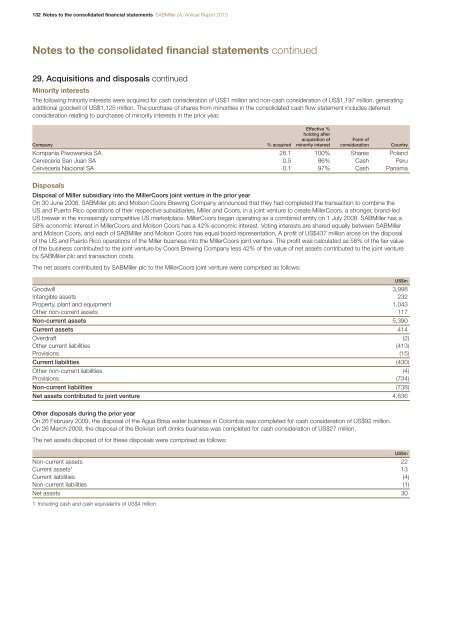

132 Notes to the consolidated financial statements <strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010Notes to the consolidated financial statements continued29. Acquisitions and disposals continuedMinority interestsThe following minority interests were acquired for cash consideration of US$1 million and non-cash consideration of US$1,197 million, generatingadditional goodwill of US$1,125 million. The purchase of shares from minorities in the consolidated cash flow statement includes deferredconsideration relating to purchases of minority interests in the prior year.Effective %holding afteracquisition of Form ofCompany % acquired minority interest consideration CountryKompania Piwowarska SA 28.1 100% Shares PolandCervecería San Juan SA 0.5 86% Cash PeruCervecería Nacional SA 0.1 97% Cash PanamaDisposalsDisposal of Miller subsidiary into the MillerCoors joint venture in the prior yearOn 30 June 2008, <strong>SABMiller</strong> plc and Molson Coors Brewing Company announced that they had completed the transaction to combine theUS and Puerto Rico operations of their respective subsidiaries, Miller and Coors, in a joint venture to create MillerCoors, a stronger, brand-ledUS brewer in the increasingly competitive US marketplace. MillerCoors began operating as a combined entity on 1 July 2008. <strong>SABMiller</strong> has a58% economic interest in MillerCoors and Molson Coors has a 42% economic interest. Voting interests are shared equally between <strong>SABMiller</strong>and Molson Coors, and each of <strong>SABMiller</strong> and Molson Coors has equal board representation. A profit of US$437 million arose on the disposalof the US and Puerto Rico operations of the Miller business into the MillerCoors joint venture. The profit was calculated as 58% of the fair valueof the business contributed to the joint venture by Coors Brewing Company less 42% of the value of net assets contributed to the joint ventureby <strong>SABMiller</strong> plc and transaction costs.The net assets contributed by <strong>SABMiller</strong> plc to the MillerCoors joint venture were comprised as follows:US$mGoodwill 3,998Intangible assets 232Property, plant and equipment 1,043Other non-current assets 117Non-current assets 5,390Current assets 414Overdraft (2)Other current liabilities (413)Provisions (15)Current liabilities (430)Other non-current liabilities (4)Provisions (734)Non-current liabilities (738)Net assets contributed to joint venture 4,636Other disposals during the prior yearOn 26 February 2009, the disposal of the Agua Brisa water business in Colombia was completed for cash consideration of US$92 million.On 26 March 2009, the disposal of the Bolivian soft drinks business was completed for cash consideration of US$27 million.The net assets disposed of for these disposals were comprised as follows:US$mNon-current assets 22Current assets 1 13Current liabilities (4)Non-current liabilities (1)Net assets 301 Including cash and cash equivalents of US$4 million.

<strong>SABMiller</strong> plc <strong>Annual</strong> <strong>Report</strong> 2010 Notes to the consolidated financial statements 13330. Commitments, contingencies and guaranteesa. Operating lease commitmentsThe minimum lease rentals to be paid under non-cancellable leases at 31 March 2010 are as follows:2010 2009US$mUS$mLand and buildingsWithin one year 50 50Later than one year and less than five years 109 83After five years 33 46192 179Plant, vehicles and systemsWithin one year 32 26Later than one year and less than five years 54 62After five years 37 8123 96b. Other commitments2010 2009US$mUS$mCapital commitments not provided in the financial informationContracts placed for future expenditure for property, plant and equipment 261 403Contracts placed for future expenditure for intangible assets 2 2Share of capital commitments of joint ventures 37 65Other commitments not provided in the financial informationContracts placed for future expenditure 2,086 1,499Share of joint ventures’ other commitments 482 606Contracts placed for future expenditure in 2010 primarily relate to minimum purchase commitments for raw materials and packaging materials,which are principally due between 2010 and 2015. Additionally, as part of the business capability programme the group has entered into contractsfor the provision of IT, communications and consultancy services and in relation to which the group had commitments of US$142 million at31 March 2010.The group’s share of joint ventures’ other commitments primarily relate to MillerCoors’ various long-term non-cancellable advertising andpromotion commitments.c. Contingent liabilities and guarantees2010 2009US$mUS$mGuarantees to third parties provided in respect of trade loans 1 16 28Guarantees to third parties provided in respect of bank facilities 9 8Share of associates’ contingent liabilities – 1Share of joint ventures’ contingent liabilities 8 10Litigation 2 14 14Other contingent liabilities – 247 631 Guarantees to third parties provided in respect of trade loansThese primarily relate to guarantees given by Grolsch to banks in relation to loans taken out by trade customers.2 LitigationThe group has a number of activities in a wide variety of geographic areas and is subject to certain legal claims incidental to its operations.In the opinion of the directors, after taking appropriate legal advice, these claims are not expected to have, either individually or in aggregate,a material adverse effect upon the group’s financial position, except insofar as already provided in the consolidated financial statements.Other<strong>SABMiller</strong> and Altria entered into a tax matters agreement (the Agreement) on 30 May 2002, to regulate the conduct of tax matters betweenthem with regard to the acquisition of Miller and to allocate responsibility for contingent tax costs. <strong>SABMiller</strong> has agreed to indemnify Altriaagainst any taxes, losses, liabilities and costs that Altria incurs arising out of or in connection with a breach by <strong>SABMiller</strong> of any representation,agreement or covenant in the Agreement, subject to certain exceptions.The group has exposures to various environmental risks. Although it is difficult to predict the group’s liability with respect to these risks, futurepayments, if any, would be made over a period of time in amounts that would not be material to the group’s financial position, except insofaras already provided in the consolidated financial statements.Overview Business review Governance Financial statements Shareholder information