and limitations commonly<br />

used in Hospital & Surgical policies and their effects on medical claims<br />

• Explain the definition, intent and effects of Congenital, Pre-existing, Medically Necessary and Customary &<br />

Reasonable clauses on medical claims<br />

Day 1<br />

Session 1<br />

Medical Jargons and Abbreviations<br />

Day 2<br />

Session 2<br />

Structure of Hospital & Surgical<br />

Insurance Policy<br />

Session 3<br />

What is Sickness and Injuries<br />

Session 4<br />

Congenital Conditions<br />

Session 5<br />

Pre-existing and Long- standing<br />

conditions<br />

FEES<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

Day 3<br />

Session 6<br />

Waiting Period<br />

Session 7<br />

Medically Necessary<br />

Session 8<br />

Customary and Reasonable<br />

Charges<br />

Session 9<br />

Wrap Up Discussion<br />

FEES<br />

MEMBER<br />

RM 1,200<br />

GROUP MEMBER<br />

RM 1,150<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

NON MEMBER<br />

RM 1,400<br />

GROUP NON MEMBER<br />

RM 1,350<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

INTERNATIONAL<br />

USD 400<br />

GROUP INTERNATIONAL<br />

USD 380<br />

54 55