Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Indian Hotels Company Limited<br />

142<br />

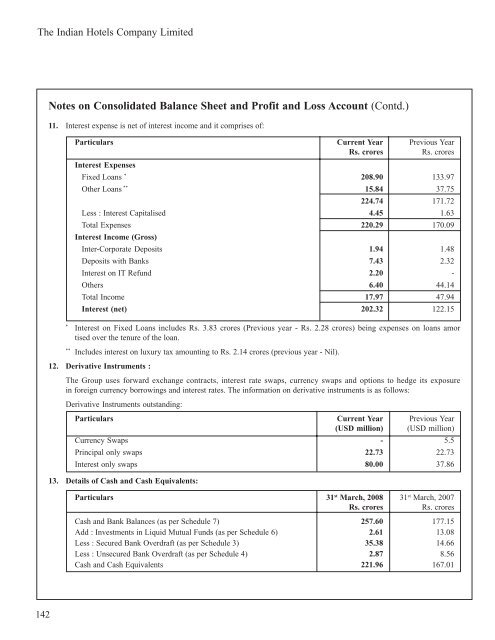

Notes on Consolidated <strong>Balance</strong> <strong>Sheet</strong> and Pr<strong>of</strong>it and Loss Account (Contd.)<br />

11. Interest expense is net <strong>of</strong> interest income and it comprises <strong>of</strong>:<br />

Particulars Current Year Previous Year<br />

Interest Expenses<br />

Rs. crores Rs. crores<br />

Fixed Loans * 208.90 133.97<br />

O<strong>the</strong>r Loans ** 15.84 37.75<br />

224.74 171.72<br />

Less : Interest Capitalised 4.45 1.63<br />

Total Expenses<br />

Interest Income (Gross)<br />

220.29 170.09<br />

Inter-Corporate Deposits 1.94 1.48<br />

Deposits with Banks 7.43 2.32<br />

Interest on IT Refund 2.20 -<br />

O<strong>the</strong>rs 6.40 44.14<br />

Total Income 17.97 47.94<br />

Interest (net) 202.32 122.15<br />

* Interest on Fixed Loans includes Rs. 3.83 crores (Previous year - Rs. 2.28 crores) being expenses on loans amor<br />

tised over <strong>the</strong> tenure <strong>of</strong> <strong>the</strong> loan.<br />

** Includes interest on luxury tax amounting to Rs. 2.14 crores (previous year - Nil).<br />

12. Derivative Instruments :<br />

The Group uses forward exchange contracts, interest rate swaps, currency swaps and options to hedge its exposure<br />

in foreign currency borrowings and interest rates. The information on derivative instruments is as follows:<br />

Derivative Instruments outstanding:<br />

Particulars Current Year Previous Year<br />

(USD million) (USD million)<br />

Currency Swaps - 5.5<br />

Principal only swaps 22.73 22.73<br />

Interest only swaps 80.00 37.86<br />

13. Details <strong>of</strong> Cash and Cash Equivalents:<br />

Particulars 31 st March, 2008 31 st March, 2007<br />

Rs. crores Rs. crores<br />

Cash and Bank <strong>Balance</strong>s (as per Schedule 7) 257.60 177.15<br />

Add : Investments in Liquid Mutual Funds (as per Schedule 6) 2.61 13.08<br />

Less : Secured Bank Overdraft (as per Schedule 3) 35.38 14.66<br />

Less : Unsecured Bank Overdraft (as per Schedule 4) 2.87 8.56<br />

Cash and Cash Equivalents 221.96 167.01