Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Indian Hotels Company Limited<br />

92<br />

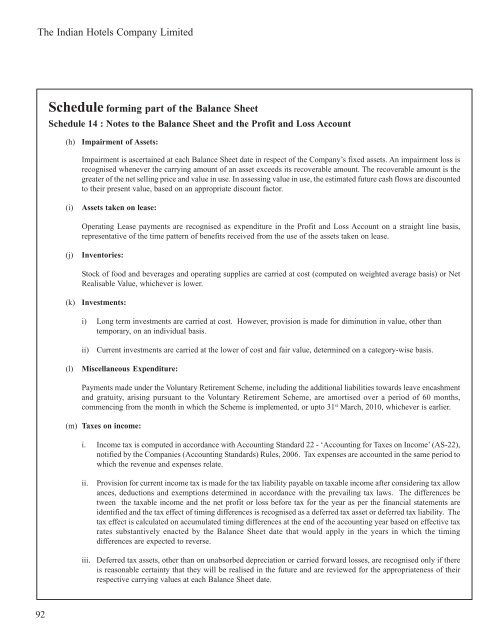

Schedule forming <strong>part</strong> <strong>of</strong> <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong><br />

Schedule 14 : Notes to <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> and <strong>the</strong> Pr<strong>of</strong>it and Loss Account<br />

(h) Impairment <strong>of</strong> Assets:<br />

Impairment is ascertained at each <strong>Balance</strong> <strong>Sheet</strong> date in respect <strong>of</strong> <strong>the</strong> Company’s fixed assets. An impairment loss is<br />

recognised whenever <strong>the</strong> carrying amount <strong>of</strong> an asset exceeds its recoverable amount. The recoverable amount is <strong>the</strong><br />

greater <strong>of</strong> <strong>the</strong> net selling price and value in use. In assessing value in use, <strong>the</strong> estimated future cash flows are discounted<br />

to <strong>the</strong>ir present value, based on an appropriate discount factor.<br />

(i) Assets taken on lease:<br />

Operating Lease payments are recognised as expenditure in <strong>the</strong> Pr<strong>of</strong>it and Loss Account on a straight line basis,<br />

representative <strong>of</strong> <strong>the</strong> time pattern <strong>of</strong> benefits received from <strong>the</strong> use <strong>of</strong> <strong>the</strong> assets taken on lease.<br />

(j) Inventories:<br />

Stock <strong>of</strong> food and beverages and operating supplies are carried at cost (computed on weighted average basis) or Net<br />

Realisable Value, whichever is lower.<br />

(k) Investments:<br />

i) Long term investments are carried at cost. However, provision is made for diminution in value, o<strong>the</strong>r than<br />

temporary, on an individual basis.<br />

ii) Current investments are carried at <strong>the</strong> lower <strong>of</strong> cost and fair value, determined on a category-wise basis.<br />

(l) Miscellaneous Expenditure:<br />

Payments made under <strong>the</strong> Voluntary Retirement Scheme, including <strong>the</strong> additional liabilities towards leave encashment<br />

and gratuity, arising pursuant to <strong>the</strong> Voluntary Retirement Scheme, are amortised over a period <strong>of</strong> 60 months,<br />

commencing from <strong>the</strong> month in which <strong>the</strong> Scheme is implemented, or upto 31 st March, 2010, whichever is earlier.<br />

(m) Taxes on income:<br />

i. Income tax is computed in accordance with Accounting Standard 22 - ‘Accounting for Taxes on Income’ (AS-22),<br />

notified by <strong>the</strong> Companies (Accounting Standards) Rules, 2006. Tax expenses are accounted in <strong>the</strong> same period to<br />

which <strong>the</strong> revenue and expenses relate.<br />

ii. Provision for current income tax is made for <strong>the</strong> tax liability payable on taxable income after considering tax allow<br />

ances, deductions and exemptions determined in accordance with <strong>the</strong> prevailing tax laws. The differences be<br />

tween <strong>the</strong> taxable income and <strong>the</strong> net pr<strong>of</strong>it or loss before tax for <strong>the</strong> year as per <strong>the</strong> financial statements are<br />

identified and <strong>the</strong> tax effect <strong>of</strong> timing differences is recognised as a deferred tax asset or deferred tax liability. The<br />

tax effect is calculated on accumulated timing differences at <strong>the</strong> end <strong>of</strong> <strong>the</strong> accounting year based on effective tax<br />

rates substantively enacted by <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> date that would apply in <strong>the</strong> years in which <strong>the</strong> timing<br />

differences are expected to reverse.<br />

iii. Deferred tax assets, o<strong>the</strong>r than on unabsorbed depreciation or carried forward losses, are recognised only if <strong>the</strong>re<br />

is reasonable certainty that <strong>the</strong>y will be realised in <strong>the</strong> future and are reviewed for <strong>the</strong> appropriateness <strong>of</strong> <strong>the</strong>ir<br />

respective carrying values at each <strong>Balance</strong> <strong>Sheet</strong> date.