PETROCHEMICAL | 27 April 2010COMPANY UPDATESipchemOverweightTarget Price (SR) 29.4Current price (SR) 24.7Stock details52-week range H/L (SR) 26/17Market cap ($mn) 2,198Shares outstanding (mn) 333Listed on exchanges TADAWULPrice perf (%) 1M 3M 12MAbsolute 1.6 8.6 39.5Rel. to market 0.3 (1.6) 12.8Avg daily T/o (mn) SR US$3M 26.4 7.112M 28.2 7.5Reuters code2310.SEBloomberg code SIPCHEM ABWebsite www.sipchem.comValuation multiples09 10E 11EP/E (x) 58.4 9.5 7.0P/B (x) 1.7 1.5 1.3EV/EBITDA (x) 34.0 6.5 4.9Div yield (%) 4.0 4.0 4.0Source: <strong>NCBC</strong> Research estimatesShare price performance30800025700020156000105000504000Apr-09 Oct-09 Apr-10Sipchem TASI (RHS)Source: Bloomberg2Q 2010 to benefit from Phase II<strong>Saudi</strong> International Petrochemical Co (Sipchem) 2010 results are tobenefit from the commercial start of its Acetyl complex scheduled forApril 2010. An improved outlook on oil prices and higher operatingefficiency further strengthens our outlook towards the stock. Ourprice target increases 6% to SR29.4 and we reiterate our Overweightrating on the stock.• Commercial start of phase II expansion in 2Q 2010: Management hasindicated an April start to commercial operations at its Phase II complex,however we are conservatively assuming a May 2010 start. Earnings from thisAcetyl complex will likely boost Sipchem’s 2010e net income by over 6x YoY toSR870mn.• Revised oil forecasts boost petrochemical price forecasts: We haverevised our petrochemical price forecasts upward in line with our revisions inoil prices given rising demand and stabilizing supplies. The higher pricing alongwith an expanded capacity base positively impacts Sipchem’s valuation.• Improved operating efficiency to fuel 2010 earnings growth: In 4Q2009, Sipchem benefited from improved operating performance post itsmaintenance shutdown during 3Q 2009, a strong recovery in petrochemicalprices and reduced anti-dumping charges. As a result, Sipchem’s net incomegrew to SR56.5mn in 4Q 2009 from SR34.7mn in 4Q 2008. We expect thesefactors to fuel earnings growth in 2010 as well.• Improved visibility on Phase III expansion plan: Sipchem aims to awardthe engineering, procurement and construction (EPC) contract for Phase III byend 2010. This expansion would add 125,000 mtpa of polyvinyl acetate and200,000 mtpa of ethylene vinyl acetate to Sipchem’s existing petrochemicalproduct mix. This joint venture, 75% owned by Sipchem and 25% by Korea’sHanwha Chemical Co, is expected by management to be completed by end2013. We do not yet incorporate Phase III into our valuation, offering furtherupside.• Estimates and Valuation: Stronger pricing and improved efficiencies driveour changes to estimates. Better 2009 full year results and the contributionfrom the Acetyl complex increase our confidence in the stock. Hence, our pricetarget increases by 5.6% to SR29.4 representing an upside of 19.1%. Wecontinue to remain Overweight on Sipchem.FinancialsTariq Al-Alaiwatt.alalaiwat@ncbc.comTel. +966 2690 7627Please refer to the last page forimportant disclaimer2009 2010E 2011E 2012E 2013ERevenues SR mn 830 2,817 3,741 3,911 3,565EBITDA SR mn 328 1,722 2,269 2,136 1,887EBITDA margin % 39.5 61.1 60.6 54.6 52.9Net income SR mn 141 870 1,171 1,069 905Net margin % 17.0 30.9 31.3 27.3 25.4EPS SR 0.42 2.61 3.51 3.21 2.72Assets SR mn 11,818 12,377 12,852 13,241 13,318Equity SR mn 4,922 5,457 6,292 7,026 7,595Source: Company, <strong>NCBC</strong> Research estimates

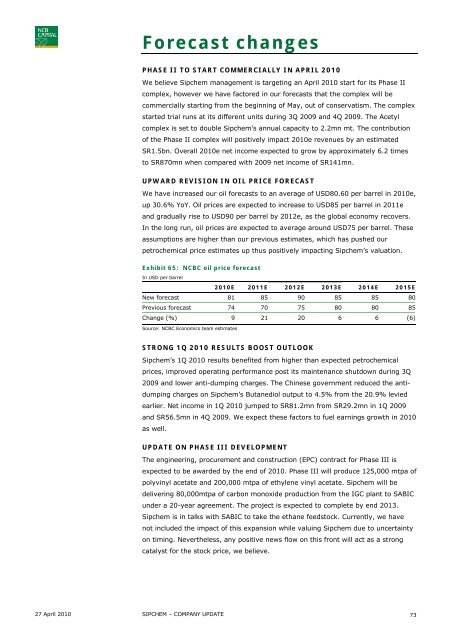

Forecast changesPHASE II TO START COMMERCIALLY IN APRIL 2010We believe Sipchem management is targeting an April 2010 start for its Phase IIcomplex, however we have factored in our forecasts that the complex will becommercially starting from the beginning of May, out of conservatism. The complexstarted trial runs at its different units during 3Q 2009 and 4Q 2009. The Acetylcomplex is set to double Sipchem’s annual capacity to 2.2mn mt. The contributionof the Phase II complex will positively impact 2010e revenues by an estimatedSR1.5bn. Overall 2010e net income expected to grow by approximately 6.2 timesto SR870mn when compared with 2009 net income of SR141mn.UPWARD REVISION IN OIL PRICE FORECASTWe have increased our oil forecasts to an average of USD80.60 per barrel in 2010e,up 30.6% YoY. Oil prices are expected to increase to USD85 per barrel in 2011eand gradually rise to USD90 per barrel by 2012e, as the global economy recovers.In the long run, oil prices are expected to average around USD75 per barrel. Theseassumptions are higher than our previous estimates, which has pushed ourpetrochemical price estimates up thus positively impacting Sipchem’s valuation.Exhibit 65: <strong>NCBC</strong> oil price forecastIn USD per barrel2010E 2011E 2012E 2013E 2014E 2015ENew forecast 81 85 90 85 85 80Previous forecast 74 70 75 80 80 85Change (%) 9 21 20 6 6 (6)Source: <strong>NCBC</strong> Economics team estimatesSTRONG 1Q 2010 RESULTS BOOST OUTLOOKSipchem’s 1Q 2010 results benefited from higher than expected petrochemicalprices, improved operating performance post its maintenance shutdown during 3Q2009 and lower anti-dumping charges. The Chinese government reduced the antidumpingcharges on Sipchem’s Butanediol output to 4.5% from the 20.9% leviedearlier. Net income in 1Q 2010 jumped to SR81.2mn from SR29.2mn in 1Q 2009and SR56.5mn in 4Q 2009. We expect these factors to fuel earnings growth in 2010as well.UPDATE ON PHASE III DEVELOPMENTThe engineering, procurement and construction (EPC) contract for Phase III isexpected to be awarded by the end of 2010. Phase III will produce 125,000 mtpa ofpolyvinyl acetate and 200,000 mtpa of ethylene vinyl acetate. Sipchem will bedelivering 80,000mtpa of carbon monoxide production from the IGC plant to SABICunder a 20-year agreement. The project is expected to complete by end 2013.Sipchem is in talks with SABIC to take the ethane feedstock. Currently, we havenot included the impact of this expansion while valuing Sipchem due to uncertaintyon timing. Nevertheless, any positive news flow on this front will act as a strongcatalyst for the stock price, we believe.27 April 2010 SIPCHEM – COMPANY UPDATE73