Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

Saudi Petrochemicals - NCBC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

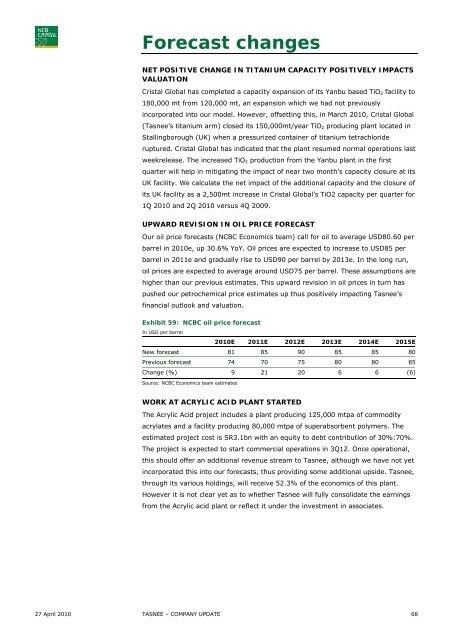

Forecast changesNET POSITIVE CHANGE IN TITANIUM CAPACITY POSITIVELY IMPACTSVALUATIONCristal Global has completed a capacity expansion of its Yanbu based TiO 2 facility to180,000 mt from 120,000 mt, an expansion which we had not previouslyincorporated into our model. However, offsetting this, in March 2010, Cristal Global(Tasnee’s titanium arm) closed its 150,000mt/year TiO 2 producing plant located inStallingborough (UK) when a pressurized container of titanium tetrachlorideruptured. Cristal Global has indicated that the plant resumed normal operations lastweekrelease. The increased TiO 2 production from the Yanbu plant in the firstquarter will help in mitigating the impact of near two month’s capacity closure at itsUK facility. We calculate the net impact of the additional capacity and the closure ofits UK facility as a 2,500mt increase in Cristal Global’s TiO2 capacity per quarter for1Q 2010 and 2Q 2010 versus 4Q 2009.UPWARD REVISION IN OIL PRICE FORECASTOur oil price forecasts (<strong>NCBC</strong> Economics team) call for oil to average USD80.60 perbarrel in 2010e, up 30.6% YoY. Oil prices are expected to increase to USD85 perbarrel in 2011e and gradually rise to USD90 per barrel by 2013e. In the long run,oil prices are expected to average around USD75 per barrel. These assumptions arehigher than our previous estimates. This upward revision in oil prices in turn haspushed our petrochemical price estimates up thus positively impacting Tasnee’sfinancial outlook and valuation.Exhibit 59: <strong>NCBC</strong> oil price forecastIn USD per barrel2010E 2011E 2012E 2013E 2014E 2015ENew forecast 81 85 90 85 85 80Previous forecast 74 70 75 80 80 85Change (%) 9 21 20 6 6 (6)Source: <strong>NCBC</strong> Economics team estimatesWORK AT ACRYLIC ACID PLANT STARTEDThe Acrylic Acid project includes a plant producing 125,000 mtpa of commodityacrylates and a facility producing 80,000 mtpa of superabsorbent polymers. Theestimated project cost is SR3.1bn with an equity to debt contribution of 30%:70%.The project is expected to start commercial operations in 3Q12. Once operational,this should offer an additional revenue stream to Tasnee, although we have not yetincorporated this into our forecasts, thus providing some additional upside. Tasnee,through its various holdings, will receive 52.3% of the economics of this plant.However it is not clear yet as to whether Tasnee will fully consolidate the earningsfrom the Acrylic acid plant or reflect it under the investment in associates.27 April 2010 TASNEE – COMPANY UPDATE 68