Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

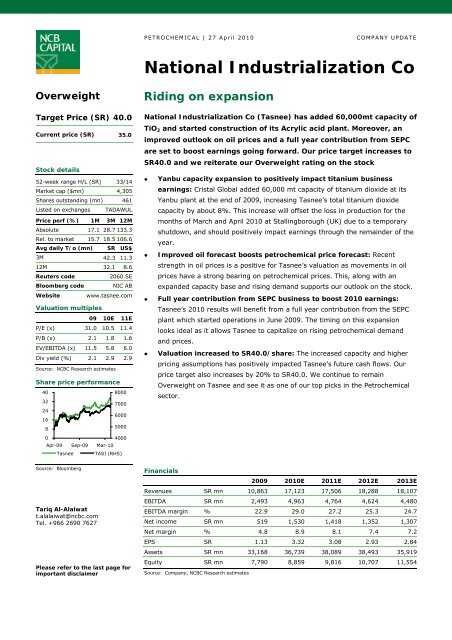

PETROCHEMICAL | 27 April 2010COMPANY UPDATENational Industrialization CoOverweightTarget Price (SR) 40.0Current price (SR) 35.0Stock details52-week range H/L (SR) 33/14Market cap ($mn) 4,305Shares outstanding (mn) 461Listed on exchanges TADAWULPrice perf (%) 1M 3M 12MAbsolute 17.1 28.7 133.3Rel. to market 15.7 18.5 106.6Avg daily T/o (mn) SR US$3M 42.3 11.312M 32.1 8.6Reuters code2060.SEBloomberg codeNIC ABWebsite www.tasnee.comValuation multiples09 10E 11EP/E (x) 31.0 10.5 11.4P/B (x) 2.1 1.8 1.6EV/EBITDA (x) 11.5 5.8 6.0Div yield (%) 2.1 2.9 2.9Source: <strong>NCBC</strong> Research estimatesShare price performance403280007000246000168500004000Apr-09 Sep-09 Mar-10Tasnee TASI (RHS)Riding on expansionNational Industrialization Co (Tasnee) has added 60,000mt capacity ofTiO 2 and started construction of its Acrylic acid plant. Moreover, animproved outlook on oil prices and a full year contribution from SEPCare set to boost earnings going forward. Our price target increases toSR40.0 and we reiterate our Overweight rating on the stock• Yanbu capacity expansion to positively impact titanium businessearnings: Cristal Global added 60,000 mt capacity of titanium dioxide at itsYanbu plant at the end of 2009, increasing Tasnee’s total titanium dioxidecapacity by about 8%. This increase will offset the loss in production for themonths of March and April 2010 at Stallingborough (UK) due to a temporaryshutdown, and should positively impact earnings through the remainder of theyear.• Improved oil forecast boosts petrochemical price forecast: Recentstrength in oil prices is a positive for Tasnee’s valuation as movements in oilprices have a strong bearing on petrochemical prices. This, along with anexpanded capacity base and rising demand supports our outlook on the stock.• Full year contribution from SEPC business to boost 2010 earnings:Tasnee’s 2010 results will benefit from a full year contribution from the SEPCplant which started operations in June 2009. The timing on this expansionlooks ideal as it allows Tasnee to capitalize on rising petrochemical demandand prices.• Valuation increased to SR40.0/share: The increased capacity and higherpricing assumptions has positively impacted Tasnee’s future cash flows. Ourprice target also increases by 20% to SR40.0. We continue to remainOverweight on Tasnee and see it as one of our top picks in the <strong>Petrochemicals</strong>ector.Source: BloombergFinancials2009 2010E 2011E 2012E 2013ERevenues SR mn 10,863 17,123 17,506 18,288 18,107EBITDA SR mn 2,493 4,963 4,764 4,624 4,480Tariq Al-Alaiwatt.alalaiwat@ncbc.comEBITDA margin % 22.9 29.0 27.2 25.3 24.7Tel. +966 2690 7627 Net income SR mn 519 1,530 1,418 1,352 1,307Net margin % 4.8 8.9 8.1 7.4 7.2EPS SR 1.13 3.32 3.08 2.93 2.84Assets SR mn 33,168 36,739 38,089 38,493 35,919Equity SR mn 7,790 8,859 9,816 10,707 11,554Please refer to the last page forimportant disclaimerSource: Company, <strong>NCBC</strong> Research estimates