30 Operations review <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Operations review continuedAfrica: Resilient lager volumegrowth underpins EBITAgrowth of 4% on an organic,constant currency basisAfricaFinancial summary 2010 2009 %Group revenue (includingshare of associates) (US$m) 2,716 2,567 6EBITA 1 (US$m) 565 562 1EBITA margin (%) 20.8 21.9Sales volumes (hl 000)Lager 13,476 12,726 6Lager (organic) 13,443 12,726 6Soft drinks 10,442 8,352 25Soft drinks (organic) 8,687 8,352 4Other alcoholic beverages 3,922 4,079 (4)1 In 2010 before net exceptional charges of US$3 million beingbusiness capability programme costs (2009: US$nil).Key focus areas■ Spur growth in beer and soft drinks withexpanded brand portfolios across a widerprice range■ Further develop sales and distribution toenhance our outlet presence and extendour geographic coverage■ Optimally manage our capital investmentprogramme to enable continuing growth■ Mitigate high imported input costs throughinnovation and local supply chainsAfrica’s volumes continued to grow in a year in whicheconomic growth slowed as a result of the globaleconomic recession, and which also resulted in weakercurrencies, increased cost of debt and higher inflation.Our multi-beverage portfolio proved resilient, with totalorganic volumes up 4% including lager volume growthof 6% and soft drinks growth of 4%. During the year, weacquired further non-alcoholic beverage businesses inUganda, Ethiopia and Zambia, invested in new breweriesin Angola, Mozambique, Southern Sudan and Tanzaniaand expanded capacity in Uganda and Zambia.Brand and pack differentiation produced strong growth inthe premium category and further growth in the affordablesegment. We made progress in driving affordability by usinglocal ingredients and supporting enterprise developmentthrough farming initiatives and local sourcing.<strong>Report</strong>ed EBITA grew 1%, and by 4% in organic,constant currency terms. Margins declined in the secondhalf to end the year 90 bps below the prior year on anorganic, constant currency basis as the depreciation ofsome local currencies increased the cost of imported rawmaterials. Fixed costs increased with capacity expansionand supply chain difficulties in Angola negatively impactedmargin. Price increases across the region were generallyat or below inflation levels.In Tanzania, lager volumes declined 4%, in line withthe industry, as a result of softer consumer spendingand adverse weather conditions earlier in the year.Marketing spend on all brands was increased witha focus on brand innovation. Ndovu Special Maltand Castle Lite were both launched in the premiumsegment in a new 375 ml green bottle and volumeperformance was above initial expectations. SafariLager, Redd’s and Castle Milk Stout all benefited frompackaging renovations. Our new brewery in Mbeya wassuccessfully commissioned during the second half of theyear allowing us to reduce distribution costs in the southwest region. Our arrangement with East African BreweriesLimited (EABL) to brew and distribute their products inTanzania was terminated in the final quarter of the year.Mozambique returned to strong growth with lagervolumes up 11%. This reflects improved economicconditions and good growth in the north, aided by thecommissioning of our new brewery in Nampula. BothLaurentina Premium and Laurentina Preta, a dark lager,grew strongly. The draught category performed well in theon-premise channel. Profitability growth slowed reflectingincreased import costs driven up by the depreciation ofthe metical against the rand.Uganda delivered strong lager growth of 24%, assisted bynewly upgraded capacity and improved market execution.The launch of the new long neck bottle invigorated themarket and differentiated the Nile Special and Club brands.In addition, the launch of Nile Gold, a premium malt lager,was well received. In the final quarter, we completed theacquisition of the Rwenzori water business, the marketleader in bottled water in Uganda.Zambia lager volumes benefited from the reduction inexcise at the beginning of the financial year, driving growthof 17%. A further excise reduction was announced inMarch 2010. The beer portfolio was expanded with thelaunch of the local premium brand Mosi Gold in December2009. Soft drinks volumes grew 1% on an organic basis.The maheu business (a non-alcoholic traditional beverage),acquired in September 2009, performed well, growingour non-alcoholic brand portfolio and driving soft drinksvolumes up 28% on a reported basis. EBITA margin wasimpacted by unfavourable exchange rates as a result ofthe weak kwacha, which drove up the cost of importedraw materials.

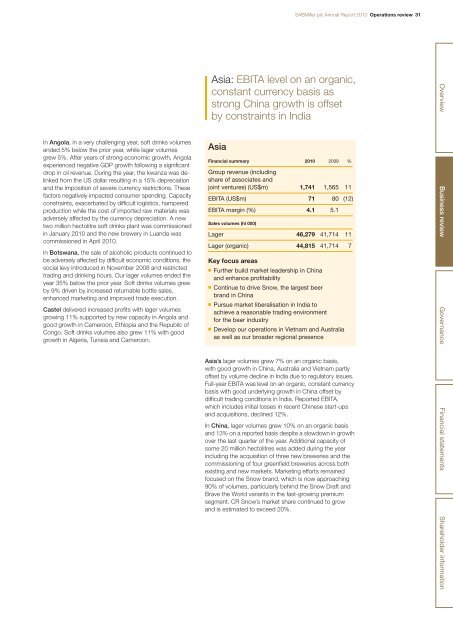

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Operations review 31In Angola, in a very challenging year, soft drinks volumesended 5% below the prior year, while lager volumesgrew 5%. After years of strong economic growth, Angolaexperienced negative GDP growth following a significantdrop in oil revenue. During the year, the kwanza was delinkedfrom the US dollar resulting in a 15% depreciationand the imposition of severe currency restrictions. Thesefactors negatively impacted consumer spending. Capacityconstraints, exacerbated by difficult logistics, hamperedproduction while the cost of imported raw materials wasadversely affected by the currency depreciation. A newtwo million hectolitre soft drinks plant was commissionedin January 2010 and the new brewery in Luanda wascommissioned in April 2010.In Botswana, the sale of alcoholic products continued tobe adversely affected by difficult economic conditions, thesocial levy introduced in November 2008 and restrictedtrading and drinking hours. Our lager volumes ended theyear 35% below the prior year. Soft drinks volumes grewby 9% driven by increased returnable bottle sales,enhanced marketing and improved trade execution.Castel delivered increased profits with lager volumesgrowing 11% supported by new capacity in Angola andgood growth in Cameroon, Ethiopia and the Republic ofCongo. Soft drinks volumes also grew 11% with goodgrowth in Algeria, Tunisia and Cameroon.Asia: EBITA level on an organic,constant currency basis asstrong China growth is offsetby constraints in IndiaAsiaFinancial summary 2010 2009 %Group revenue (includingshare of associates andjoint ventures) (US$m) 1,741 1,565 11EBITA (US$m) 71 80 (12)EBITA margin (%) 4.1 5.1Sales volumes (hl 000)Lager 46,279 41,714 11Lager (organic) 44,815 41,714 7Key focus areas■ Further build market leadership in Chinaand enhance profitability■ Continue to drive Snow, the largest beerbrand in China■ Pursue market liberalisation in India toachieve a reasonable trading environmentfor the beer industry■ Develop our operations in Vietnam and Australiaas well as our broader regional presenceAsia’s lager volumes grew 7% on an organic basis,with good growth in China, Australia and Vietnam partlyoffset by volume decline in India due to regulatory issues.Full-year EBITA was level on an organic, constant currencybasis with good underlying growth in China offset bydifficult trading conditions in India. <strong>Report</strong>ed EBITA,which includes initial losses in recent Chinese start-upsand acquisitions, declined 12%.In China, lager volumes grew 10% on an organic basisand 13% on a reported basis despite a slowdown in growthover the last quarter of the year. Additional capacity ofsome 20 million hectolitres was added during the yearincluding the acquisition of three new breweries and thecommissioning of four greenfield breweries across bothexisting and new markets. Marketing efforts remainedfocused on the Snow brand, which is now approaching90% of volumes, particularly behind the Snow Draft andBrave the World variants in the fast-growing premiumsegment. CR Snow’s market share continued to growand is estimated to exceed 20%.Overview Business reviewGovernance Financial statements Shareholder information