Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

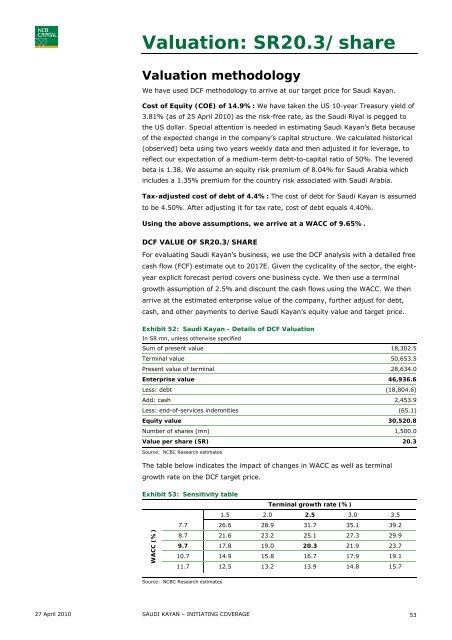

Valuation: SR20.3/shareValuation methodologyWe have used DCF methodology to arrive at our target price for <strong>Saudi</strong> Kayan.Cost of Equity (COE) of 14.9%: We have taken the US 10-year Treasury yield of3.81% (as of 25 April 2010) as the risk-free rate, as the <strong>Saudi</strong> Riyal is pegged tothe US dollar. Special attention is needed in estimating <strong>Saudi</strong> Kayan’s Beta becauseof the expected change in the company’s capital structure. We calculated historical(observed) beta using two years weekly data and then adjusted it for leverage, toreflect our expectation of a medium-term debt-to-capital ratio of 50%. The leveredbeta is 1.38. We assume an equity risk premium of 8.04% for <strong>Saudi</strong> Arabia whichincludes a 1.35% premium for the country risk associated with <strong>Saudi</strong> Arabia.Tax-adjusted cost of debt of 4.4%: The cost of debt for <strong>Saudi</strong> Kayan is assumedto be 4.50%. After adjusting it for tax rate, cost of debt equals 4.40%.Using the above assumptions, we arrive at a WACC of 9.65%.DCF VALUE OF SR20.3/SHAREFor evaluating <strong>Saudi</strong> Kayan’s business, we use the DCF analysis with a detailed freecash flow (FCF) estimate out to 2017E. Given the cyclicality of the sector, the eightyearexplicit forecast period covers one business cycle. We then use a terminalgrowth assumption of 2.5% and discount the cash flows using the WACC. We thenarrive at the estimated enterprise value of the company, further adjust for debt,cash, and other payments to derive <strong>Saudi</strong> Kayan’s equity value and target price.Exhibit 52: <strong>Saudi</strong> Kayan - Details of DCF ValuationIn SR mn, unless otherwise specifiedSum of present value 18,302.5Terminal value 50,653.5Present value of terminal 28,634.0Enterprise value 46,936.6Less: debt (18,804.6)Add: cash 2,453.9Less: end-of-services indemnities (65.1)Equity value 30,520.8Number of shares (mn) 1,500.0Value per share (SR) 20.3Source: <strong>NCBC</strong> Research estimatesThe table below indicates the impact of changes in WACC as well as terminalgrowth rate on the DCF target price.Exhibit 53: Sensitivity tableTerminal growth rate (%)1.5 2.0 2.5 3.0 3.57.7 26.6 28.9 31.7 35.1 39.2WACC (%)8.7 21.6 23.2 25.1 27.3 29.99.7 17.8 19.0 20.3 21.9 23.710.7 14.9 15.8 16.7 17.9 19.111.7 12.5 13.2 13.9 14.8 15.7Source: <strong>NCBC</strong> Research estimates27 April 2010 SAUDI KAYAN – INITIATING COVERAGE53