Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Annual Report 2007-2008<br />

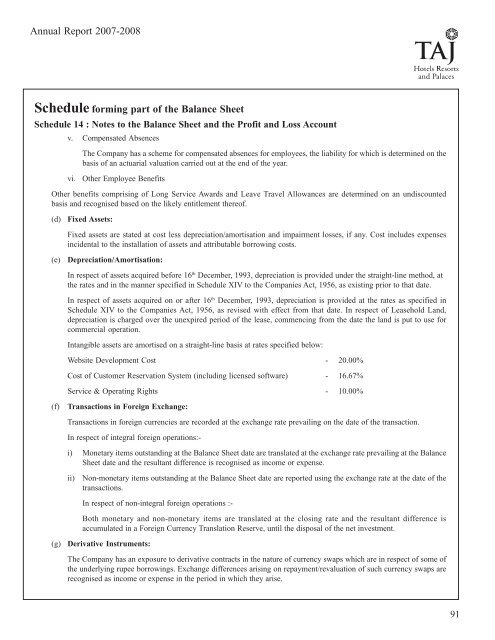

Schedule forming <strong>part</strong> <strong>of</strong> <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong><br />

Schedule 14 : Notes to <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> and <strong>the</strong> Pr<strong>of</strong>it and Loss Account<br />

v. Compensated Absences<br />

The Company has a scheme for compensated absences for employees, <strong>the</strong> liability for which is determined on <strong>the</strong><br />

basis <strong>of</strong> an actuarial valuation carried out at <strong>the</strong> end <strong>of</strong> <strong>the</strong> year.<br />

vi. O<strong>the</strong>r Employee Benefits<br />

O<strong>the</strong>r benefits comprising <strong>of</strong> Long Service Awards and Leave Travel Allowances are determined on an undiscounted<br />

basis and recognised based on <strong>the</strong> likely entitlement <strong>the</strong>re<strong>of</strong>.<br />

(d) Fixed Assets:<br />

Fixed assets are stated at cost less depreciation/amortisation and impairment losses, if any. Cost includes expenses<br />

incidental to <strong>the</strong> installation <strong>of</strong> assets and attributable borrowing costs.<br />

(e) Depreciation/Amortisation:<br />

In respect <strong>of</strong> assets acquired before 16 th December, 1993, depreciation is provided under <strong>the</strong> straight-line method, at<br />

<strong>the</strong> rates and in <strong>the</strong> manner specified in Schedule XIV to <strong>the</strong> Companies Act, 1956, as existing prior to that date.<br />

In respect <strong>of</strong> assets acquired on or after 16 th December, 1993, depreciation is provided at <strong>the</strong> rates as specified in<br />

Schedule XIV to <strong>the</strong> Companies Act, 1956, as revised with effect from that date. In respect <strong>of</strong> Leasehold Land,<br />

depreciation is charged over <strong>the</strong> unexpired period <strong>of</strong> <strong>the</strong> lease, commencing from <strong>the</strong> date <strong>the</strong> land is put to use for<br />

commercial operation.<br />

Intangible assets are amortised on a straight-line basis at rates specified below:<br />

Website Development Cost - 20.00%<br />

Cost <strong>of</strong> Customer Reservation System (including licensed s<strong>of</strong>tware) - 16.67%<br />

Service & Operating Rights - 10.00%<br />

(f) Transactions in Foreign Exchange:<br />

Transactions in foreign currencies are recorded at <strong>the</strong> exchange rate prevailing on <strong>the</strong> date <strong>of</strong> <strong>the</strong> transaction.<br />

In respect <strong>of</strong> integral foreign operations:-<br />

i) Monetary items outstanding at <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> date are translated at <strong>the</strong> exchange rate prevailing at <strong>the</strong> <strong>Balance</strong><br />

<strong>Sheet</strong> date and <strong>the</strong> resultant difference is recognised as income or expense.<br />

ii) Non-monetary items outstanding at <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> date are reported using <strong>the</strong> exchange rate at <strong>the</strong> date <strong>of</strong> <strong>the</strong><br />

transactions.<br />

In respect <strong>of</strong> non-integral foreign operations :-<br />

Both monetary and non-monetary items are translated at <strong>the</strong> closing rate and <strong>the</strong> resultant difference is<br />

accumulated in a Foreign Currency Translation Reserve, until <strong>the</strong> disposal <strong>of</strong> <strong>the</strong> net investment.<br />

(g) Derivative Instruments:<br />

The Company has an exposure to derivative contracts in <strong>the</strong> nature <strong>of</strong> currency swaps which are in respect <strong>of</strong> some <strong>of</strong><br />

<strong>the</strong> underlying rupee borrowings. Exchange differences arising on repayment/revaluation <strong>of</strong> such currency swaps are<br />

recognised as income or expense in <strong>the</strong> period in which <strong>the</strong>y arise.<br />

91