Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Scheduleforming part of the Balance Sheet - Domain-b

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Indian Hotels Company Limited<br />

90<br />

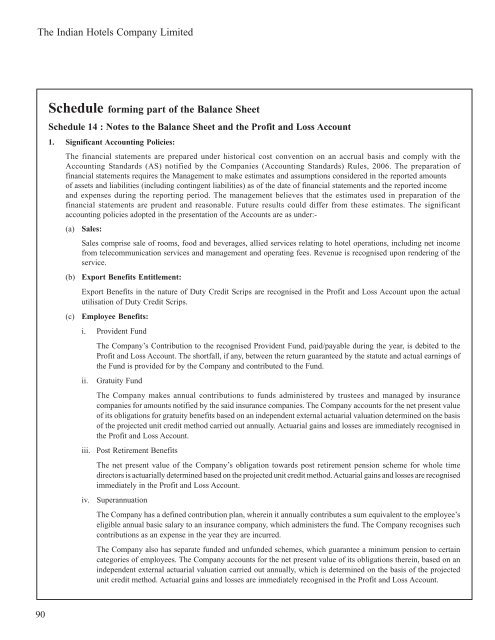

Schedule forming <strong>part</strong> <strong>of</strong> <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong><br />

Schedule 14 : Notes to <strong>the</strong> <strong>Balance</strong> <strong>Sheet</strong> and <strong>the</strong> Pr<strong>of</strong>it and Loss Account<br />

1. Significant Accounting Policies:<br />

The financial statements are prepared under historical cost convention on an accrual basis and comply with <strong>the</strong><br />

Accounting Standards (AS) notified by <strong>the</strong> Companies (Accounting Standards) Rules, 2006. The preparation <strong>of</strong><br />

financial statements requires <strong>the</strong> Management to make estimates and assumptions considered in <strong>the</strong> reported amounts<br />

<strong>of</strong> assets and liabilities (including contingent liabilities) as <strong>of</strong> <strong>the</strong> date <strong>of</strong> financial statements and <strong>the</strong> reported income<br />

and expenses during <strong>the</strong> reporting period. The management believes that <strong>the</strong> estimates used in preparation <strong>of</strong> <strong>the</strong><br />

financial statements are prudent and reasonable. Future results could differ from <strong>the</strong>se estimates. The significant<br />

accounting policies adopted in <strong>the</strong> presentation <strong>of</strong> <strong>the</strong> Accounts are as under:-<br />

(a) Sales:<br />

Sales comprise sale <strong>of</strong> rooms, food and beverages, allied services relating to hotel operations, including net income<br />

from telecommunication services and management and operating fees. Revenue is recognised upon rendering <strong>of</strong> <strong>the</strong><br />

service.<br />

(b) Export Benefits Entitlement:<br />

Export Benefits in <strong>the</strong> nature <strong>of</strong> Duty Credit Scrips are recognised in <strong>the</strong> Pr<strong>of</strong>it and Loss Account upon <strong>the</strong> actual<br />

utilisation <strong>of</strong> Duty Credit Scrips.<br />

(c) Employee Benefits:<br />

i. Provident Fund<br />

The Company’s Contribution to <strong>the</strong> recognised Provident Fund, paid/payable during <strong>the</strong> year, is debited to <strong>the</strong><br />

Pr<strong>of</strong>it and Loss Account. The shortfall, if any, between <strong>the</strong> return guaranteed by <strong>the</strong> statute and actual earnings <strong>of</strong><br />

<strong>the</strong> Fund is provided for by <strong>the</strong> Company and contributed to <strong>the</strong> Fund.<br />

ii. Gratuity Fund<br />

The Company makes annual contributions to funds administered by trustees and managed by insurance<br />

companies for amounts notified by <strong>the</strong> said insurance companies. The Company accounts for <strong>the</strong> net present value<br />

<strong>of</strong> its obligations for gratuity benefits based on an independent external actuarial valuation determined on <strong>the</strong> basis<br />

<strong>of</strong> <strong>the</strong> projected unit credit method carried out annually. Actuarial gains and losses are immediately recognised in<br />

<strong>the</strong> Pr<strong>of</strong>it and Loss Account.<br />

iii. Post Retirement Benefits<br />

The net present value <strong>of</strong> <strong>the</strong> Company’s obligation towards post retirement pension scheme for whole time<br />

directors is actuarially determined based on <strong>the</strong> projected unit credit method. Actuarial gains and losses are recognised<br />

immediately in <strong>the</strong> Pr<strong>of</strong>it and Loss Account.<br />

iv. Superannuation<br />

The Company has a defined contribution plan, wherein it annually contributes a sum equivalent to <strong>the</strong> employee’s<br />

eligible annual basic salary to an insurance company, which administers <strong>the</strong> fund. The Company recognises such<br />

contributions as an expense in <strong>the</strong> year <strong>the</strong>y are incurred.<br />

The Company also has separate funded and unfunded schemes, which guarantee a minimum pension to certain<br />

categories <strong>of</strong> employees. The Company accounts for <strong>the</strong> net present value <strong>of</strong> its obligations <strong>the</strong>rein, based on an<br />

independent external actuarial valuation carried out annually, which is determined on <strong>the</strong> basis <strong>of</strong> <strong>the</strong> projected<br />

unit credit method. Actuarial gains and losses are immediately recognised in <strong>the</strong> Pr<strong>of</strong>it and Loss Account.