Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Indian Hotels Company Limited<br />

38<br />

� Share <strong>of</strong> pr<strong>of</strong>it in Associates represents Company’s proportionate share in Pr<strong>of</strong>it After tax <strong>of</strong> its associates. The increase is<br />

on account <strong>of</strong> improved performance <strong>of</strong> its associates carrying out hoteliering business.<br />

Operating expenses:<br />

The operating expenses increased by 13% from Rs. 1946.43 crores to Rs. 2195.62 crores. The increase was mainly on account <strong>of</strong><br />

payroll to keep in line with competition and industry, new properties acquired in USA over last couple <strong>of</strong> years, increase in<br />

advertisement and general administration expenses. The increased advertisement expenses are an endeavour to make Taj a global<br />

brand and create awareness <strong>of</strong> its rapid international expansion.<br />

Consolidated Pr<strong>of</strong>its:<br />

Pr<strong>of</strong>it Before tax & Interest increased by 24% from Rs. 709.09 crores to Rs. 881.18 crores, which is in line with <strong>the</strong> growth in domestic<br />

properties.<br />

Interest costs:<br />

Interest cost was higher at Rs. 202.32 crores for <strong>the</strong> year ended March 31, 2008 as compared to Rs. 122.15 crores in <strong>the</strong> previous year<br />

consequent to incremental debt to fund acquisition <strong>of</strong> Campton Place in San Francisco and 11.57% <strong>of</strong> <strong>the</strong> Common Stock A <strong>of</strong><br />

Orient-Express Hotels Limited, USA.<br />

Pr<strong>of</strong>it after Tax from Ordinary Activities:<br />

Pr<strong>of</strong>it after Tax from Ordinary Activities, increased from Rs. 409.14 crores to Rs. 370.31 crores, an increase <strong>of</strong> 10 %.<br />

Exceptional Items:<br />

International Hotel Management Services Inc., a 100% overseas subsidiary <strong>of</strong> <strong>the</strong> Company, in order to undertake extensive<br />

renovation, shut down all <strong>the</strong> rooms at The Pierre Hotel, New York. Consequent to <strong>the</strong> closure <strong>of</strong> rooms for renovation, <strong>the</strong><br />

Company incurred an expenditure <strong>of</strong> Rs. 54.16 crores as employee severance cost.<br />

Pr<strong>of</strong>it after Exceptional items and Tax:<br />

Pr<strong>of</strong>it after tax for 2007/08 in view <strong>of</strong> <strong>the</strong> exceptional items and higher interest cost was marginally lower from Rs. 370.31 crores to<br />

Rs. 354.98 crores.<br />

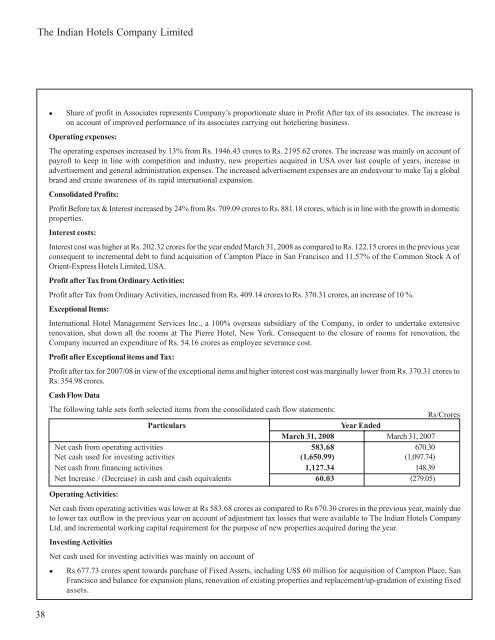

Cash Flow Data<br />

The following table sets forth selected items from <strong>the</strong> consolidated cash flow statements:<br />

Particulars Year Ended<br />

Rs/Crores<br />

March 31, 2008 March 31, 2007<br />

Net cash from operating activities 583.68 670.30<br />

Net cash used for investing activities (1,650.99) (1,097.74)<br />

Net cash from financing activities 1,127.34 148.39<br />

Net Increase / (Decrease) in cash and cash equivalents 60.03 (279.05)<br />

Operating Activities:<br />

Net cash from operating activities was lower at Rs 583.68 crores as compared to Rs 670.30 crores in <strong>the</strong> previous year, mainly due<br />

to lower tax outflow in <strong>the</strong> previous year on account <strong>of</strong> adjustment tax losses that were available to The Indian Hotels Company<br />

Ltd. and incremental working capital requirement for <strong>the</strong> purpose <strong>of</strong> new properties acquired during <strong>the</strong> year.<br />

Investing Activities<br />

Net cash used for investing activities was mainly on account <strong>of</strong><br />

� Rs 677.73 crores spent towards purchase <strong>of</strong> Fixed Assets, including US$ 60 million for acquisition <strong>of</strong> Campton Place, San<br />

Francisco and balance for expansion plans, renovation <strong>of</strong> existing properties and replacement/up-gradation <strong>of</strong> existing fixed<br />

assets.