Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

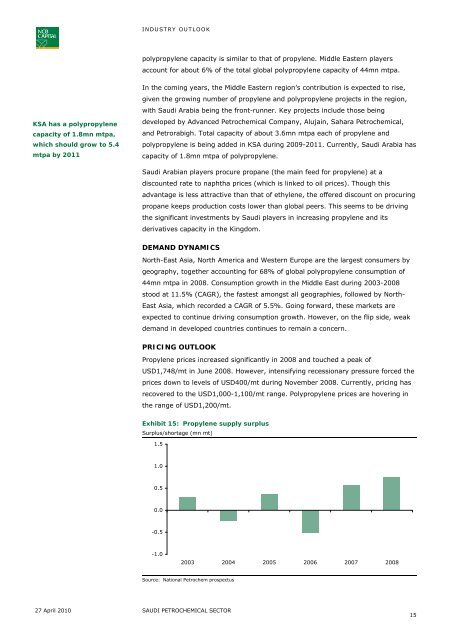

INDUSTRY OUTLOOKpolypropylene capacity is similar to that of propylene. Middle Eastern playersaccount for about 6% of the total global polypropylene capacity of 44mn mtpa.KSA has a polypropylenecapacity of 1.8mn mtpa,which should grow to 5.4mtpa by 2011In the coming years, the Middle Eastern region’s contribution is expected to rise,given the growing number of propylene and polypropylene projects in the region,with <strong>Saudi</strong> Arabia being the front-runner. Key projects include those beingdeveloped by Advanced Petrochemical Company, Alujain, Sahara Petrochemical,and Petrorabigh. Total capacity of about 3.6mn mtpa each of propylene andpolypropylene is being added in KSA during 2009-2011. Currently, <strong>Saudi</strong> Arabia hascapacity of 1.8mn mtpa of polypropylene.<strong>Saudi</strong> Arabian players procure propane (the main feed for propylene) at adiscounted rate to naphtha prices (which is linked to oil prices). Though thisadvantage is less attractive than that of ethylene, the offered discount on procuringpropane keeps production costs lower than global peers. This seems to be drivingthe significant investments by <strong>Saudi</strong> players in increasing propylene and itsderivatives capacity in the Kingdom.DEMAND DYNAMICSNorth-East Asia, North America and Western Europe are the largest consumers bygeography, together accounting for 68% of global polypropylene consumption of44mn mtpa in 2008. Consumption growth in the Middle East during 2003-2008stood at 11.5% (CAGR), the fastest amongst all geographies, followed by North-East Asia, which recorded a CAGR of 5.5%. Going forward, these markets areexpected to continue driving consumption growth. However, on the flip side, weakdemand in developed countries continues to remain a concern.PRICING OUTLOOKPropylene prices increased significantly in 2008 and touched a peak ofUSD1,748/mt in June 2008. However, intensifying recessionary pressure forced theprices down to levels of USD400/mt during November 2008. Currently, pricing hasrecovered to the USD1,000-1,100/mt range. Polypropylene prices are hovering inthe range of USD1,200/mt.Exhibit 15: Propylene supply surplusSurplus/shortage (mn mt)1.51.00.50.0-0.5-1.02003 2004 2005 2006 2007 2008Source: National Petrochem prospectus27 April 2010 SAUDI PETROCHEMICAL SECTOR15