- Page 1 and 2:

Dit prospectus is gemaakt voor de u

- Page 3 and 4:

A Dutch language description of the

- Page 5:

FUND LINKED INTEREST NOTE PROVISION

- Page 8 and 9:

Where:SPX (0) means the Reference L

- Page 10 and 11:

(b)Whether the Notesrelate to a bas

- Page 12 and 13:

37. Instalment Notes: Not Applicabl

- Page 14 and 15:

PART B - OTHER INFORMATION1. LISTIN

- Page 16 and 17:

Index to track general stock market

- Page 18 and 19:

(b)(c)(d)(e)(f)Conditions to which

- Page 20 and 21:

ANNEXDUTCH LANGUAGE DESCRIPTIONNEDE

- Page 22 and 23:

OFFERING CIRCULARRABOBANK STRUCTURE

- Page 24 and 25:

ChapterTABLE OF CONTENTSPageSUMMARY

- Page 26 and 27:

Rabobank’s current long-term depo

- Page 28 and 29:

y the International Swaps and Deriv

- Page 30 and 31:

Delivery of the Deliverable Obligat

- Page 32 and 33:

RISK FACTORSThe Issuer believes tha

- Page 34 and 35:

Transfer limits are determined acco

- Page 36 and 37:

Effect of governmental policy and r

- Page 38 and 39:

Currency Linked NotesThe Issuer may

- Page 40 and 41:

Adjustment to the terms and conditi

- Page 42 and 43:

Prospective purchasers of the Notes

- Page 44 and 45:

Notes issued at a substantial disco

- Page 46 and 47:

implementation of the Savings Direc

- Page 48 and 49:

Legal investment considerations may

- Page 50 and 51:

IMPORTANT INFORMATIONThis Offering

- Page 52 and 53:

equirement to publish a prospectus

- Page 54 and 55:

Issuer or such directors and office

- Page 56 and 57:

FORM OF FINAL TERMS (LESS THAN EUR

- Page 58 and 59:

REPRESENTATION CAN BE MADE AS TO TH

- Page 60 and 61:

8. Maturity Date or Redemption Mont

- Page 62 and 63:

(i)Other terms relating to the meth

- Page 64 and 65:

Redemption Amounts and Late Payment

- Page 66 and 67:

INDEX LINKED INTEREST NOTE PROVISIO

- Page 68 and 69:

[[●]/See Schedule]](b)(c)(d)(e)Pa

- Page 70 and 71:

(Specify other)](f) Additional Fina

- Page 72 and 73:

(c) Day Count Fraction: [Actual/Act

- Page 74 and 75:

(c)Provisions for determining Final

- Page 76 and 77:

(e)Relevant provisions for determin

- Page 78 and 79:

[The obligation(s) identified as fo

- Page 80 and 81:

(x) Physical Settlement Period: [

- Page 82 and 83:

(j) Fund Business Day: [[●] (Give

- Page 84 and 85:

DISTRIBUTION45. (a) If syndicated,

- Page 86 and 87:

PART B - OTHER INFORMATION 71. LIST

- Page 88 and 89:

composed by the Issuer and if the i

- Page 90 and 91:

(When completing this paragraph, co

- Page 92 and 93:

(h)(i)(j)(k)(l)[Procedure for exerc

- Page 94 and 95:

FORM OF FINAL TERMS (AT LEAST EUR 5

- Page 96 and 97:

(When adding any other terms, risk

- Page 98 and 99:

[Fund Linked Redemption]/[Dual Curr

- Page 100 and 101:

(f) Screen Rate Determination: [App

- Page 102 and 103:

(e)Currencies and/or formula isimpo

- Page 104 and 105:

(d)Provisions for determining theRa

- Page 106 and 107:

(f) Additional Disruption Events: [

- Page 108 and 109:

(j)Others terms or specialcondition

- Page 110 and 111:

[Actual/Actual (ISDA)]/[Other](d) O

- Page 112 and 113:

INDEX LINKED REDEMPTION NOTE PROVIS

- Page 114 and 115:

(g) Observation Date(s): [[●] (Gi

- Page 116 and 117:

Obligations:[The obligation(s) iden

- Page 118 and 119:

Terms relating to PhysicalDelivery:

- Page 120 and 121:

(vi) Benchmark Change: The benchmar

- Page 122 and 123:

(When adding any other final terms,

- Page 124 and 125:

PART B - OTHER INFORMATION 121. LIS

- Page 126 and 127:

information about the index can be

- Page 128 and 129:

(Include other information concerni

- Page 130 and 131:

SCHEDULE [●] TO THE FINAL TERMS(I

- Page 132 and 133:

Terms and Conditions for the purpos

- Page 134 and 135:

Day Count Fraction =[360 x (Y2 - Y

- Page 136 and 137:

“Delivery Agent”“Determinatio

- Page 138 and 139:

and/or of DTC, as applicable, as th

- Page 140 and 141:

Bearer Notes are represented either

- Page 142 and 143:

writing, be mailed by uninsured pos

- Page 144 and 145:

(b)Interest on Floating Rate Notes,

- Page 146 and 147:

The Agency Agreement contains provi

- Page 148 and 149:

(d)Interest on Dual Currency NotesI

- Page 150 and 151:

In the case of a partial redemption

- Page 152 and 153:

Where such calculation is made for

- Page 154 and 155:

Redemption Amount and/or the Strike

- Page 156 and 157:

(irrespective of whether that eight

- Page 158 and 159:

price risk of the Issuer issuing an

- Page 160 and 161:

espect of a Multi-Exchange Index ex

- Page 162 and 163:

exchange or quotation system as on

- Page 164 and 165:

8. Equity Linked Notes(a)Redemption

- Page 166 and 167:

e appropriate to preserve the econo

- Page 168 and 169:

case, such date of delivery shall b

- Page 170 and 171:

Equity Issuer or Underlying Equity

- Page 172 and 173:

For the avoidance of doubt, where a

- Page 174 and 175:

(vii)If the Calculation Agent deter

- Page 176 and 177:

(C)“Valid Date” shall mean a Sc

- Page 178 and 179:

effect transactions in, or obtain m

- Page 180 and 181:

occurrence of a Disrupted Day shall

- Page 182 and 183:

Calculation Agent) on the overall m

- Page 184 and 185:

9. Fund Linked Notes(a)Redemption o

- Page 186 and 187:

(x)(xi)(xii)any material change or

- Page 188 and 189:

elevant Final Terms) or its equival

- Page 190 and 191:

(c)Disrupted Days(i)Valuation Dates

- Page 192 and 193:

“FundAdministrator”“Fund Advi

- Page 194 and 195:

(b)Cash SettlementIf Cash Settlemen

- Page 196 and 197:

no further or other amount in respe

- Page 198 and 199:

Notice, the relevant Noteholder may

- Page 200 and 201:

the same highest or lowest value, t

- Page 202 and 203:

method or if such Obligation’s yi

- Page 204 and 205:

“Best AvailableInformation”mean

- Page 206 and 207:

(ii)(iii)where “Grace Period Exte

- Page 208 and 209:

“Deliverable Obligation”means,

- Page 210 and 211:

Obligation may be included as a Del

- Page 212 and 213:

“Assignable Loan”, “Consent R

- Page 214 and 215:

whose outstanding Voting Shares are

- Page 216 and 217:

Obligation”“Governmental Author

- Page 218 and 219:

Entity consolidates or amalgamates

- Page 220 and 221:

aforementioned currencies, which cu

- Page 222 and 223:

Default Requirement have become due

- Page 224 and 225:

Issuer a certificate signed by a Ma

- Page 226 and 227:

Quotations shall include or exclude

- Page 228 and 229:

effective.“Restructured Bond orLo

- Page 230 and 231:

Deliverable Obligation Characterist

- Page 232 and 233:

change in the Reference Obligation

- Page 234 and 235:

Derivatives Definitions.Upon the Ca

- Page 236 and 237: (ii)The following Valuation Methods

- Page 238 and 239: (l)Provisions relating to Multiple

- Page 240 and 241: (d)Payments in respect of Registere

- Page 242 and 243: 12. TaxationAll payments of princip

- Page 244 and 245: 15. AgentsThe Issuing and Paying Ag

- Page 246 and 247: The Agency Agreement may be amended

- Page 248 and 249: the first payment of interest there

- Page 250 and 251: FORM OF THE NOTESInitial Issue of N

- Page 252 and 253: procure the delivery of, a Permanen

- Page 254 and 255: −Notices. So long as any Notes ar

- Page 256 and 257: CLEARING AND SETTLEMENTBook-Entry O

- Page 258 and 259: Euroclear and Clearstream customers

- Page 260 and 261: 59.1 per cent., and the return on e

- Page 262 and 263: agricultural market. Structured Fin

- Page 264 and 265: Real estate, Rabo Vastgoedgroep N.V

- Page 266 and 267: and that Rabobank Group’s broad r

- Page 268 and 269: Leveraging Rabobank’s distributio

- Page 270 and 271: RABOBANK GROUP STRUCTURECoöperatie

- Page 272 and 273: Rabobank Nederland’s “central b

- Page 274 and 275: continue. Management expects that t

- Page 276 and 277: footnotes to the audited consolidat

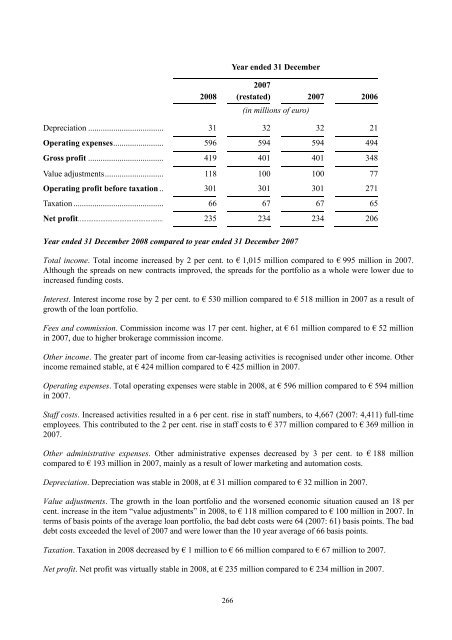

- Page 278 and 279: Operating expenses. Total operating

- Page 280 and 281: Year ended 31 December20082007(rest

- Page 282 and 283: Year ended 31 December20082007(rest

- Page 284 and 285: Other income. Other income decrease

- Page 288 and 289: Year ended 31 December 2007 compare

- Page 290 and 291: Year ended 31 December 2007 compare

- Page 292 and 293: Year ended 31 December20082007*(res

- Page 294 and 295: Contingent liabilities relate prima

- Page 296 and 297: The BIS ratio is calculated by divi

- Page 298 and 299: The table below sets forth a geogra

- Page 300 and 301: (in millions of euro)BanksPublicaut

- Page 302 and 303: The following table provides an ana

- Page 304 and 305: At 31 December(in millions of euro)

- Page 306 and 307: (in millions of euro) 30-Jun-09 31-

- Page 308 and 309: RISK MANAGEMENTRabobank Group place

- Page 310 and 311: Credit riskRabobank Group aims to o

- Page 312 and 313: Liquidity risk is an organisation-w

- Page 314 and 315: Supervisory BoardThe Supervisory Bo

- Page 316 and 317: increasing legislation and regulati

- Page 318 and 319: Supervisory Board of Rabobank Neder

- Page 320 and 321: Auxiliary positionsDate of first ap

- Page 322 and 323: Date of first appointment tothe Sup

- Page 324 and 325: Date of first appointment tothe Sup

- Page 326 and 327: Supervision & Monetary Affairs and

- Page 328 and 329: REGULATION OF RABOBANK GROUPRaboban

- Page 330 and 331: Dutch regulationGeneralAs of Septem

- Page 332 and 333: EmergenciesThe Financial Supervisio

- Page 334 and 335: TAXATIONGeneralThe following summar

- Page 336 and 337:

to dispose of the Notes. In some ca

- Page 338 and 339:

settlement institution and pays the

- Page 340 and 341:

their own professional advisers as

- Page 342 and 343:

should consult their tax adviser co

- Page 344 and 345:

espect to the Discount Note for eac

- Page 346 and 347:

(c) it does not provide for any pri

- Page 348 and 349:

U.S. federal income tax purposes) h

- Page 350 and 351:

Contingent NotesGain from the sale

- Page 352 and 353:

issue price of a Foreign Currency C

- Page 354 and 355:

4.3 U.S. Federal Income Tax Treatme

- Page 356 and 357:

Issuers intend to treat the Forward

- Page 358 and 359:

Retirement of an Option Note for Ca

- Page 360 and 361:

U.S. Holder will be required to dis

- Page 362 and 363:

‘“benefit plan investors”.

- Page 364 and 365:

(7) Distribution of this Offering C

- Page 366 and 367:

(d)(e)at any time to fewer than 100

- Page 368 and 369:

for the purposes of its business an

- Page 370 and 371:

e-offering or resale, directly or i

- Page 372 and 373:

GENERAL INFORMATION1. Application h

- Page 374:

PRINCIPAL OFFICE OF THE ISSUERCoöp