Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

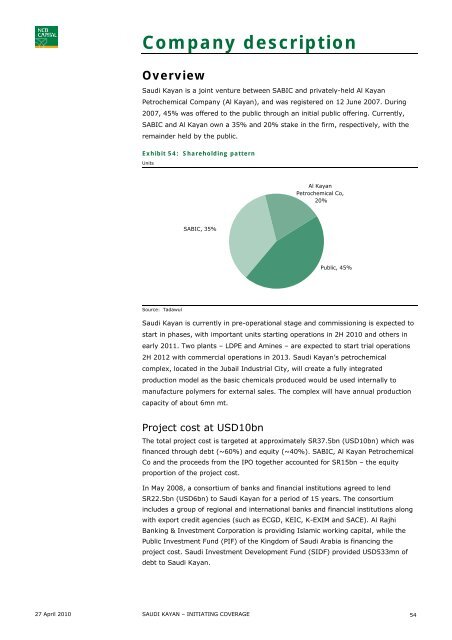

Company descriptionOverview<strong>Saudi</strong> Kayan is a joint venture between SABIC and privately-held Al KayanPetrochemical Company (Al Kayan), and was registered on 12 June 2007. During2007, 45% was offered to the public through an initial public offering. Currently,SABIC and Al Kayan own a 35% and 20% stake in the firm, respectively, with theremainder held by the public.Exhibit 54: Shareholding patternUnitsAl KayanPetrochemical Co,20%SABIC, 35%Public, 45%Source: Tadawul<strong>Saudi</strong> Kayan is currently in pre-operational stage and commissioning is expected tostart in phases, with important units starting operations in 2H 2010 and others inearly 2011. Two plants – LDPE and Amines – are expected to start trial operations2H 2012 with commercial operations in 2013. <strong>Saudi</strong> Kayan’s petrochemicalcomplex, located in the Jubail Industrial City, will create a fully integratedproduction model as the basic chemicals produced would be used internally tomanufacture polymers for external sales. The complex will have annual productioncapacity of about 6mn mt.Project cost at USD10bnThe total project cost is targeted at approximately SR37.5bn (USD10bn) which wasfinanced through debt (~60%) and equity (~40%). SABIC, Al Kayan PetrochemicalCo and the proceeds from the IPO together accounted for SR15bn – the equityproportion of the project cost.In May 2008, a consortium of banks and financial institutions agreed to lendSR22.5bn (USD6bn) to <strong>Saudi</strong> Kayan for a period of 15 years. The consortiumincludes a group of regional and international banks and financial institutions alongwith export credit agencies (such as ECGD, KEIC, K-EXIM and SACE). Al RajhiBanking & Investment Corporation is providing Islamic working capital, while thePublic Investment Fund (PIF) of the Kingdom of <strong>Saudi</strong> Arabia is financing theproject cost. <strong>Saudi</strong> Investment Development Fund (SIDF) provided USD533mn ofdebt to <strong>Saudi</strong> Kayan.27 April 2010 SAUDI KAYAN – INITIATING COVERAGE54