Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

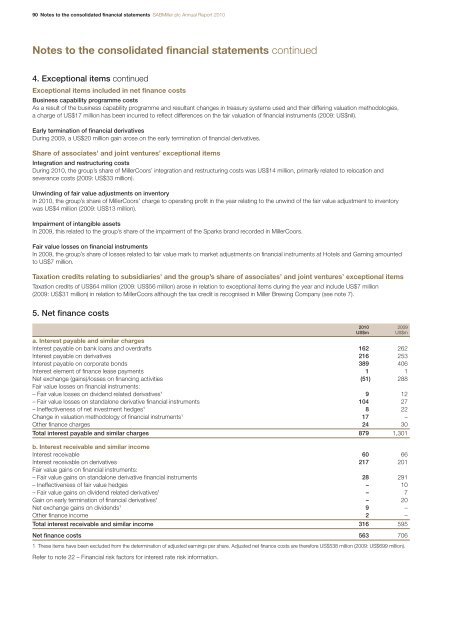

90 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued4. Exceptional items continuedExceptional items included in net finance costsBusiness capability programme costsAs a result of the business capability programme and resultant changes in treasury systems used and their differing valuation methodologies,a charge of US$17 million has been incurred to reflect differences on the fair valuation of financial instruments (2009: US$nil).Early termination of financial derivativesDuring 2009, a US$20 million gain arose on the early termination of financial derivatives.Share of associates’ and joint ventures’ exceptional itemsIntegration and restructuring costsDuring 2010, the group’s share of MillerCoors’ integration and restructuring costs was US$14 million, primarily related to relocation andseverance costs (2009: US$33 million).Unwinding of fair value adjustments on inventoryIn 2010, the group’s share of MillerCoors’ charge to operating profit in the year relating to the unwind of the fair value adjustment to inventorywas US$4 million (2009: US$13 million).Impairment of intangible assetsIn 2009, this related to the group’s share of the impairment of the Sparks brand recorded in MillerCoors.Fair value losses on financial instrumentsIn 2009, the group’s share of losses related to fair value mark to market adjustments on financial instruments at Hotels and Gaming amountedto US$7 million.Taxation credits relating to subsidiaries’ and the group’s share of associates’ and joint ventures’ exceptional itemsTaxation credits of US$64 million (2009: US$56 million) arose in relation to exceptional items during the year and include US$7 million(2009: US$31 million) in relation to MillerCoors although the tax credit is recognised in Miller Brewing Company (see note 7).5. Net finance costs2010 2009US$mUS$ma. Interest payable and similar chargesInterest payable on bank loans and overdrafts 162 262Interest payable on derivatives 216 253Interest payable on corporate bonds 389 406Interest element of finance lease payments 1 1Net exchange (gains)/losses on financing activities (51) 288Fair value losses on financial instruments:– Fair value losses on dividend related derivatives 1 9 12– Fair value losses on standalone derivative financial instruments 104 27– Ineffectiveness of net investment hedges 1 8 22Change in valuation methodology of financial instruments 1 17 –Other finance charges 24 30Total interest payable and similar charges 879 1,301b. Interest receivable and similar incomeInterest receivable 60 66Interest receivable on derivatives 217 201Fair value gains on financial instruments:– Fair value gains on standalone derivative financial instruments 28 291– Ineffectiveness of fair value hedges – 10– Fair value gains on dividend related derivatives 1 – 7Gain on early termination of financial derivatives 1 – 20Net exchange gains on dividends 1 9 –Other finance income 2 –Total interest receivable and similar income 316 595Net finance costs 563 7061 These items have been excluded from the determination of adjusted earnings per share. Adjusted net finance costs are therefore US$538 million (2009: US$699 million).Refer to note 22 – Financial risk factors for interest rate risk information.