Dit prospectus is gemaakt voor de uitgifte van dit product en ... - Iex

Dit prospectus is gemaakt voor de uitgifte van dit product en ... - Iex

Dit prospectus is gemaakt voor de uitgifte van dit product en ... - Iex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

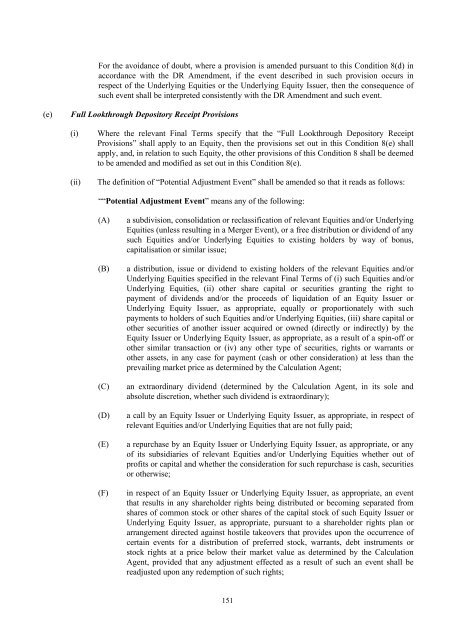

For the avoidance of doubt, where a prov<strong>is</strong>ion <strong>is</strong> am<strong>en</strong><strong>de</strong>d pursuant to th<strong>is</strong> Con<strong>dit</strong>ion 8(d) inaccordance with the DR Am<strong>en</strong>dm<strong>en</strong>t, if the ev<strong>en</strong>t <strong>de</strong>scribed in such prov<strong>is</strong>ion occurs inrespect of the Un<strong>de</strong>rlying Equities or the Un<strong>de</strong>rlying Equity Issuer, th<strong>en</strong> the consequ<strong>en</strong>ce ofsuch ev<strong>en</strong>t shall be interpreted cons<strong>is</strong>t<strong>en</strong>tly with the DR Am<strong>en</strong>dm<strong>en</strong>t and such ev<strong>en</strong>t.(e)Full Lookthrough Depository Receipt Prov<strong>is</strong>ions(i)(ii)Where the rele<strong>van</strong>t Final Terms specify that the “Full Lookthrough Depository ReceiptProv<strong>is</strong>ions” shall apply to an Equity, th<strong>en</strong> the prov<strong>is</strong>ions set out in th<strong>is</strong> Con<strong>dit</strong>ion 8(e) shallapply, and, in relation to such Equity, the other prov<strong>is</strong>ions of th<strong>is</strong> Con<strong>dit</strong>ion 8 shall be <strong>de</strong>emedto be am<strong>en</strong><strong>de</strong>d and modified as set out in th<strong>is</strong> Con<strong>dit</strong>ion 8(e).The <strong>de</strong>finition of “Pot<strong>en</strong>tial Adjustm<strong>en</strong>t Ev<strong>en</strong>t” shall be am<strong>en</strong><strong>de</strong>d so that it reads as follows:““Pot<strong>en</strong>tial Adjustm<strong>en</strong>t Ev<strong>en</strong>t” means any of the following:(A)(B)(C)(D)(E)(F)a subdiv<strong>is</strong>ion, consolidation or reclassification of rele<strong>van</strong>t Equities and/or Un<strong>de</strong>rlyingEquities (unless resulting in a Merger Ev<strong>en</strong>t), or a free d<strong>is</strong>tribution or divi<strong>de</strong>nd of anysuch Equities and/or Un<strong>de</strong>rlying Equities to ex<strong>is</strong>ting hol<strong>de</strong>rs by way of bonus,capital<strong>is</strong>ation or similar <strong>is</strong>sue;a d<strong>is</strong>tribution, <strong>is</strong>sue or divi<strong>de</strong>nd to ex<strong>is</strong>ting hol<strong>de</strong>rs of the rele<strong>van</strong>t Equities and/orUn<strong>de</strong>rlying Equities specified in the rele<strong>van</strong>t Final Terms of (i) such Equities and/orUn<strong>de</strong>rlying Equities, (ii) other share capital or securities granting the right topaym<strong>en</strong>t of divi<strong>de</strong>nds and/or the proceeds of liquidation of an Equity Issuer orUn<strong>de</strong>rlying Equity Issuer, as appropriate, equally or proportionately with suchpaym<strong>en</strong>ts to hol<strong>de</strong>rs of such Equities and/or Un<strong>de</strong>rlying Equities, (iii) share capital orother securities of another <strong>is</strong>suer acquired or owned (directly or indirectly) by theEquity Issuer or Un<strong>de</strong>rlying Equity Issuer, as appropriate, as a result of a spin-off orother similar transaction or (iv) any other type of securities, rights or warrants orother assets, in any case for paym<strong>en</strong>t (cash or other consi<strong>de</strong>ration) at less than theprevailing market price as <strong>de</strong>termined by the Calculation Ag<strong>en</strong>t;an extraordinary divi<strong>de</strong>nd (<strong>de</strong>termined by the Calculation Ag<strong>en</strong>t, in its sole andabsolute d<strong>is</strong>cretion, whether such divi<strong>de</strong>nd <strong>is</strong> extraordinary);a call by an Equity Issuer or Un<strong>de</strong>rlying Equity Issuer, as appropriate, in respect ofrele<strong>van</strong>t Equities and/or Un<strong>de</strong>rlying Equities that are not fully paid;a repurchase by an Equity Issuer or Un<strong>de</strong>rlying Equity Issuer, as appropriate, or anyof its subsidiaries of rele<strong>van</strong>t Equities and/or Un<strong>de</strong>rlying Equities whether out ofprofits or capital and whether the consi<strong>de</strong>ration for such repurchase <strong>is</strong> cash, securitiesor otherw<strong>is</strong>e;in respect of an Equity Issuer or Un<strong>de</strong>rlying Equity Issuer, as appropriate, an ev<strong>en</strong>tthat results in any sharehol<strong>de</strong>r rights being d<strong>is</strong>tributed or becoming separated fromshares of common stock or other shares of the capital stock of such Equity Issuer orUn<strong>de</strong>rlying Equity Issuer, as appropriate, pursuant to a sharehol<strong>de</strong>r rights plan orarrangem<strong>en</strong>t directed against hostile takeovers that provi<strong>de</strong>s upon the occurr<strong>en</strong>ce ofcertain ev<strong>en</strong>ts for a d<strong>is</strong>tribution of preferred stock, warrants, <strong>de</strong>bt instrum<strong>en</strong>ts orstock rights at a price below their market value as <strong>de</strong>termined by the CalculationAg<strong>en</strong>t, provi<strong>de</strong>d that any adjustm<strong>en</strong>t effected as a result of such an ev<strong>en</strong>t shall bereadjusted upon any re<strong>de</strong>mption of such rights;151