PETROCHEMICAL | 27 April 2010INITIATION OF COVERAGEPetrochemUnderweight Waiting until 2012Target Price (SR) 15.8Current price (SR) 18.7Potential downside (%) ↓ 15.1Stock details52-week range H/L (SR) 20/13Market cap ($mn) 2,390Shares outstanding (mn) 480Listed on exchangesTADAWULPrice perf (%) 1M 3M SLAbsolute 21.9 24.3 42.9Rel. to market 16.5 13.9 23.6Avg daily T/o (mn) SR US$3M 46.2 12.3Since listing 93.0 24.8Reuters codeBloomberg codeWebsite2002.SEPETROCH ABwww.petrochem.com.saValuation multiples09 10E 11EP/E (x) n/a n/a n/aP/B (x) 1.3 1.9 2.0EV/EBITDA (x) n/a n/a n/aDiv yield (%) 0.0 0.0 0.0Source: <strong>NCBC</strong> Research estimatesSL: Since listingShare price performance25201510Aug-09 Nov-09PetrochemFeb-1080007000600050004000TASI (RHS)National Petrochemical Co. (Petrochem), expected to commenceoperations in 2012, will be entering into the Ethylene and Propylenederivatives arena through a JV with Chevron Phillips. However, giventhat there will likely be no revenue until 2012e and that 2010e-2011ewill remain in net losses, we initiate coverage on Petrochem with anUnderweight rating and target price of SR15.8/share.• No sales to be reported until 2012: We expect Petrochem to only reportrevenue figures starting in 2012e once its plants become operational. Givenour assumption that its plants will be commercially operational from 2Q12,2012e will comprise 9 months of production. We expect 2013e will be the firstyear for a full year of production to impact the revenue figures.• Net losses in 2010e & 2011e: We expect Petrochem will be incurring netlosses during 2010e and 2011e. The majority of the net losses during this timeare from interest expenses. Once revenues start in 2012e, we expect the netincome to turn positive, however quickly peaking in 2013e at SR1,080.3mn,with contraction likely thereafter due to a lower utilization rate.• Planned product lines offers limited growth opportunities: Polyethyleneand polypropylene will account for close to 88% of Petrochem’s external salevolumes. However, there is potential for oversupply here in the medium-termgiven the aggressive capex by most of the <strong>Saudi</strong> players in extending theirethylene and propylene derivatives capacities.• Strong partnership to offer motivated marketing: Chevron PhillipsPetrochemical Company, Petrochem’s JV partner, is an experienced marketerwith fully developed platforms and channels. Chevron Phillips has an off-takeagreement with Petrochem which limits its inventory risk.• Valuation: Petrochem trades at a 2009 P/BV multiple of 1.9x (sector average:2.9x and TASI: 2.2x). Our DCF analysis results in a valuation of SR15.8/share.Given the limited positive catalysts since operations will not start for anothertwo years, we initiate coverage on Petrochem with an Underweight rating anda target price of SR15.8 representing 15.1% downside.Source: BloombergTariq Al-Alaiwatt.alalaiwat@ncbc.comTel. +966 2690 7627Please refer to the last page forimportant disclaimerFinancials2009 2010E 2011E 2012E 2013ERevenues SR mn 0 0 0 5,932 8,721EBITDA SR mn (9) (15) (17) 2,115 3,087EBITDA margin % n/a n/a n/a 35.6 35.4Net income SR mn (61) (127) (236) 905 1,080Net margin % n/a n/a n/a 15.3 12.4EPS SR (0.19) (0.26) (0.49) 2.90 3.46Assets SR mn 14,581 19,228 21,284 22,666 23,189Equity SR mn 4,757 4,630 4,394 5,299 6,380Source: Company, <strong>NCBC</strong> Research estimates

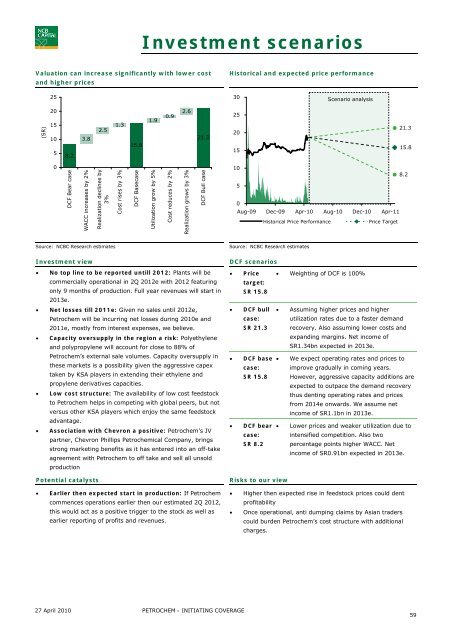

Investment scenariosValuation can increase significantly with lower costand higher pricesHistorical and expected price performance2530Scenario analysis(SR)20151058.23.82.51.315.81.90.92.621.325201521.315.80DCF Bear caseWACC increases by 2%Realization declines by3%Cost rises by 3%DCF BasecaseUtilization grow by 5%Cost reduces by 2%Realization grows by 3%DCF Bull case108.250Aug-09 Dec-09 Apr-10 Aug-10 Dec-10 Apr-11Historical Price PerformancePrice TargetSource: <strong>NCBC</strong> Research estimatesSource: <strong>NCBC</strong> Research estimatesInvestment view• No top line to be reported untill 2012: Plants will becommercially operational in 2Q 2012e with 2012 featuringonly 9 months of production. Full year revenues will start in2013e.• Net losses till 2011e: Given no sales until 2012e,Petrochem will be incurring net losses during 2010e and2011e, mostly from interest expenses, we believe.• Capacity oversupply in the region a risk: Polyethyleneand polypropylene will account for close to 88% ofPetrochem’s external sale volumes. Capacity oversupply inthese markets is a possibility given the aggressive capextaken by KSA players in extending their ethylene andpropylene derivatives capacities.• Low cost structure: The availability of low cost feedstockto Petrochem helps in competing with global peers, but notversus other KSA players which enjoy the same feedstockadvantage.• Association with Chevron a positive: Petrochem’s JVpartner, Chevron Phillips Petrochemical Company, bringsstrong marketing benefits as it has entered into an off-takeagreement with Petrochem to off take and sell all unsoldproductionPotential catalysts• Earlier then expected start in production: If Petrochemcommences operations earlier then our estimated 2Q 2012,this would act as a positive trigger to the stock as well asearlier reporting of profits and revenues.DCF scenarios• Price • Weighting of DCF is 100%target:SR 15.8• DCF bullcase:SR 21.3• Assuming higher prices and higherutilization rates due to a faster demandrecovery. Also assuming lower costs andexpanding margins. Net income ofSR1.34bn expected in 2013e.• DCF base • We expect operating rates and prices tocase:SR 15.8improve gradually in coming years.However, aggressive capacity additions areexpected to outpace the demand recoverythus denting operating rates and pricesfrom 2014e onwards. We assume netincome of SR1.1bn in 2013e.• DCF bear • Lower prices and weaker utilization due tocase:intensified competition. Also twoSR 8.2 percentage points higher WACC. Netincome of SR0.91bn expected in 2013e.Risks to our view• Higher then expected rise in feedstock prices could dentprofitability• Once operational, anti dumping claims by Asian traderscould burden Petrochem’s cost structure with additionalcharges.27 April 2010 PETROCHEM - INITIATING COVERAGE59