Dit prospectus is gemaakt voor de uitgifte van dit product en ... - Iex

Dit prospectus is gemaakt voor de uitgifte van dit product en ... - Iex

Dit prospectus is gemaakt voor de uitgifte van dit product en ... - Iex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

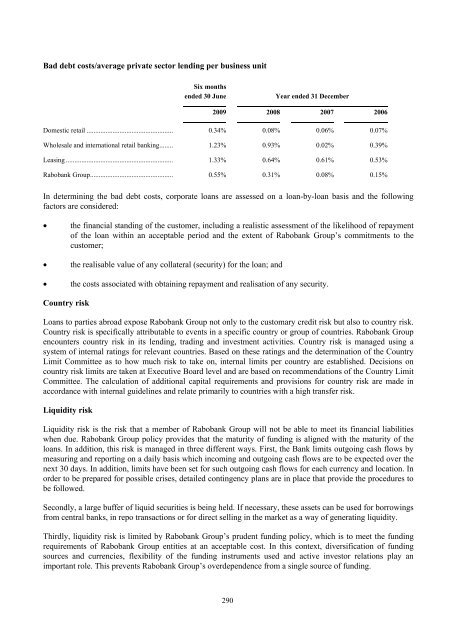

Bad <strong>de</strong>bt costs/average private sector l<strong>en</strong>ding per business unitSix months<strong>en</strong><strong>de</strong>d 30 JuneYear <strong>en</strong><strong>de</strong>d 31 December2009 2008 2007 2006Domestic retail .................................................. 0.34% 0.08% 0.06% 0.07%Wholesale and international retail banking........ 1.23% 0.93% 0.02% 0.39%Leasing .............................................................. 1.33% 0.64% 0.61% 0.53%Rabobank Group................................................ 0.55% 0.31% 0.08% 0.15%In <strong>de</strong>termining the bad <strong>de</strong>bt costs, corporate loans are assessed on a loan-by-loan bas<strong>is</strong> and the followingfactors are consi<strong>de</strong>red:• the financial standing of the customer, including a real<strong>is</strong>tic assessm<strong>en</strong>t of the likelihood of repaym<strong>en</strong>tof the loan within an acceptable period and the ext<strong>en</strong>t of Rabobank Group’s commitm<strong>en</strong>ts to thecustomer;• the real<strong>is</strong>able value of any collateral (security) for the loan; and• the costs associated with obtaining repaym<strong>en</strong>t and real<strong>is</strong>ation of any security.Country r<strong>is</strong>kLoans to parties abroad expose Rabobank Group not only to the customary cre<strong>dit</strong> r<strong>is</strong>k but also to country r<strong>is</strong>k.Country r<strong>is</strong>k <strong>is</strong> specifically attributable to ev<strong>en</strong>ts in a specific country or group of countries. Rabobank Group<strong>en</strong>counters country r<strong>is</strong>k in its l<strong>en</strong>ding, trading and investm<strong>en</strong>t activities. Country r<strong>is</strong>k <strong>is</strong> managed using asystem of internal ratings for rele<strong>van</strong>t countries. Based on these ratings and the <strong>de</strong>termination of the CountryLimit Committee as to how much r<strong>is</strong>k to take on, internal limits per country are establ<strong>is</strong>hed. Dec<strong>is</strong>ions oncountry r<strong>is</strong>k limits are tak<strong>en</strong> at Executive Board level and are based on recomm<strong>en</strong>dations of the Country LimitCommittee. The calculation of ad<strong>dit</strong>ional capital requirem<strong>en</strong>ts and prov<strong>is</strong>ions for country r<strong>is</strong>k are ma<strong>de</strong> inaccordance with internal gui<strong>de</strong>lines and relate primarily to countries with a high transfer r<strong>is</strong>k.Liqui<strong>dit</strong>y r<strong>is</strong>kLiqui<strong>dit</strong>y r<strong>is</strong>k <strong>is</strong> the r<strong>is</strong>k that a member of Rabobank Group will not be able to meet its financial liabilitieswh<strong>en</strong> due. Rabobank Group policy provi<strong>de</strong>s that the maturity of funding <strong>is</strong> aligned with the maturity of theloans. In ad<strong>dit</strong>ion, th<strong>is</strong> r<strong>is</strong>k <strong>is</strong> managed in three differ<strong>en</strong>t ways. First, the Bank limits outgoing cash flows bymeasuring and reporting on a daily bas<strong>is</strong> which incoming and outgoing cash flows are to be expected over th<strong>en</strong>ext 30 days. In ad<strong>dit</strong>ion, limits have be<strong>en</strong> set for such outgoing cash flows for each curr<strong>en</strong>cy and location. Inor<strong>de</strong>r to be prepared for possible cr<strong>is</strong>es, <strong>de</strong>tailed conting<strong>en</strong>cy plans are in place that provi<strong>de</strong> the procedures tobe followed.Secondly, a large buffer of liquid securities <strong>is</strong> being held. If necessary, these assets can be used for borrowingsfrom c<strong>en</strong>tral banks, in repo transactions or for direct selling in the market as a way of g<strong>en</strong>erating liqui<strong>dit</strong>y.Thirdly, liqui<strong>dit</strong>y r<strong>is</strong>k <strong>is</strong> limited by Rabobank Group’s pru<strong>de</strong>nt funding policy, which <strong>is</strong> to meet the fundingrequirem<strong>en</strong>ts of Rabobank Group <strong>en</strong>tities at an acceptable cost. In th<strong>is</strong> context, diversification of fundingsources and curr<strong>en</strong>cies, flexibility of the funding instrum<strong>en</strong>ts used and active investor relations play animportant role. Th<strong>is</strong> prev<strong>en</strong>ts Rabobank Group’s over<strong>de</strong>p<strong>en</strong><strong>de</strong>nce from a single source of funding.290