Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

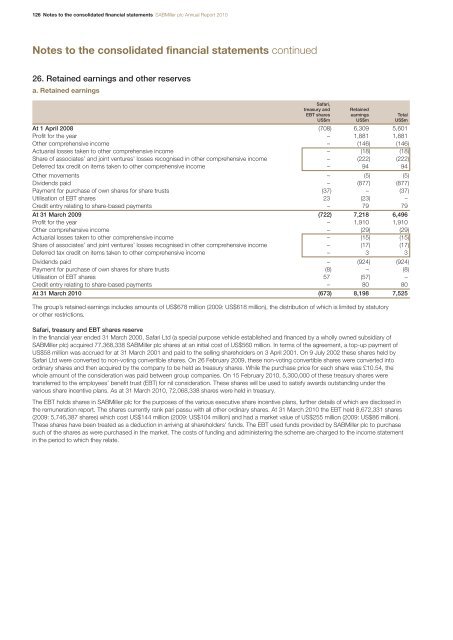

126 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued26. Retained earnings and other reservesa. Retained earningsSafari,treasury and RetainedEBT shares earnings TotalUS$m US$m US$mAt 1 April 2008 (708) 6,309 5,601Profit for the year – 1,881 1,881Other comprehensive income – (146) (146)Actuarial losses taken to other comprehensive income – (18) (18)Share of associates’ and joint ventures’ losses recognised in other comprehensive income – (222) (222)Deferred tax credit on items taken to other comprehensive income – 94 94Other movements – (5) (5)Dividends paid – (877) (877)Payment for purchase of own shares for share trusts (37) – (37)Utilisation of EBT shares 23 (23) –Credit entry relating to share-based payments – 79 79At 31 March 2009 (722) 7,218 6,496Profit for the year – 1,910 1,910Other comprehensive income – (29) (29)Actuarial losses taken to other comprehensive income – (15) (15)Share of associates’ and joint ventures’ losses recognised in other comprehensive income – (17) (17)Deferred tax credit on items taken to other comprehensive income – 3 3Dividends paid – (924) (924)Payment for purchase of own shares for share trusts (8) – (8)Utilisation of EBT shares 57 (57) –Credit entry relating to share-based payments – 80 80At 31 March 2010 (673) 8,198 7,525The group’s retained earnings includes amounts of US$678 million (2009: US$618 million), the distribution of which is limited by statutoryor other restrictions.Safari, treasury and EBT shares reserveIn the financial year ended 31 March 2000, Safari Ltd (a special purpose vehicle established and financed by a wholly owned subsidiary of<strong>SABMiller</strong> plc) acquired 77,368,338 <strong>SABMiller</strong> plc shares at an initial cost of US$560 million. In terms of the agreement, a top-up payment ofUS$58 million was accrued for at 31 March 2001 and paid to the selling shareholders on 3 April 2001. On 9 July 2002 these shares held bySafari Ltd were converted to non-voting convertible shares. On 26 February 2009, these non-voting convertible shares were converted intoordinary shares and then acquired by the company to be held as treasury shares. While the purchase price for each share was £10.54, thewhole amount of the consideration was paid between group companies. On 15 February 2010, 5,300,000 of these treasury shares weretransferred to the employees’ benefit trust (EBT) for nil consideration. These shares will be used to satisfy awards outstanding under thevarious share incentive plans. As at 31 March 2010, 72,068,338 shares were held in treasury.The EBT holds shares in <strong>SABMiller</strong> plc for the purposes of the various executive share incentive plans, further details of which are disclosed inthe remuneration report. The shares currently rank pari passu with all other ordinary shares. At 31 March 2010 the EBT held 8,672,331 shares(2009: 5,746,387 shares) which cost US$144 million (2009: US$104 million) and had a market value of US$255 million (2009: US$86 million).These shares have been treated as a deduction in arriving at shareholders’ funds. The EBT used funds provided by <strong>SABMiller</strong> plc to purchasesuch of the shares as were purchased in the market. The costs of funding and administering the scheme are charged to the income statementin the period to which they relate.