Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

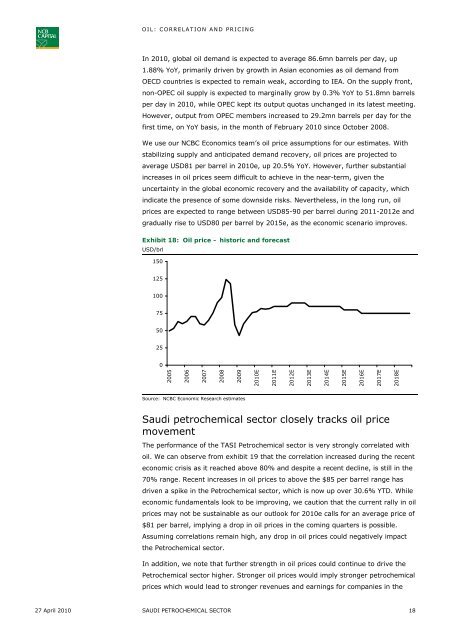

OIL: CORRELATION AND PRICINGIn 2010, global oil demand is expected to average 86.6mn barrels per day, up1.88% YoY, primarily driven by growth in Asian economies as oil demand fromOECD countries is expected to remain weak, according to IEA. On the supply front,non-OPEC oil supply is expected to marginally grow by 0.3% YoY to 51.8mn barrelsper day in 2010, while OPEC kept its output quotas unchanged in its latest meeting.However, output from OPEC members increased to 29.2mn barrels per day for thefirst time, on YoY basis, in the month of February 2010 since October 2008.We use our <strong>NCBC</strong> Economics team’s oil price assumptions for our estimates. Withstabilizing supply and anticipated demand recovery, oil prices are projected toaverage USD81 per barrel in 2010e, up 20.5% YoY. However, further substantialincreases in oil prices seem difficult to achieve in the near-term, given theuncertainty in the global economic recovery and the availability of capacity, whichindicate the presence of some downside risks. Nevertheless, in the long run, oilprices are expected to range between USD85-90 per barrel during 2011-2012e andgradually rise to USD80 per barrel by 2015e, as the economic scenario improves.Exhibit 18: Oil price – historic and forecastUSD/brl1501251007550250200520062007200820092010E2011E2012E2013E2014E2015E2016E2017E2018ESource: <strong>NCBC</strong> Economic Research estimates<strong>Saudi</strong> petrochemical sector closely tracks oil pricemovementThe performance of the TASI Petrochemical sector is very strongly correlated withoil. We can observe from exhibit 19 that the correlation increased during the recenteconomic crisis as it reached above 80% and despite a recent decline, is still in the70% range. Recent increases in oil prices to above the $85 per barrel range hasdriven a spike in the Petrochemical sector, which is now up over 30.6% YTD. Whileeconomic fundamentals look to be improving, we caution that the current rally in oilprices may not be sustainable as our outlook for 2010e calls for an average price of$81 per barrel, implying a drop in oil prices in the coming quarters is possible.Assuming correlations remain high, any drop in oil prices could negatively impactthe Petrochemical sector.In addition, we note that further strength in oil prices could continue to drive thePetrochemical sector higher. Stronger oil prices would imply stronger petrochemicalprices which would lead to stronger revenues and earnings for companies in the27 April 2010 SAUDI PETROCHEMICAL SECTOR 18