Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

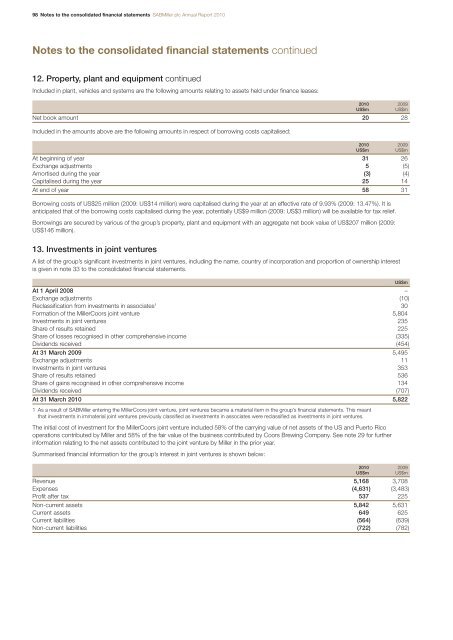

98 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued12. Property, plant and equipment continuedIncluded in plant, vehicles and systems are the following amounts relating to assets held under finance leases:2010 2009US$mUS$mNet book amount 20 28Included in the amounts above are the following amounts in respect of borrowing costs capitalised:2010 2009US$mUS$mAt beginning of year 31 26Exchange adjustments 5 (5)Amortised during the year (3) (4)Capitalised during the year 25 14At end of year 58 31Borrowing costs of US$25 million (2009: US$14 million) were capitalised during the year at an effective rate of 9.93% (2009: 13.47%). It isanticipated that of the borrowing costs capitalised during the year, potentially US$9 million (2009: US$3 million) will be available for tax relief.Borrowings are secured by various of the group’s property, plant and equipment with an aggregate net book value of US$207 million (2009:US$146 million).13. Investments in joint venturesA list of the group’s significant investments in joint ventures, including the name, country of incorporation and proportion of ownership interestis given in note 33 to the consolidated financial statements.US$mAt 1 April 2008 –Exchange adjustments (10)Reclassification from investments in associates 1 30Formation of the MillerCoors joint venture 5,804Investments in joint ventures 235Share of results retained 225Share of losses recognised in other comprehensive income (335)Dividends received (454)At 31 March 2009 5,495Exchange adjustments 11Investments in joint ventures 353Share of results retained 536Share of gains recognised in other comprehensive income 134Dividends received (707)At 31 March 2010 5,8221 As a result of <strong>SABMiller</strong> entering the MillerCoors joint venture, joint ventures became a material item in the group’s financial statements. This meantthat investments in immaterial joint ventures previously classified as investments in associates were reclassified as investments in joint ventures.The initial cost of investment for the MillerCoors joint venture included 58% of the carrying value of net assets of the US and Puerto Ricooperations contributed by Miller and 58% of the fair value of the business contributed by Coors Brewing Company. See note 29 for furtherinformation relating to the net assets contributed to the joint venture by Miller in the prior year.Summarised financial information for the group’s interest in joint ventures is shown below:2010 2009US$mUS$mRevenue 5,168 3,708Expenses (4,631) (3,483)Profit after tax 537 225Non-current assets 5,842 5,631Current assets 649 625Current liabilities (564) (639)Non-current liabilities (722) (782)