Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Indian Hotels Company Limited<br />

58<br />

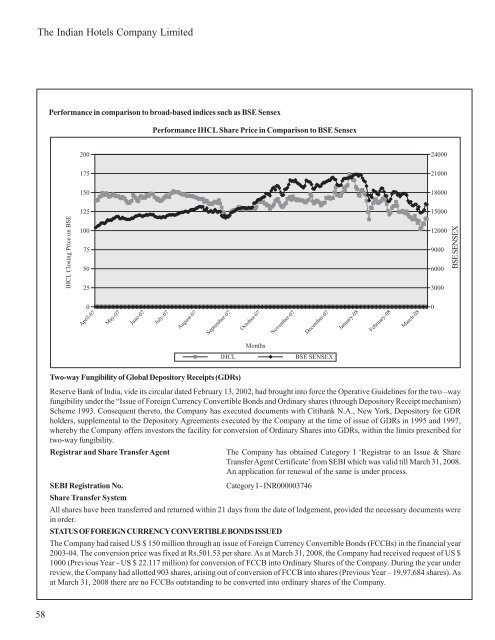

Performance in comparison to broad-based indices such as BSE Sensex<br />

Performance IHCL Share Price in Comparison to BSE Sensex<br />

Two-way Fungibility <strong>of</strong> Global Depository Receipts (GDRs)<br />

Reserve Bank <strong>of</strong> India, vide its circular dated February 13, 2002, had brought into force <strong>the</strong> Operative Guidelines for <strong>the</strong> two –way<br />

fungibility under <strong>the</strong> “Issue <strong>of</strong> Foreign Currency Convertible Bonds and Ordinary shares (through Depository Receipt mechanism)<br />

Scheme 1993. Consequent <strong>the</strong>reto, <strong>the</strong> Company has executed documents with Citibank N.A., New York, Depository for GDR<br />

holders, supplemental to <strong>the</strong> Depository Agreements executed by <strong>the</strong> Company at <strong>the</strong> time <strong>of</strong> issue <strong>of</strong> GDRs in 1995 and 1997,<br />

whereby <strong>the</strong> Company <strong>of</strong>fers investors <strong>the</strong> facility for conversion <strong>of</strong> Ordinary Shares into GDRs, within <strong>the</strong> limits prescribed for<br />

two-way fungibility.<br />

Registrar and Share Transfer Agent The Company has obtained Category I ‘Registrar to an Issue & Share<br />

Transfer Agent Certificate’ from SEBI which was valid till March 31, 2008.<br />

An application for renewal <strong>of</strong> <strong>the</strong> same is under process.<br />

SEBI Registration No. Category I - INR000003746<br />

Share Transfer System<br />

All shares have been transferred and returned within 21 days from <strong>the</strong> date <strong>of</strong> lodgement, provided <strong>the</strong> necessary documents were<br />

in order.<br />

STATUS OF FOREIGN CURRENCY CONVERTIBLE BONDS ISSUED<br />

The Company had raised US $ 150 million through an issue <strong>of</strong> Foreign Currency Convertible Bonds (FCCBs) in <strong>the</strong> financial year<br />

2003-04. The conversion price was fixed at Rs.501.53 per share. As at March 31, 2008, <strong>the</strong> Company had received request <strong>of</strong> US $<br />

1000 (Previous Year - US $ 22.117 million) for conversion <strong>of</strong> FCCB into Ordinary Shares <strong>of</strong> <strong>the</strong> Company. During <strong>the</strong> year under<br />

review, <strong>the</strong> Company had allotted 903 shares, arising out <strong>of</strong> conversion <strong>of</strong> FCCB into shares (Previous Year – 19,97,684 shares). As<br />

at March 31, 2008 <strong>the</strong>re are no FCCBs outstanding to be converted into ordinary shares <strong>of</strong> <strong>the</strong> Company.<br />

BSE SENSEX