Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Indian Hotels Company Limited<br />

36<br />

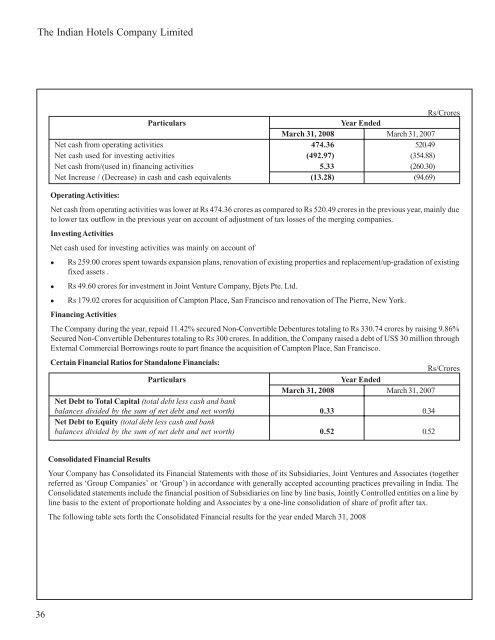

Rs/Crores<br />

Particulars Year Ended<br />

March 31, 2008 March 31, 2007<br />

Net cash from operating activities 474.36 520.49<br />

Net cash used for investing activities (492.97) (354.88)<br />

Net cash from/(used in) financing activities 5.33 (260.30)<br />

Net Increase / (Decrease) in cash and cash equivalents (13.28) (94.69)<br />

Operating Activities:<br />

Net cash from operating activities was lower at Rs 474.36 crores as compared to Rs 520.49 crores in <strong>the</strong> previous year, mainly due<br />

to lower tax outflow in <strong>the</strong> previous year on account <strong>of</strong> adjustment <strong>of</strong> tax losses <strong>of</strong> <strong>the</strong> merging companies.<br />

Investing Activities<br />

Net cash used for investing activities was mainly on account <strong>of</strong><br />

� Rs 259.00 crores spent towards expansion plans, renovation <strong>of</strong> existing properties and replacement/up-gradation <strong>of</strong> existing<br />

fixed assets .<br />

� Rs 49.60 crores for investment in Joint Venture Company, Bjets Pte. Ltd.<br />

� Rs 179.02 crores for acquisition <strong>of</strong> Campton Place, San Francisco and renovation <strong>of</strong> The Pierre, New York.<br />

Financing Activities<br />

The Company during <strong>the</strong> year, repaid 11.42% secured Non-Convertible Debentures totaling to Rs 330.74 crores by raising 9.86%<br />

Secured Non-Convertible Debentures totaling to Rs 300 crores. In addition, <strong>the</strong> Company raised a debt <strong>of</strong> US$ 30 million through<br />

External Commercial Borrowings route to <strong>part</strong> finance <strong>the</strong> acquisition <strong>of</strong> Campton Place, San Francisco.<br />

Certain Financial Ratios for Standalone Financials:<br />

Particulars Year Ended<br />

Rs/Crores<br />

March 31, 2008<br />

Net Debt to Total Capital (total debt less cash and bank<br />

March 31, 2007<br />

balances divided by <strong>the</strong> sum <strong>of</strong> net debt and net worth)<br />

Net Debt to Equity (total debt less cash and bank<br />

0.33 0.34<br />

balances divided by <strong>the</strong> sum <strong>of</strong> net debt and net worth) 0.52 0.52<br />

Consolidated Financial Results<br />

Your Company has Consolidated its Financial Statements with those <strong>of</strong> its Subsidiaries, Joint Ventures and Associates (toge<strong>the</strong>r<br />

referred as ‘Group Companies’ or ‘Group’) in accordance with generally accepted accounting practices prevailing in India. The<br />

Consolidated statements include <strong>the</strong> financial position <strong>of</strong> Subsidiaries on line by line basis, Jointly Controlled entities on a line by<br />

line basis to <strong>the</strong> extent <strong>of</strong> proportionate holding and Associates by a one-line consolidation <strong>of</strong> share <strong>of</strong> pr<strong>of</strong>it after tax.<br />

The following table sets forth <strong>the</strong> Consolidated Financial results for <strong>the</strong> year ended March 31, 2008