Annual Report - SABMiller

Annual Report - SABMiller

Annual Report - SABMiller

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

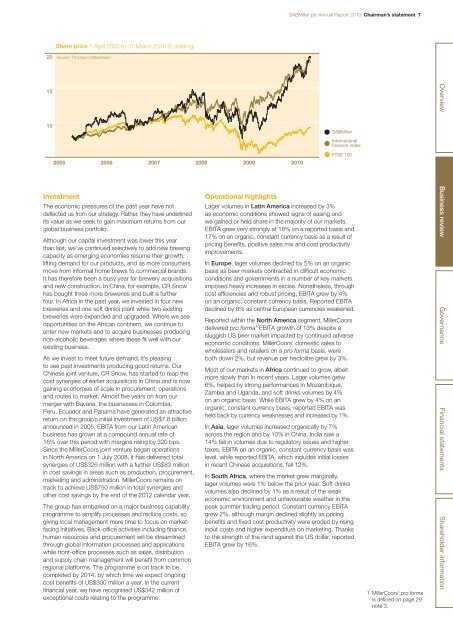

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Chairman’s statement 7Share price 1 April 2005 to 31 March 2010 (£ sterling)20Source: Thomson Datastream15102005 2006 2007 2008 2009 2010InvestmentThe economic pressures of the past year have notdeflected us from our strategy. Rather, they have underlinedits value as we seek to gain maximum returns from ourglobal business portfolio.Although our capital investment was lower this yearthan last, we’ve continued selectively to add new brewingcapacity as emerging economies resume their growth,lifting demand for our products, and as more consumersmove from informal home brews to commercial brands.It has therefore been a busy year for brewery acquisitionsand new construction. In China, for example, CR Snowhas bought three more breweries and built a furtherfour. In Africa in the past year, we invested in four newbreweries and one soft drinks plant while two existingbreweries were expanded and upgraded. Where we seeopportunities on the African continent, we continue toenter new markets and to acquire businesses producingnon-alcoholic beverages where these fit well with ourexisting business.As we invest to meet future demand, it’s pleasingto see past investments producing good returns. OurChinese joint venture, CR Snow, has started to reap thecost synergies of earlier acquisitions in China and is nowgaining economies of scale in procurement, operationsand routes to market. Almost five years on from ourmerger with Bavaria, the businesses in Colombia,Peru, Ecuador and Panama have generated an attractivereturn on the group’s initial investment of US$7.8 billionannounced in 2005. EBITA from our Latin Americanbusiness has grown at a compound annual rate of16% over this period with margins rising by 320 bps.Since the MillerCoors joint venture began operationsin North America on 1 July 2008, it has delivered totalsynergies of US$326 million with a further US$83 millionin cost savings in areas such as production, procurement,marketing and administration. MillerCoors remains ontrack to achieve US$750 million in total synergies andother cost savings by the end of the 2012 calendar year.The group has embarked on a major business capabilityprogramme to simplify processes and reduce costs, sogiving local management more time to focus on marketfacinginitiatives. Back-office activities including finance,human resources and procurement will be streamlinedthrough global information processes and applicationswhile front-office processes such as sales, distributionand supply chain management will benefit from commonregional platforms. The programme is on track to becompleted by 2014, by which time we expect ongoingcost benefits of US$300 million a year. In the currentfinancial year, we have recognised US$342 million ofexceptional costs relating to the programme.<strong>SABMiller</strong>Internationalbrewers indexFTSE 100Operational highlightsLager volumes in Latin America increased by 3%as economic conditions showed signs of easing andwe gained or held share in the majority of our markets.EBITA grew very strongly at 18% on a reported basis and17% on an organic, constant currency basis as a result ofpricing benefits, positive sales mix and cost productivityimprovements.In Europe, lager volumes declined by 5% on an organicbasis as beer markets contracted in difficult economicconditions and governments in a number of key marketsimposed heavy increases in excise. Nonetheless, throughcost efficiencies and robust pricing, EBITA grew by 4%on an organic, constant currency basis. <strong>Report</strong>ed EBITAdeclined by 8% as central European currencies weakened.<strong>Report</strong>ed within the North America segment, MillerCoorsdelivered pro forma 1 EBITA growth of 13% despite asluggish US beer market impacted by continued adverseeconomic conditions. MillerCoors’ domestic sales towholesalers and retailers on a pro forma basis, wereboth down 2%, but revenue per hectolitre grew by 3%.Most of our markets in Africa continued to grow, albeitmore slowly than in recent years. Lager volumes grew6%, helped by strong performances in Mozambique,Zambia and Uganda, and soft drinks volumes by 4%on an organic basis. While EBITA grew by 4% on anorganic, constant currency basis, reported EBITA washeld back by currency weaknesses and increased by 1%.In Asia, lager volumes increased organically by 7%across the region and by 10% in China. India saw a14% fall in volumes due to regulatory issues and highertaxes. EBITA on an organic, constant currency basis waslevel, while reported EBITA, which includes initial lossesin recent Chinese acquisitions, fell 12%.In South Africa, where the market grew marginally,lager volumes were 1% below the prior year. Soft drinksvolumes also declined by 1% as a result of the weakeconomic environment and unfavourable weather in thepeak summer trading period. Constant currency EBITAgrew 2%, although margin declined slightly as pricingbenefits and fixed cost productivity were eroded by risinginput costs and higher expenditure on marketing. Thanksto the strength of the rand against the US dollar, reportedEBITA grew by 16%.1 MillerCoors’ pro formais defined on page 29note 3.Overview Business reviewGovernance Financial statements Shareholder information