Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

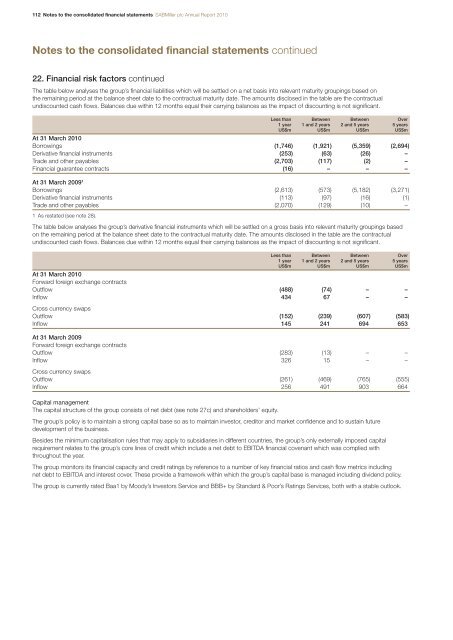

112 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued22. Financial risk factors continuedThe table below analyses the group’s financial liabilities which will be settled on a net basis into relevant maturity groupings based onthe remaining period at the balance sheet date to the contractual maturity date. The amounts disclosed in the table are the contractualundiscounted cash flows. Balances due within 12 months equal their carrying balances as the impact of discounting is not significant.Less than Between Between Over1 year 1 and 2 years 2 and 5 years 5 yearsUS$m US$m US$m US$mAt 31 March 2010Borrowings (1,746) (1,921) (5,359) (2,694)Derivative financial instruments (253) (63) (26) –Trade and other payables (2,703) (117) (2) –Financial guarantee contracts (16) – – –At 31 March 2009 1Borrowings (2,613) (573) (5,182) (3,271)Derivative financial instruments (113) (97) (16) (1)Trade and other payables (2,070) (129) (10) –1 As restated (see note 28).The table below analyses the group’s derivative financial instruments which will be settled on a gross basis into relevant maturity groupings basedon the remaining period at the balance sheet date to the contractual maturity date. The amounts disclosed in the table are the contractualundiscounted cash flows. Balances due within 12 months equal their carrying balances as the impact of discounting is not significant.Less than Between Between Over1 year 1 and 2 years 2 and 5 years 5 yearsUS$m US$m US$m US$mAt 31 March 2010Forward foreign exchange contractsOutflow (488) (74) – –Inflow 434 67 – –Cross currency swapsOutflow (152) (239) (607) (583)Inflow 145 241 694 653At 31 March 2009Forward foreign exchange contractsOutflow (283) (13) – –Inflow 326 15 – –Cross currency swapsOutflow (261) (469) (765) (555)Inflow 256 491 903 664Capital managementThe capital structure of the group consists of net debt (see note 27c) and shareholders’ equity.The group’s policy is to maintain a strong capital base so as to maintain investor, creditor and market confidence and to sustain futuredevelopment of the business.Besides the minimum capitalisation rules that may apply to subsidiaries in different countries, the group’s only externally imposed capitalrequirement relates to the group’s core lines of credit which include a net debt to EBITDA financial covenant which was complied withthroughout the year.The group monitors its financial capacity and credit ratings by reference to a number of key financial ratios and cash flow metrics includingnet debt to EBITDA and interest cover. These provide a framework within which the group’s capital base is managed including dividend policy.The group is currently rated Baa1 by Moody’s Investors Service and BBB+ by Standard & Poor’s Ratings Services, both with a stable outlook.