Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Indian Hotels Company Limited<br />

136<br />

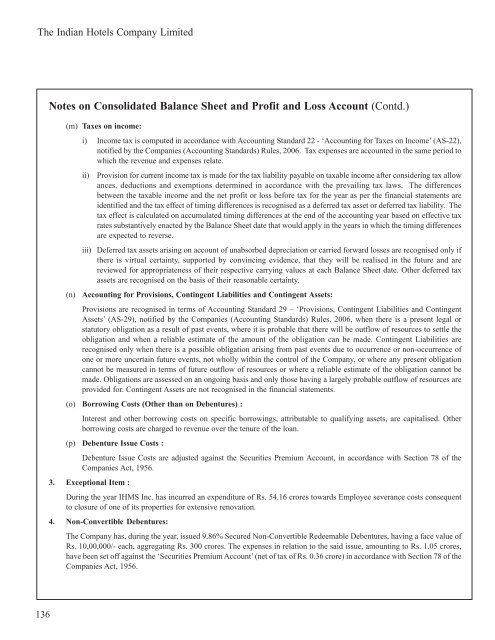

Notes on Consolidated <strong>Balance</strong> <strong>Sheet</strong> and Pr<strong>of</strong>it and Loss Account (Contd.)<br />

(m) Taxes on income:<br />

i) Income tax is computed in accordance with Accounting Standard 22 - ‘Accounting for Taxes on Income’ (AS-22),<br />

notified by <strong>the</strong> Companies (Accounting Standards) Rules, 2006. Tax expenses are accounted in <strong>the</strong> same period to<br />

which <strong>the</strong> revenue and expenses relate.<br />

ii) Provision for current income tax is made for <strong>the</strong> tax liability payable on taxable income after considering tax allow<br />

ances, deductions and exemptions determined in accordance with <strong>the</strong> prevailing tax laws. The differences<br />

between <strong>the</strong> taxable income and <strong>the</strong> net pr<strong>of</strong>it or loss before tax for <strong>the</strong> year as per <strong>the</strong> financial statements are<br />

identified and <strong>the</strong> tax effect <strong>of</strong> timing differences is recognised as a deferred tax asset or deferred tax liability. The<br />

tax effect is calculated on accumulated timing differences at <strong>the</strong> end <strong>of</strong> <strong>the</strong> accounting year based on effective tax<br />

rates substantively enacted by <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> date that would apply in <strong>the</strong> years in which <strong>the</strong> timing differences<br />

are expected to reverse.<br />

iii) Deferred tax assets arising on account <strong>of</strong> unabsorbed depreciation or carried forward losses are recognised only if<br />

<strong>the</strong>re is virtual certainty, supported by convincing evidence, that <strong>the</strong>y will be realised in <strong>the</strong> future and are<br />

reviewed for appropriateness <strong>of</strong> <strong>the</strong>ir respective carrying values at each <strong>Balance</strong> <strong>Sheet</strong> date. O<strong>the</strong>r deferred tax<br />

assets are recognised on <strong>the</strong> basis <strong>of</strong> <strong>the</strong>ir reasonable certainty.<br />

(n) Accounting for Provisions, Contingent Liabilities and Contingent Assets:<br />

Provisions are recognised in terms <strong>of</strong> Accounting Standard 29 – ‘Provisions, Contingent Liabilities and Contingent<br />

Assets’ (AS-29), notified by <strong>the</strong> Companies (Accounting Standards) Rules, 2006, when <strong>the</strong>re is a present legal or<br />

statutory obligation as a result <strong>of</strong> past events, where it is probable that <strong>the</strong>re will be outflow <strong>of</strong> resources to settle <strong>the</strong><br />

obligation and when a reliable estimate <strong>of</strong> <strong>the</strong> amount <strong>of</strong> <strong>the</strong> obligation can be made. Contingent Liabilities are<br />

recognised only when <strong>the</strong>re is a possible obligation arising from past events due to occurrence or non-occurrence <strong>of</strong><br />

one or more uncertain future events, not wholly within <strong>the</strong> control <strong>of</strong> <strong>the</strong> Company, or where any present obligation<br />

cannot be measured in terms <strong>of</strong> future outflow <strong>of</strong> resources or where a reliable estimate <strong>of</strong> <strong>the</strong> obligation cannot be<br />

made. Obligations are assessed on an ongoing basis and only those having a largely probable outflow <strong>of</strong> resources are<br />

provided for. Contingent Assets are not recognised in <strong>the</strong> financial statements.<br />

(o) Borrowing Costs (O<strong>the</strong>r than on Debentures) :<br />

Interest and o<strong>the</strong>r borrowing costs on specific borrowings, attributable to qualifying assets, are capitalised. O<strong>the</strong>r<br />

borrowing costs are charged to revenue over <strong>the</strong> tenure <strong>of</strong> <strong>the</strong> loan.<br />

(p) Debenture Issue Costs :<br />

Debenture Issue Costs are adjusted against <strong>the</strong> Securities Premium Account, in accordance with Section 78 <strong>of</strong> <strong>the</strong><br />

Companies Act, 1956.<br />

3. Exceptional Item :<br />

During <strong>the</strong> year IHMS Inc. has incurred an expenditure <strong>of</strong> Rs. 54.16 crores towards Employee severance costs consequent<br />

to closure <strong>of</strong> one <strong>of</strong> its properties for extensive renovation.<br />

4. Non-Convertible Debentures:<br />

The Company has, during <strong>the</strong> year, issued 9.86% Secured Non-Convertible Redeemable Debentures, having a face value <strong>of</strong><br />

Rs. 10,00,000/- each, aggregating Rs. 300 crores. The expenses in relation to <strong>the</strong> said issue, amounting to Rs. 1.05 crores,<br />

have been set <strong>of</strong>f against <strong>the</strong> ‘Securities Premium Account’ (net <strong>of</strong> tax <strong>of</strong> Rs. 0.36 crore) in accordance with Section 78 <strong>of</strong> <strong>the</strong><br />

Companies Act, 1956.